The Australian Alert Service is the weekly publication of the Australian Citizens Party.

It will keep you updated on strategic events both in Australia, and worldwide, as well as the organising activities of the Citizens Party.

To subscribe to the Australian Alert Service, it's easy, and it's secure.

Click here for subscriptions within Australia

Click here for overseas subscriptions

Lead Editorial

1 July 2020

Vol. 22. No. 26

Liberal MP Tim Wilson has acknowledged the legal risk that deposits can be “bailed in” to recapitalise failing banks—contrary to his own government’s position. Wilson prefaced his acknowledgement, however, by expressing his doubt that the banks are in any trouble. “At this stage I am not convinced there is any risk”, he said. Famous last words.

The truth about Australia’s banks is contrary to the public’s perception of their strength and profitability. The banks have been able to cultivate this perception through a PR campaign fronted by the government itself, going back to the 2008 global banking meltdown when the government loudly assured the public Australia’s banks were “sound”. They weren’t then—Kevin Rudd had been forced to prop them up with guarantees to the international creditors with whom the banks had to roll over more than $400 billion every three months—and they aren’t now, whatever the Morrison government claims.

In terms of their everyday business, the banks were already facing serious problems last year when house prices were plunging. With mortgage lending accounting for more than 65 per cent of the business of each of the Big Four— which are 80 per cent of the banking sector—the banks faced potentially disastrous asset write-downs and increased capital requirements. As the Rudd government did in 2008, Scott Morrison moved to prop up the property market through a boost to first home buyers, and the media and their associated real estate firms all jumped on the bandwagon to convince people to rush back into the market. Why the panic over houses becoming cheaper? Because a property crash would smash the banks.

Now the response to the coronavirus pandemic has thrown the housing market into disarray again, and again the issue is not property prices per se, but the danger to the banks. The Australian reported on 29 June that Morgan Stanley has estimated that repayments have been deferred on more than 11 per cent of the major banks’ mortgages. This amounts to almost 500,000 borrowers representing almost $200 billion in loans. On top of that repayments on more than 300,000 business loans have been deferred. Morgan Stanley reports 20 per cent of borrowers had just a one-month buffer on their repayments, and 20 per cent had no buffer. These figures correspond to the Digital Finance Analytics household survey, which in April revealed the proportion of households in mortgage stress had shot up to 38 per cent. At issue is the combined capital of the banks, which is $235 billion or 10.5 per cent of “risk-weighted” assets. The Australian Prudential Regulation Authority (APRA) has long boasted this level of capital makes the banks “unquestionably strong”, but the ruse of risk-weighting means actual capital is only around 6 per cent. Knowing the banks are in trouble, APRA has suspended normal capital requirements so the banks don’t have to account for the downturn in the property values that are the collateral for their main assets. This may work on paper, but in reality it means the banks’ risks are soaring. Such is the desperation, Freedom of Information documents have revealed the Reserve Bank in April internally mooted the idea of temporarily suspending the housing market.

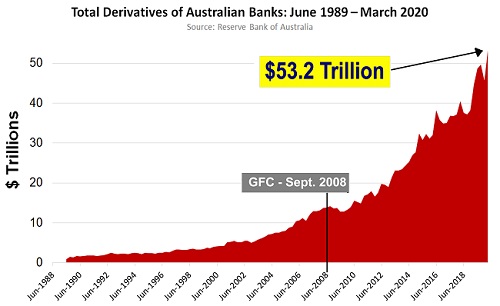

The big unknown that trumps all other bank risks is derivatives, the financial gambling instruments that legendary investor Warren Buffet called financial “weapons of mass destruction”. Total Australian bank derivatives soared $7.5 trillion in the January quarter to a new all-time high of $53.2 trillion! These are “off-balance sheet” and unaudited. The question is, why are the banks going on a derivatives binge at this time? Derivatives are hugely risky but can be hugely profitable and help to paper over losses the banks are making in other areas.

All this underscores the fact that bail-in is not academic. It’s there to be used. Demand Parliament pass the Banking Amendments (Deposits) Bill 2020 so it can’t be used to steal deposits. (Make a submission—details here.)

In this week's issue:

- Politicians lie about bail-in! Demand they pass the amendment

- Collaery tried in secret to protect Downer’s Timor bastardry

- Royal Commission can’t hide bushfire truth

- Final demolition of Volcker Rule lights up derivatives risk

- China leads plan to prevent African debt defaults

- FBI document links Biden to Russiagate orchestration

- Putin’s discussion of the Second World War can prevent World War III!

- Have you made your bail-in inquiry submission?

- Join the fight to save the Dairy Industry

- Back on the streets!

- China is far from the biggest foreign landowner in Australia

Click here for the archive of previous issues of the Australian Alert Service