After then-Treasurer Scott Morrison announced the $10,000 cash ban in the 2018 budget, his successor Josh Frydenberg estimated to Parliament that the government’s “black economy” interventions, of which the cash ban is one, would bring in an additional $5.3 billion in revenue over four years—tempting, to a government desperate to balance the budget.

“However, on the Parliament’s website, it states that most of the projected revenue from black economy interventions come from a one-off tax on tobacco stored in warehouses, a total of $3.6 billion”, intrepid citizen-researcher Melissa Harrison reported on exposingtheblackeconomyreport.com. “If you don’t include this one-off tax, Parliament’s website states the revenue is only $950 million! The cost of their black economy interventions are estimated to be around $345 million. Is it worth it? Is it worth all of this legislation that has been passed, and will continue to be passed? These have serious effects on the civil and economic liberties of everyday Australians.”

As usual, most politicians wouldn’t be aware of these details, being too lazy or too distracted to pay attention. They would assume that the cash ban will reduce tax evasion and increase government revenue, and think that’s a good thing.

Tax justice is important, and it’s right that the government should police tax evasion, as long as it doesn’t resort to totalitarian measures like the cash ban. There is a far more glaring tax injustice, though, that the government and the KPMG Black Economy Taskforce deliberately swept under the carpet—tax avoidance by the biggest and richest megabanks and multinational corporations. Another area that deserves to be taxed is financial speculation, because it doesn’t contribute to the economy, it actually saps money away at the expense of investment in productive industries and infrastructure. If the government turned its focus on these areas, it would both promote justice and fairness in the taxation system and economy and raise considerable extra revenue with which to fund its responsibilities.

Corporate withholding tax

At the 30 January 2020 Senate cash ban hearing, Senator Rex Patrick highlighted data showing that 204 corporations collectively made more than $800 billion in revenue in Australia in the last five years, but paid no tax—zero! That is because company tax is paid on profits, not revenue, and these corporations make use of the most slick tax accountants and lawyers, most of whom would work for the Big Four global accounting firms—KPMG, EY, PwC, and Deloitte—who work the corporations’ books to inflate expenses and reduce profits, and capitalise on offshore tax havens and on tax loopholes that they help to write.

The interim solution to endemic corporate tax avoidance is a withholding tax on revenue. Whereas Australia’s corporate tax rate on profits is 30 per cent, a withholding tax should be much lower, around 2-5 per cent. The principle is the same as personal income tax, which is a withholding tax individuals pay in advance and then get a partial refund when they do their annual tax return. At 2 per cent, a withholding tax on just the corporations cited by Senator Patrick would raise $16 billion, over five years, more than the government’s black economy measures.

Speculation tax

For more than two decades, the Citizens Party has had a policy of a 0.1 per cent ($1 on every $1,000) tax on speculative financial turnover. The tax would apply to:

Equities trading (stock market)—not all share trades are speculative, but for genuine share investors who buy shares in companies to invest and hold long-term and earn dividends, a tax of $1 on every $1,000 will not be onerous. But for aggressive speculators and especially high frequency traders, it will be a disincentive. According to the 2017 Australian Financial Markets Association (AFMA) Report (latest available), annual stock market turnover for 2016-17 was $1,542 billion ($1.542 trillion), so the tax would have raised $1.542 billion.

Exchange-traded futures and options (derivatives)—the 2017 AFMA report records turnover of exchange-traded derivatives on everything from short- and long-term bonds, electricity, grain and other commodities was $48,864 billion ($48.864 trillion), which would have produced revenue of $48.864 billion.

Forex (foreign exchange)—total foreign exchange turnover in Australia in 2016-17 was $36,819 billion ($36.819 trillion). That year, Australia’s total international trade was $442 billion, meaning just 1.2 per cent of forex turnover related to imports and exports—98.8 per cent was pure speculation. Taxing this speculation would have raised $36.819 billion.

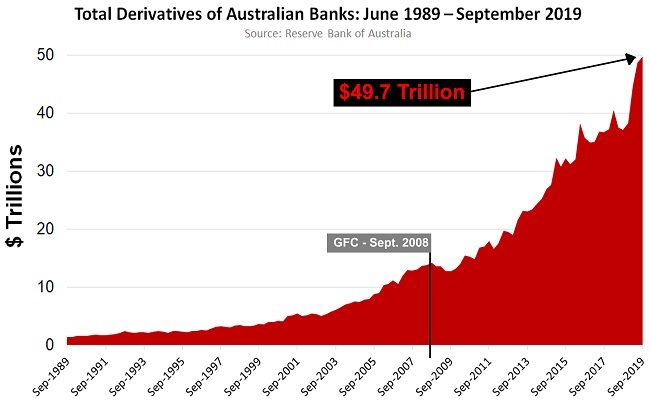

Over-the-counter (OTC) derivatives—the AFMA report only records OTC interest rate derivatives, which is the largest category of derivatives deals that banks make with each other “over the counter” as opposed to on an exchange. These are the derivatives that have proved to be the most dangerous in the financial system, evidenced by the litany of crises they have caused. In 2016-17 turnover in OTC interest rate derivatives was $18,962 billion ($18.962 trillion), meaning the tax would have raised $18.962 billion. However, it must be noted that since 2016-17, total OTC derivatives held by Australia’s banks has soared, so the same tax today would raise significantly more.

Total revenue from 0.1 per cent speculation tax—$104.182 billion!

These are the tax options available to any government that is serious about a tax system that is both just, and benefits the economy. They will clearly raise far more revenue than the cash ban measures, but without subjecting the population to totalitarian controls.