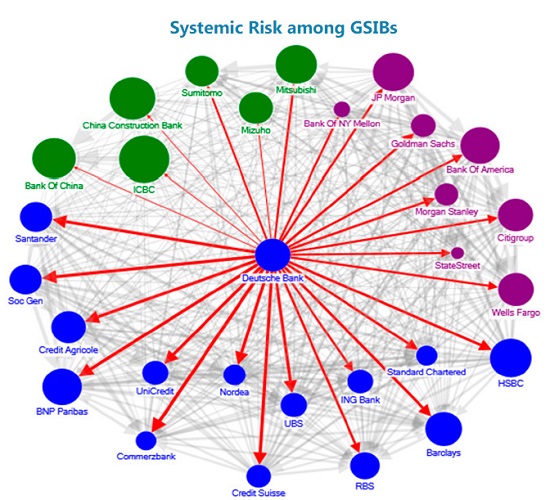

In June 2016 the IMF warned that Deutsche Bank was so highly connected into other megabanks worldwide that it posed one of the greatest risks to the global financial system of any troubled bank. The IMF’s Financial Sector Assessment Program for Germany called it “the most important net contributor to systemic risks” in the world.

Once the world’s leading industrial bank, under British patronage Deutsche Bank became one of the world’s largest derivatives gamblers, with talk in recent years suggesting it could be the “Lehman Brothers” of a new financial crisis. But with more than 20 times Lehman’s maximum derivatives exposure, Deutsche Bank is far more dangerous. It is in the same league as US behemoths JPMorgan Chase, Citigroup and Goldman Sachs.

The bank currently holds €43.5 trillion (US$49 trillion) of notional derivatives, down some 10 per cent on its 2018 height of €48.3 trillion. (In contrast, over the course of 2018 DB’s share value fell nearly 60 per cent.) Some €33 billion of the bank’s derivatives are assessed as “Level 3” assets, essentially because they are so toxic there is no market for them. Although they are actually worthless, under European Union laws banks are allowed to price them according to their own models.

A 2016 evaluation by the US Federal Deposit Insurance Corporation (FDIC) measured Deutsche Bank’s leverage ratio—its equity capital measured against its assets—as the lowest of the world’s global systematically important banks (G-SIBs), and slightly worse than that of Lehman Brothers in mid-2008 before its bankruptcy.

Deutsche Bank shares, which have fallen nearly 40 per cent over the past year, have been hovering around the €6.40 mark for several days, as experts warn of major problems should it reach €5.70 (US$6.40). On 22 May, financial cycle expert Charles Nenner called DB the global canary in the coal mine, warning that the bank could “go out of business” if shares fall below that level, affecting other Too Big To Fail banks.

According to USAWatchdog.com, Nenner warned: “It is a very dangerous situation. I don’t think DB is the only one. They just got caught. I think if you look at the balance sheets very closely of other banks, especially Europe and Italian banks, you will see a lot of troubling signs also. I don’t think it’s only Deutsche Bank. It’s much more. … If it breaks US$6.40, the downside price target is zero. If everybody watches my analysis and it does go below US$6.40, everybody is going to run for the exits.” Drawing upon the IMF’s 2016 warning, Nenner clarified that “if they have to close their derivatives, who knows which bank is going to lose how much? It’s going to be a big problem.”

Financial expert and principal of Digital Finance Analytics, Martin North, raised the Deutsche Bank risk in a video on his Walk the World YouTube channel, “How low can Deutsche Bank go?” While there are many potential triggers, he said, “for me this is one of the most likely catalysts for a global financial meltdown”.

There is no doubt that if Deutsche Bank’s derivatives book takes a hit, it will leave other major banks, globally, with massive holes in their balance sheets, and threaten to crash the entire global system. “If Deutsche Bank would collapse without any control, that would have, I think, a tremendous contagion effect on other major banks in Europe”, Daisuke Kotegawa, the former deputy director of Japan’s Ministry of Finance who resolved a derivatives crisis in Japan’s banks in 1998, said to Executive Intelligence Review magazine in an interview recorded 8 October 2016. “I just will refrain from specifying the names of those banks, but I should say that about 10-15 major banks in Europe would become insolvent and disappear.” He proposed a four-step resolution of Deutsche Bank: 1) nationalisation by the German government; 2) a Glass-Steagall separation of investment banking from commercial banking, to create a firewall to protect the real economy from the meltdown of the derivatives bubble; 3) cancellation of its derivatives; and 4) jail terms for the criminal bankers responsible for its condition.

Australian Alert Service 29 May 2019