The Australian Alert Service is the weekly publication of the Australian Citizens Party.

It will keep you updated on strategic events both in Australia, and worldwide, as well as the organising activities of the Citizens Party.

To subscribe to the Australian Alert Service, it's easy, and it's secure.

Click here for subscriptions within Australia

Click here for overseas subscriptions

Lead Editorial

9 September 2020

Vol. 22. No. 36

The Reserve Bank last week increased its term funding facility for the private banks of three-year loans at 0.25 per cent, established on an emergency basis as part of the pandemic response, from $90 billion to $200 billion. The banks were expected to use the RBA facility to assist the economy, especially through loans to small and medium enterprises (SMEs) to tide them over; however, while it has helped the banks to wear the cost of allowing payment deferrals on 800,000 mortgage and business loans, they have only extended a tiny fraction in loans to small business, which are on their knees. According to Digital Finance Analytics’ Martin North, his survey shows one-third of SMEs expect to go under.

What are the banks doing with the RBA facility? They are using the 0.25 per cent loans to buy government bonds and “earn a profitable yield”, according to John Kehoe in the 8 September Australian Financial Review, who called it “QE by stealth” (QE being quantitative easing—central bank money printing). Kehoe reported that the RBA and Australian Prudential Regulation Authority intend to direct the private banks to buy up to $240 billion worth of federal and state government bonds to “normalise emergency bank liquidity, in a regulatory move that will lower government borrowing costs and encourage stimulus spending on infrastructure and other programs”. Most of the $240 billion in bonds will be purchased with the $200 billion in cheap money from the RBA, which means it is QE—the RBA will be printing money to fund governments, channelled through the private banks. Grant Wilson, the head of Asia Pacific at Exante Data, observed in the 6 September AFR that the $200 billion facility will make Australia’s banks less dependent on short-term foreign borrowing, and move Australia’s financial system towards increasing self-sufficiency.

Ironically, this RBA/APRA directive somewhat takes Australia back to pre-banking deregulation in 1982, when banks were required to hold 30 per cent of their assets in government bonds. The regulatory benefit is that government bonds are regarded as the safest of all financial investments, so having them comprise 30 per cent of the banks’ assets kept the banks safe; it was also a guaranteed funding source for the government. There are key differences, however. The pre-deregulation regulatory requirement wasn’t funded by central bank QE—the banks invested real assets. And back then Australia had a very different, and much more productive, economy.

Today the RBA is shifting deck chairs on the Titanic. The RBA and the government are not trying to fix the speculative black hole at the centre of Australia’s economy, which is the property bubble that consumes so much debt and income. When officials say that banks buying government bonds will help to fund infrastructure, as good as that sounds they don’t mean nation-building infrastructure to restructure our economy on a more productive footing. They mean catch-up infrastructure concentrated in the overcrowded big cities, to connect the myriad housing developments that have been hastily built in outer suburbs in the past decade to basic transportation and other infrastructure. These developments cram in as many houses as they can, without space between them or backyards, and sell them to young families desperate to establish themselves in the market, who then have lengthy commutes to work on gridlocked roads. This has been the driver of the Australian economy as it is the main motivation for the bank credit that is the lifeblood of the financial system, but it has driven us into record, unpayable debt.

It is good that the current crisis is forcing institutions to realise we can be more financially self-sufficient; but we must also be more productive. We must overhaul the economy, by investing in the infrastructure and industries that can create real, tangible national wealth (p. 3). Instead of the RBA rearranging financial deckchairs, we need a national development bank.

In this issue:

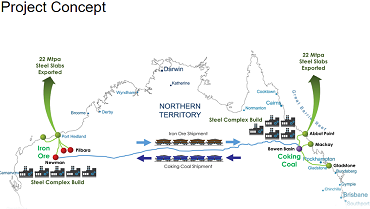

- Project Iron Boomerang—revolutionise global steelmaking and reindustrialise Australia

- Clarence River water projects urgent

- Five Eyes ‘national security’ blob absorbs competition regulation

- Australia is not a corporation, it’s a corporate state

- Quad’s economic arm joins China pile-on

- Experts demand P5 summit to avert war: Schiller Institute conference

- China narrative part three: Espionage and interference

- Ninth Circuit strikes down illegal spying on Americans

- MPs do take heed!

- FDR’s Reconstruction Finance Corporation: the Great Depression could have been averted!

- ALMANAC: Presumptuous Pompeo pushes preposterous policy on ‘Peking’

Click here for the archive of previous issues of the Australian Alert Service