The Australian Alert Service is the weekly publication of the Australian Citizens Party.

It will keep you updated on strategic events both in Australia, and worldwide, as well as the organising activities of the Citizens Party.

To subscribe to the Australian Alert Service, it's easy, and it's secure.

Click here for subscriptions within Australia

Click here for overseas subscriptions

Lead Editorial

25 November 2020

Vol. 22. No. 47

The Citizens Party’s campaign, commencing in 2013, to stop Australia adopting the global bail-in policy to save too-big-to-fail banks in a new financial crisis, forced the Bank for International Settlements (BIS) into a global retreat. In 2014 Australia hosted the G20 summit at which Bank of England and Financial Stability Board head Mark Carney had insisted global bail-in terms be agreed and formalised. Such an outcry was generated over the bail-in prospect—which was shrouded in secrecy prior to the Citizens Party’s exposés—that the BIS had to water down its proposal and delay it by a full year. Read the full story on p. 5.

Australians had had no inkling of the legislative agenda to put their private investments and savings up for grabs to recapitalise collapsing banks, let alone that its incubation was part of the broader plan of international financiers to assert a financial dictatorship ahead of a new financial meltdown.

Today, such is the heat on MPs over this issue, that you cannot rule out anything when One Nation Senator Malcolm Roberts’s Banking Amendment (Deposits) Bill 2020 is debated on 30 November, including a mutiny in the ALP, which is insisting it will not vote for the Roberts bill, or members of the government crossing the floor. Labor is currently being hammered with calls over its intention to yet again defend the banks, which is why it lost the last federal election. It risks exposing itself even further as Another Liberal Party.

If the bill to exclude deposits from bail-in does not pass, the stakes will be dramatically raised in the fight for a postal bank to keep our savings safe. The railroading of Christine Holgate, in part to head off the push for an Australia Post Bank, has unearthed an enormous depth of support for a public bank. The Citizens Party has now prepared legislation to create such a bank. (p. 3)

This fight is far from over. The Licenced Post Office Group, representing over 3,000 family-owned post offices, tweeted on 24 November that while Holgate offered her resignation the board has not yet accepted it. From unions to business, and even bankers, the intersecting networks that can be mobilised in support of a public savings bank are extensive. This issue can unite all sides of politics which see the urgent need for banking to be returned to the service of fostering real economic growth.

Alongside a public banking victory, the defeat of bailin in Australia today would again set back the global agenda, causing reverberations across the globe. It would inflict a major gash in the City of London-Wall Street plans to reinvent their financial system for the post-crash era. That system has seen numerous makeovers already, but its intention is always the same. One of the “Old Labor” leaders in the fight to establish and keep the original Commonwealth Bank as an instrument of national development, NSW Premier Jack Lang, put it succinctly in his 1962 book, The Great Bust. The Bank of England knew it had to drag the Commonwealth Bank into its net, he wrote. The Commonwealth Bank was only permitted to be a junior member of the Bank of England which was destined to become a “super Bankers’ Bank”. The objective: that the global bank “would determine the economic policy of the world”, with bankers “the supreme rulers”. If the Bank of England could control the Commonwealth Bank, “there should be no impediment in the way of controlling the Government of the country as well”, he warned.

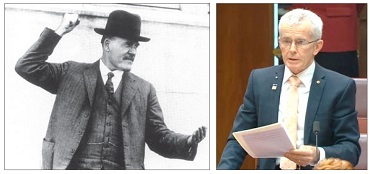

In the event, the Bank for International Settlements, founded by Bank of England Governor Montagu Norman along with Nazi Finance Minister Hjalmar Schacht, took up that role. We stand on the shoulders of Lang, John Curtin, Commonwealth Bank founder King O’Malley and m

In this week's issue:

- Australia needs a national post office bank now!

- It’s now Labor’s ‘bail-in’

- How the Citizens Party disrupted the global bail-in regime

- Asian trade deal a mixed bag but offers benefits of regional cooperation

- Japan-Aust. defence pact could sabotage economic cooperation

- Afghanistan war crimes report absolves the main culprits

- Bankers escalate zero-carbon dictatorship

- ‘Democracy’: A cautionary tale from Ukraine

- Trump pressing for his one-term agenda

- Super isn’t for workers, it’s for banks and markets

- Macquarie uses super to buy privatised infrastructure

- ALMANAC: Can Iraq be a centre of development rather than conflict?

Click here for the archive of previous issues of the Australian Alert Service