The Liberal National Party’s Queensland state election campaign launch on 18 October featured as its centrepiece a pledge by LNP leader Deb Frecklington to build the Bradfield Scheme to divert floodwaters from north Queensland into the dry inland for irrigation. This prompted National Party MP Barnaby Joyce to enthuse in federal Parliament on 20 October: “Thank goodness that we now have the vision to actually start on this project.”

But do they? The LNP is not proposing a change in their approach to infrastructure funding that would guarantee this project can go ahead. Alongside the Citizens Party, the original champion of the Bradfield Scheme is Bob Katter, who in a fiery 17 October Facebook post preempted the LNP’s launch by highlighting how Australia’s financial system sabotages development and industries. “We have the iron ball of bureaucracy around our ankles and we have banks that want to know the value of our house when we want to build a Bradfield Scheme”, Katter said. “And the mortgage lender banks are only interested in how much they can sell a half-built dam or factory for. They look to the mortgage value rather than the project. Australians must throw out their current political and monetary regime and replace it with an aggressive ‘build and own our nation’ attitude which is the driver in America, China, Europe and Brazil. Instead, we are still floundering around in the fairy floss of free marketism which is an explanation and admission that we know absolutely nothing about anything and we don’t have to do anything because it will all be done for us.”

Bob Katter is leading the push in Parliament for a national development bank to finance the infrastructure and industries needed to reindustrialise the Australian economy; the Citizens Party is finalising legislation for a national bank for Katter to introduce in Parliament. There is growing support in the federal Parliament for this approach, including among the Greens, One Nation, the LNP and even some Labor MPs.

Parliamentary support for a national bank

On 4 December 2019, Greens’ finance spokesman Senator Peter Whish-Wilson participated in a matter of public importance debate initiated by One Nation on the matter of the danger of bank deposits being “bailed in”— confiscated to prop up failing banks. Senator Whish-Wilson emphasised that he was largely in agreement with One Nation on the need to reform the banking sector, and singled out the need for a national bank.

“Three years ago, the Greens initiated a select inquiry into infrastructure finance and infrastructure spending in Australia”, he said. “We went all around this country. We literally heard from hundreds of witnesses, mostly businesses and experts. We looked at the size of the infrastructure gap in Australia, and that varied, but in some estimates it was up to a trillion dollars. Many of the projects in that gap were small projects in rural and regional areas. There is no shortage of infrastructure projects that will set up this country for this century, will deliver productivity and will deliver for local communities. We believe in a government infrastructure bank.” (Emphasis added.)

On 23 March 2020, One Nation Senator Malcolm Roberts intervened in the debate over the government’s $130 billion COVID-19 response package, by pointing out the short-sightedness of the government’s approach. “It is One Nation policy to create a ‘people’s bank’ to give the big four banks some real competition in the areas in which they are complete failures—honesty, integrity and accountability”, he said. “A people’s bank would be really handy right now. … Can this government really only think a few months ahead? Where is the vision in this rescue package? Why are we not getting cracking today on nation-building schemes to create new productive capacity to power this nation to a future, to create fresh wealth for everyday Australians? Where is the Bradfield scheme? Where are the dams, the power stations, the ports and airports? Where are the railways to places that need them? We are selling off our farms, shrinking rural Australia, shedding jobs and sending the profits from this new corporate agriculture to the Cayman Islands.”

Some members of the Liberal and National parties are speaking out for a national infrastructure bank. In an 11 June 2020 speech in the Senate, LNP Senator Gerard Rennick declared: “The Reserve Bank must fund an infrastructure bank that will underwrite nation-building projects. An infrastructure bank is where monetary policy meets fiscal policy, and it is the link that governments need to grow our economy. If there has been a fundamental flaw in the western government’s response to the GFC, it has been in propping up inefficient companies and banks instead of building productive infrastructure like China, whose economy has grown strongly because of its commitment to nation-building infrastructure. Let’s not forget: 50 years ago China was coming out of the Cultural Revolution. Yet today it has managed to pull a billion people out of poverty because its central bank, and not foreign banks, funded the development of infrastructure.”

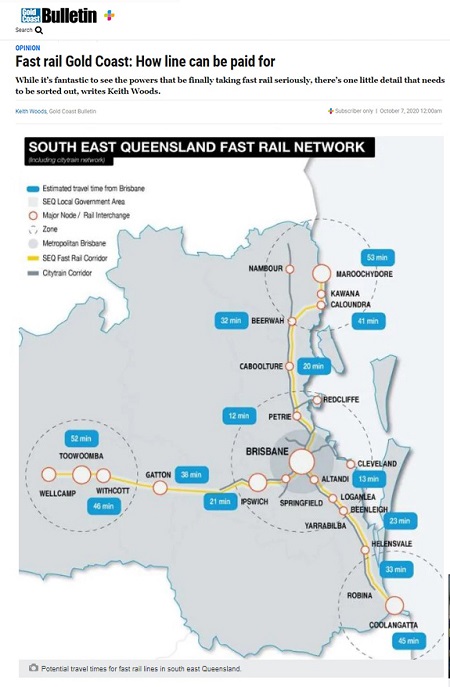

In a 7 October Gold Coast Bulletin column, “How massive fast rail cost can be paid for”, columnist Keith Woods reported Senator Rennick’s proposal for using a national infrastructure bank to fund fast rail for the Gold Coast. “Queensland Senator Gerard Rennick, among those pushing hardest for nation-building infrastructure projects including a Gold Coast fast rail line, has put forward an eye-catching proposal on how the funding could be arranged”, Woods reported. “On a visit to the Gold Coast last week, he outlined to your columnist his vision of a national Infrastructure Bank…. It’s quite complicated monetary policy, but put simply, Senator Rennick wants to see nation-building infrastructure delivered, and jobs created, without resorting to borrowing yet more billions from overseas.” He quoted Senator Rennick on how it will create long-term investment opportunities: “Infrastructure bonds can be issued for long periods of up to 30 years.”

Diversifying trade and investment hearing

Another LNP politician who has indicated support for a national development bank is the Member for Dawson, George Christensen, who chairs the Parliamentary Joint Standing Committee on Trade and Investment Growth which is conducting an inquiry into “Diversifying trade and investment”. On 30 September, Christensen’s committee took testimony from Dr Mark McGovern, an economist at Queensland University of Technology who has worked with Bob Katter on proposals for using the Reserve Bank for debt restructuring and investment. In his testimony, Dr McGovern emphasised the need for a national development bank:

“It struck me that at the moment we have a serious crisis, partly COVID-related and partly due to financial stress in the banking system and things like that”, he said. “If we think about diversifying profiles, Australia’s investment profile is extremely narrow at the moment because it’s been based upon some traditional banking and a lot of securitisation, which has grown asset bubbles—which have been recognised in the rural sector and are evident in the urban sector in some areas—and because we are relying upon a privately sourced base of funding for our national endeavours.

“An area of diversification where we could have real effect within a very short time is by picking up a couple of the issues that I discussed in [my submission]. There were two particular ones that capture the possibilities. The first was an Australian reconstruction and development board, which was part of a bill to establish a capability within the Reserve Bank to be able to issue public funds for public purposes in a wholesale manner from the Reserve Bank, so that different agencies could access this instead of going to private providers through bond markets and things like that. That was one idea that was introduced in a bill as a response to the adjustment problems that were extremely evident in the rural sector when it was going through a transition where loans were unserviced or liquidations were occurring and distress was very widespread.

“The second part of this is the whole question of development. There’s no point in trying to use a credit card to develop a farm or anything like that. But if we look at the standard revolving line of credit product that is on offer it has many of the features of a credit card. If we’re going to build a country for the long term, we need finance that’s reliable for the long term. I think there are real opportunities within weeks to get something moving here, because the problems are getting worse. We can see that with the comments about lending conditions and reporting and all those sorts of things recently. We’ve got a very quick-coming problem we can address. That is a great challenge and one we can address sensibly. Otherwise, if we don’t escape the balance-sheet recession, which is coming up, we’re going to end up in a quantitative easing trap and things like that.

“But there’s also the issue of finding funds for things that the market won’t support because they’re either too long or too risky or something like that. We’ve had things like the Commonwealth Development Bank and the QIDC. We’ve had lots of other things. Then, at the centre of all this today, we have a public central bank. That is rare in the world. Most are private. We have a public bank that could, if it so chose and if it prudently evaluated things, issue funds for other agencies to implement things, especially long-term investments.” (Emphasis added.)

Christensen responded to Dr McGovern’s testimony by acknowledging: “We have had a lot of submissions relating to that and a lot of submissions calling for the establishment of a national development bank.”

In a discussion with the Australian Alert Service, Dr McGovern emphasised that one of the main benefits of a national development bank is its flexibility to support industry through varying conditions. He noted the old Commonwealth Development Bank sometimes charged a higher interest rate than the private banks, but when its borrowers went through difficult periods the CDB was able to accommodate them in ways private banks couldn’t or wouldn’t. This is especially important for agricultural lending, when perfectly viable farms can be cruelled by drought but with flexible financial support they can make it through and be productive again on the other side.

This week, the Citizens Party launched a new online advertisement: “CREATE A NATIONAL BANK! Australia can create more than a 1.5 million jobs almost overnight”. The three-minute video explains how the only way Australia will get out of this economic crisis is to build the infrastructure that will support the manufacturing and agricultural industries we need to become a productive economy again, which we can do very quickly with a national infrastructure bank, and create more than a million and a half productive industrial jobs in the process. Watch the ad at https://youtu.be/8GDIAziJaEY on YouTube.

By Robert Barwick, Australian Alert Service, 21 October 2020