The peddlers of hysteria over Chinese foreign investment in Australia are conspicuously silent about investment from the United States, which was over twelve times larger than China’s in the last year.1 Australia is also heavily indebted to the USA; if the creditor was China, the media would call it a “debt trap”.

Of all foreign investors, the USA owns the lion’s share of Australian businesses, stocks and government bonds, and provides Australian banks with about a third of their offshore funding, fuelling the Australian housing market. Although Austrade claims foreign investment grows our economy and creates jobs, foreign investment can negatively impact the domestic economy; as Australian economist Professor Steve Keane observed in a 26 June 2020 YouTube interview, foreign investment means “profits get repatriated” overseas.

The Australian government’s relentless China-bashing in lockstep with US foreign policy is baffling Australian industry leaders, who can’t understand their willingness to destroy our hard-working exporters. (“Five Eyes directs destruction of Australia-China relationship”, AAS, 28 April.) Does Australia’s subservience to US investors and capital markets explain the government’s behaviour?

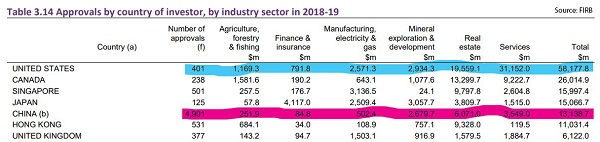

In 2019 the USA was the top foreign investor in Australia, accounting for over one quarter of all foreign investment ($983.7 billion), dwarfing China—in 9th place at $78.2 billion (2 per cent of total foreign investment). In 2018-19 the Foreign Investment Review Board (FIRB) reported the USA led proposed investment applications ($58.2 billion), with China in 5th place ($13.1 billion) and trending downwards (see chart). In the Department of Foreign Affairs and Trade’s latest comprehensive study on foreign-owned businesses in Australia in 2014- 15, the USA led the pack ($593 billion or 30.8 per cent of total), with China coming in fifth ($137 billion or 7.1 per cent).

Austrade’s profile on US investment in Australia links to a 2017 report published by the United States Studies Centre at the University of Sydney (USSC), “Indispensable economic partners”, celebrating the “remarkable benefit” of the USAustralia investment relationship. USSC published a 2020 follow-up report, “Enduring partners”, with a glowing foreword written by Senator Simon Birmingham, then Minister for Trade, Tourism and Investment.

USSC reports that while Australia represents 5 per cent of the Asia-Pacific’s GDP, it receives 18 per cent of US investment into the region. The USA accounts for almost half of all identified foreign investment in Australian shares, and 28 per cent of foreign investment in Australian bonds. In 2019, the total two-way investment between the USA andAustralia (with Australia’s side dominated by superannuation fund investments) was $1.8 trillion—equal to 90 per cent of the entire Australian share market, and almost equal to Australia’s 2019-20 GDP.

What’s in it for us?

USSC boasted that since the Australia-United States Free Trade Agreement (AUSFTA) went into effect in 2005, the Australian-US investment relationship had nearly tripled, growing by over $1.2 trillion (or 283 per cent). In reality, however, Australia suffered significant losses from AUSFTA. As Leith van Onselen noted in a 13 February 2017 report for MacroBusiness: “AUSFTA is anything but ‘free trade’, with the costs from patent and copyright extensions, along with trade diversion, costing Australians dearly.” Then-Foreign Minister Julie Bishop revealed in 2017 that AUSFTA “works very much in the US’s favour”,2 as Australia had a trade deficit with the USA. This compares to the Australia-China trade relationship, which is a huge surplus in our favour, and growing—in 2019-20 China was Australia’s largest goods export destination ($134 billion or 36 per cent of total exports), up $29 billion (or 27 per cent) year on year.3

According to USSC, in the last five years US investment in Australia has risen by 25 per cent, growing at an annual rate of 8.1 per cent (the average annual US offshore investment growth rate was 3.9 per cent). In 2019, US foreign investment into Australia was nearly a trillion dollars—but where is this money actually going, and how does it benefit Australians? Official Australian statistics are scant, but the USSC reported in 2017 that 60 per cent of overall US investment in Australia went into portfolio investments, and over 44 per cent of US foreign direct investment went to holding companies, which are used for tax considerations. USSC noted the “enormous amount of cash held offshore” by US corporate giants such as Apple, Google, and eBay, which had been seeking exposure to the Australian housing market through overseas securities investments.

The Productivity Commission reports Australia is “a growing net debtor to the world due to wholesale loans to the banking sector (which are largely used for residential mortgages)”.4 USSC noted in 2017 that the Big Four banks get a quarter of their offshore funding from the USA—triple the amount which comes from shareholders—and are “heavily reliant on wholesale funding from US debt markets”, boasting: “[I]t is not a stretch to say that Australians’ mortgages are brought to them by US capital markets.”

Where Australia is a net foreign investor is in equities— shares—due to significant offshore investments by superannuation funds. USSC noted it is estimated more than $500 billion (around 20 per cent of Australia’s superannuation pool) is boosting the US stock market, reporting “Australian super funds and insurance companies have about half of their offshore share market investment in the USA.” Superannuation giant AustralianSuper reports 58 per cent of its international investments are in US shares, dwarfing its next-largest investment destination, the UK, at 5 per cent.5

The United States is Australia’s biggest absentee landlord and creditor through its foreign investment and lending. It’s a costly relationship: on top of the multi-billions we are already losing to the USA through repatriated profits, interest payments, and trade imbalance, we are now following the US foreign policy confrontation of China and acting against our own interests by unnecessarily destroying our relationship with our biggest trading partner, smashing a wrecking ball through our exports to China. Perversely, our great ally the United States is picking up many of the markets we are losing by aligning with Washington’s anti-China agenda.

By Melissa Harrison, Australian Alert Service, 5 May 2021

Footnotes