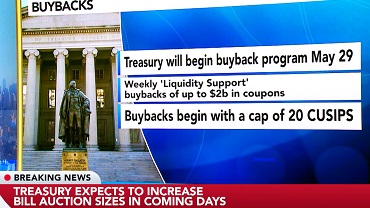

In an indicator of instability in US Treasury markets, on 1 May the US Treasury announced a program to buy back its own securities, from May through July, for the first time in over two decades. This is happening as the Treasury continues to issue record levels of new debt, offering large tranches of new bills.

Treasury announced that starting on 29 May it will purchase up to US$2 billion worth of Treasuries and a further US$500 million worth of Treasury Inflation-Protected Securities in a weekly “Liquidity Support” operation. It will buy back older government bonds issued at lower interest rates that are currently plaguing the books of financial institutions. The second, third and fourth largest US bank collapses since the Great Depression, which occurred last year, were catalysed by losses from such securities which were devalued as interest rates soared. This is the first such buyback operation since the 2000-02 period.

In recent times large banks have reduced trading activity in US government securities, and the US Federal Reserve has reduced its purchases of US government debt due to its quantitative tightening (which tightening will ease off in conjunction with the Treasury’s latest move). Furthermore, in December 2023 the Securities and Exchange Commission (SEC) approved a new rule, to be phased in by December 2025, requiring trading of Treasuries (including most “repurchase” operations whereby banks park their Treasuries overnight in exchange for cash—more on that soon) to occur via clearinghouses, namely through a “middleman” that backstops transactions.

Along with the buyback scheme, the Treasury announced that it will issue US$243 billion in net new debt in the AprilJune quarter. Combined with new Treasury debt issued in the first quarter and the planned issue for July-September, that makes a projected US$1.84 trillion net new US debt for those three quarters, keeping up the incredible pace of US$2.5 trillion/year in new debt.

But this is a matter of hold your breath, close your eyes and hope for the best. As Bloomberg News reported 1 May: “When traders in the roughly US$27 trillion US Treasury market have trouble trading, it’s a matter for far wider concern. Liquidity metrics have hit crisis levels ... raising worries about underlying fragility in the functioning of a market that’s a key underpinning of the global financial system. That’s one reason why, for the first time in more than two decades, the Treasury says it will begin regularly buying back its bonds starting 29 May. Its goal is to stabilise the situation and buy time for policymakers to implement more permanent solutions.”

Problem: gambling

More permanent solutions must involve a focus on rehabilitating the productive, physical economic sector, with government intervention to channel finance in that direction. More of the same—such as the suggestion of the advisory panel to Treasury, which includes BlackRock and JPM Chase, to create new types of securities—will not work.

The US Treasury bond market has long had a reputation as the deepest and most liquid market in the world, underpinning the functionality of the global financial order. In practice this means that any player—whomever, whenever—that wants to enter the market to sell US Treasuries, or to source them, can do so immediately, without fear of being left in the lurch. In recent years this capacity has been severely challenged. According to Bloomberg’s US Government Securities Liquidity Index, Treasury market liquidity is still close to the worst levels of 2020, which was a drastic crunch point, as we revisit here.

In March 2020 Treasury trading stalled precipitously, as the repercussions of COVID hit the USA, but major disruptions had commenced six months earlier, during the September 2019 “repo” crisis. The repo market, short for “repurchase agreements”, is a crucial venue for day-to-day liquidity of banks and other market players, utilising Treasury bonds and other government securities. A financial player can drum up short-term cash by temporarily selling its Treasury holdings to another financial entity, agreeing to repurchase those same assets at a future date, usually within 24- 48 hours, at the same price plus a fee. Essentially, industrial scale pawnbroking for banks. The repo market has become indispensable to provide interbank liquidity for financial houses, for sourcing of Treasury bonds to use as collateral, and for the US Federal Reserve to conduct market operations, influencing monetary policy by tightening or loosening access.

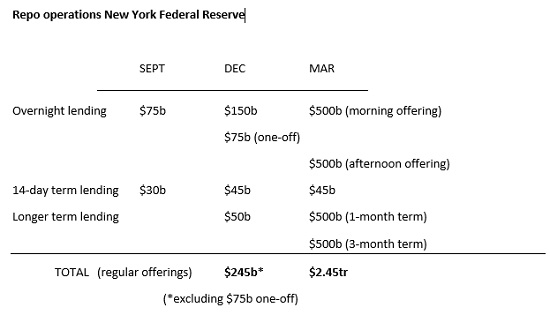

In September 2019 the big banks that had always ponied up repo cash in exchange for collateral simply stopped lending, depriving other banks and financial institutions of funding. Overnight lending rates soared. Increased reserve requirements, the banks claimed, limited their lending activity, but they were also engaging in greater Treasury bond speculation which was tying up their funds. The Fed had to step in to provide overnight lending. Later it emerged that the debacle was triggered by troubled hedge funds—even bigger speculators (in Treasuries and more), some of which at the time had frozen investor withdrawals or even shut up shop—demanding much higher levels of repo cash than usual. But banks were loathe to lend to them at the usual overnight rates. Consequently, in order to save the Treasury market, which underpins the credibility of the entire US dollar order, the Fed was forced to intervene—in essence bailing out private, speculative hedge funds hosting the investments of the super-rich.

This 2019 intervention, injecting multi-trillions of dollars, had been the first since the 2008 global financial crisis. Despite some calming in the opening weeks of 2020, the problem remained and low-level Fed interventions continued. Then, in early March 2020, it suddenly jacked up its lending operations—way beyond 2019 levels. The instability to which it was responding was again led by hedge funds, which were losing out on their bets on the spread between current and future Treasury prices—the Treasury “basis trade”—and raiding repo markets for short-term cash to meet margin calls on their borrowings.

Around a year later, in April 2021, a report by the US Federal Reserve Board admitted that regulatory changes following the 2008 crisis, and particularly from 2017, had elevated the role of hedge funds in repo markets, increasing the level of speculation in the sector. But with major banks putting less capital into repo functions and the market flooded with more Treasuries than ever, the Fed had to keep the hedge funds involved. “[T]he US Treasury market is probably the single most important market in the economy and the world”, said Fed Chairman Jerome Powell that same month: “It needs to be liquid.” (For more on this subject see “The rise of the hedge funds”, AAS, 14 July 2021, and “The fall of the hedge funds?”, AAS, 5 April 2023, available at citizensparty.org.au)

The 2021 Fed report essentially admitted that the Fed had to save hedge funds in order to save the Treasury market. In August 2021 the Fed established a standing repurchase facility—whereby it would assume a permanent role in providing repo liquidity—absolving the banks of sole responsibility. JPMorgan Chase had suggested this earlier, as it would leave the banks free to invest their excess daily reserves in higherprofit ventures. The Fed also broadened the range of repo market participants, without disclosing names and details.

Today, hedge funds hold far more Treasuries than banks. The 2024 IMF Global Financial Stability Report, “The Last Mile: Financial Vulnerabilities and Risks”, expressed concern that the volatile US Treasury market could represent a threat to the global financial system: “A concentration of vulnerability has built up, as a handful of highly leveraged funds account for most of the short positions in Treasury futures”. Eight or fewer very large, highly leveraged, speculative hedge funds hold some 30 per cent of all futures positions on 5-, 10-, and 20-year Treasury securities, and 50 per cent of all futures positions on 2-year Treasuries. The crash marches on Unsurprisingly, given the extent of the Fed injections, none of which went into the real economy, inflation soared and two years after the March 2020 repo disaster, in March 2022 the Fed started tightening monetary policy and raising rates. This precipitated a whole new crisis, which we saw explode with the US regional banking crisis that commenced in March 2023. The Treasuries piled onto the banks’ books became increasingly worthless as their market value plummeted due to their inverse relationship to rising interest rates. New bonds issued at higher rates are far more attractive, equating to fewer buyers for existing bonds. The same was true of the Treasuries piled up at the Fed.

As AAS has covered, a January report published by the American Enterprise Institute stated that the Fed is “operating at a loss, deeply technically insolvent, and with asset shortfalls”. It is in a similar position to collapsing US banks, with around US$1 trillion of unrealised losses in its portfolio. This position limits it from conducting some market operations for monetary policy and presents a very real danger if interest rates remain high. If the situation is not solved, ultimately “taxpayers will bear the burden of accumulating Federal Reserve losses that are hidden by Federal Reserve accounting policies and not included in reported government deficit statistics”, said the AEI report. (“The Black Swan rears its head at the Fed”, AAS, 17 April.)

Already in 2024 we have seen the collapse of Republic First Bankcorp with US$4.3 billion in deposits. The US Federal Deposit Insurance Corporation (FDIC) organised its takeover, by Fulton Bank. And New York Community Bankcorp, which had helped rescue Signature Bank last year, is in a holding pattern after being bailed out by big investment funds. The Fed program to assist regional bank liquidity expired in March, bank deposits remain low, and bank lending is still in decline.

The Fed has destroyed itself with its vain rescue missions and now the Treasury is going in to bat for the same banks and hedge funds. Only an emergency program to redirect financial flows from speculation into productive development can prevent financial and economic catastrophe.

By Elisa Barwick, Australian Alert Service, 15 May 2024