The Australian Alert Service is the weekly publication of the Australian Citizens Party.

It will keep you updated on strategic events both in Australia, and worldwide, as well as the organising activities of the Citizens Party.

To subscribe to the Australian Alert Service, it's easy, and it's secure.

Lead Editorial

6 October 2021

Vol. 23 No. 40

Already in the middle of a far-reaching economic breakdown and pandemic, we are about to be met by a new global financial blowout and, if we are not exceedingly careful, an escalation to world war.

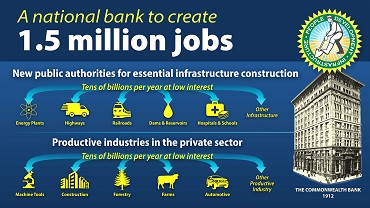

Crisis always presents a moment of opportunity, if there is leadership able to see the longer curvature of history and guide a shift in thinking. The 14th century Dark Age provided a doorway to usher in the nation-state as an efficient principle, to bring people into the process of selfgovernment and enshrining that process into lasting institutions from parliaments to legal bodies. This represented a permanent break with the feudal past. But it remained for the young American republic, centuries later, to pick a fight with imperial Britain and create a vital institution to back up the power of the nation-state: a national bank. National credit creation extends the power of the state to support the Common Good within all levels of the community. Credit backed by the wealth of the whole nation transforms whatever sector it is applied to, by fostering development in infrastructure, industry, agriculture and advancing science and technology.

When Parliament resumes on 18 October, we will deliver a powerful reminder of this fight, honing in on the corrupt financial framework created in opposition to national banking in this country (see “When fascists cried ‘freedom’ to protect the banks”, back page). Today’s financial system has not only prevented development and destroyed our industry, infrastructure and vital services, it has exposed millions of Australians to predatory banking, ruining countless lives, including those of the victims of the ASIC-approved Ponzi outfit, Sterling First.

Delegations of Sterling First victims have caught the attention of politicians in Western Australia, with a number committed to pushing for an inquiry, and even a senior government member pledging to take up the issue directly with the Australian Securities and Investments Commission (ASIC). Regulators can expect to be hit hard in Senate Estimates from members of numerous parties taking up this case as a marker for much broader, systemic crimes. Several politicians are committed to forcing an inquiry into ASIC, for which terms of reference are already being drafted. Next week, we will begin to pour on the heat, with calls to all MPs to back this inquiry.

This inquiry is not only about justice for affected parties, but interrupting the government’s deregulation agenda, which will set private finance even higher above the law. This agenda was put into high gear in late 2020 with the ousting of ASIC chair James Shipton, for attempting to be an effective regulator. At the same time, Christine Holgate was railroaded out of Australia Post, as her threat to push for a postal bank would force the banks into line.

Taking this campaign to the next level, there is now talk of a parliamentary committee to examine setting up a national development bank, to urgently transform the country to deal with all of the ongoing and oncoming crises.

As inflation gathers speed, sweeping across the global economy, reregulation is urgent. Inflation is not being reined in by central banks, because it keeps the current financial order alive by sucking the last ounces of lifeblood from the real economy and from the people (p. 8-10). A credit system will allow us to build up our economy without inflation and without building up unpayable debt, because it is directed into productive ventures that increase the real wealth of the nation, allowing it to be rapidly repaid. If we spend the next period focused on paying down debt, enforced by austerity measures, there will be no economic recovery. A credit system puts us back in control of events, rather than at their mercy. It is urgent and unavoidable. Despite many disagreements over many issues, when it comes to crunch time, this is something most MPs—certainly those with whom we are collaborating— can agree upon.

In this issue:

- Morrison government’s attack on industry super funds reveals solution to infrastructure woes

- How public Super could fund an economic transformation

- Nine’s ‘Under Investigation’ primes the pump for war on China

- CIA’s secret war plans against WikiLeaks

- Biden nominates ‘triple threat’ to banks as a top regulator

- Energy crunch a result of sustained economic raiding

- ‘It’s the cartels and deregulation, stupid!’

- Once again, call your senators!

- When fascists cried ‘freedom’ to protect the bank

Click here for the archive of previous issues of the Australian Alert Service