The Australian Alert Service is the weekly publication of the Australian Citizens Party.

It will keep you updated on strategic events both in Australia, and worldwide, as well as the organising activities of the Citizens Party.

To subscribe to the Australian Alert Service, it's easy, and it's secure.

Lead Editorial

21 July 2021

Vol. 23. No 29

What if we had spent all the money that bailed out the banks since 2008 on the economy instead? Central banks have injected many trillions of dollars into the financial system and, indirectly, government budgets, but what do we have to show for it?

A new report published 16 July by the UK House of Lords, “Quantitative easing: a dangerous addiction?”, found that evidence was lacking for any increased bank lending, investment or consumer spending from QE money printing, which is now equivalent to 40 per cent of British economic output. In the USA, banks have reduced their lending over the course of the QE experiment.

Australian banks have $314 billion idling in accounts at the Reserve Bank. The $188 billion Term Funding Facility that was created so banks could lend into the economy as part of the government’s COVID-19 stimulus package, is also just sitting in those accounts! The unregulated banks have no impetus to lend into the economy, but according to Michael West, writing 15 July for his website Michael West Media, they can command those deposits “as a bargaining tool when they borrow offshore to finance the property market and so forth”, bringing forward even larger sums into the speculative markets that they make their profits from.

While money has poured into cancerous speculation, the productive sector has been in continual decline, with production of steel, aluminium, electricity, petrol and livestock slashed. In the last ten years Australia’s manufacturing has fallen by 5 per cent in real terms. Thirty years ago, with three fifths of the population, over 200,000 more people worked in manufacturing than today. Apart from our raw materials exports, a service sector is virtually all that’s left. To see where that leads in a financial crisis, look at the case of Lebanon, a small nation with proportionally the second largest banking sector in the world, but where citizens are struggling for day-to-day survival (p. 10). Like Lebanon, Australia has been encouraged to become a financial services hub, riding on the back of Asian growth, as we have done with our raw materials exports that should have been developed locally. But now our politicians are alienating our largest export market, potentially taking that advantage out of the equation too.

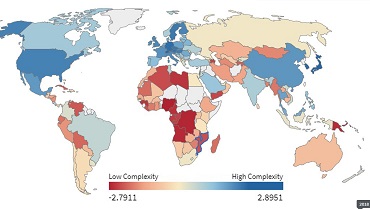

An economic index produced in 2018 by the Harvard Kennedy School’s Centre for International Development reveals that Australia fell from 57th place in 1995, in terms of the complexity of our economy, to 93rd in 2017, alongside countries like Uganda. By contrast, China rose from 51st to 19th in the same period. No wonder that while China built two new hospitals in less than two weeks after COVID-19 hit, Australia has not even managed to build one dedicated quarantine centre in over 18 months, leaving our vulnerable economy exposed.

At its core the threat we face is the economic ideology embedded in the minds of our leaders, handed down by generations of economists and a fleet of think tanks, enforced by global banking agencies invited in by none-thewiser national governments. Facing the collapse of its own financial system and associated control mechanisms, the Anglo-American financial oligarchy is activating fascist controls, as it did in the 1920s. Its greatest fear is that in a time of crisis, governments can be forced to respond to the needs of the people, as we have shown in recent campaigns. The greatest threat to its power structures is nations breaking from the economic consensus to secure a viable future. In the process, the financial system would be reorganised and taken out of the bankers’ control, with the banking interests confined by strict regulations that prevent them from interfering in economic progress. In his fight against the “economic royalists” during the 1930s depression, US President Franklin Roosevelt knew that was exactly how to contain the threat. See the back page for an insight into how it was done.

In this issue:

- End fake regulation! Demand inquiry into Sterling First and ASI

- Sterling cover-up goes all the way to the top

- KPMG’s dubious track record

- Arsonist turns firefighter? Ex-ASIO boss warns against exaggerating ‘foreign interference’ threat he once hyped

- Bob Hawke exposed as secret US informer

- Lebanon reveals the dangers of financialised economies

- Britain’s new economic axis targets alternative economic policy

- ‘Global Britain’ and gunboats

- USA exits 40-year Afghanistan War

- Don’t let the pressure off the banks, MPs!

- ASIC’s Sterling scandal shows Australia needs a hellhound of the financial system

- ALMANAC: Perceptions of China within the US body politic: Facts and Misconceptions – Part 2

Click here for the archive of previous issues of the Australian Alert Service