As the 12-18 October IMF-World Bank meetings discussed how to tackle an existential economic breakdown while simultaneously staving off a financial blowout, more detail emerged about the extreme lengths central banks went to in March in order to keep the system afloat.

The investment sometimes described as the world’s bomb shelter—US Treasury Bonds—were close to caving in. “[T]he Federal Reserve was forced to intervene even more aggressively than it did in the financial crisis of 2008”, wrote Robin Wigglesworth in the 21 September Financial Times. According to the analysis, panic broke out due to a number of intersecting market factors triggered by the expected impact of COVID-19. Treasuries were ditched as funds moved into cash. As the spread between Treasury yields and Treasury futures and bonds went haywire, hedge funds betting on the difference were hit with margin calls on money borrowed in overnight (“repo”) lending markets, renewing instability in that quarter.

RBA fills in some gaps

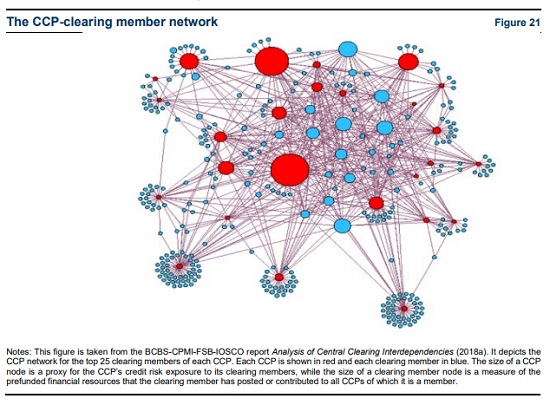

The Reserve Bank of Australia’s October Financial Stability Review reported some revealing observations on the March market dysfunction. Noting that the Bank for International Settlements’ Financial Stability Board (FSB) has approved exemptions from following its post-2008 crash rule book, which was supposed to stabilise the system during a new crisis, the report claims that the FSB architecture has nonetheless worked—at least to protect investment funds. A number of clients of the new centralised derivatives clearing system (Central Counterparty, CPP) defaulted, the report admitted, though without any loss to the CCPs or their other participants, namely investment banks and hedge funds that trade risky derivatives contracts. (See graphic.) Investment funds were thus able to “weather the turmoil ... when there were heavy redemption pressures across a wide range of funds ” . The US Treasury market dislocation caught out highly leveraged hedge funds that were “forced to unwind positions quickly as price fluctuations led to margin calls”, triggering a sell-off of US Treasuries, ultimately forcing central banks to intervene. So much for the FSB regime heading off bailouts! “Similar dynamics were also present in other government bond markets, including in Australia”, said the report. (The RBA noted that the Australian Securities and Investments Commission [ASIC] is working with an FSB working group that is currently “mapping interconnections across different parts of the financial system” to better understand the financial system.)

In addition, the RBA reported, investors made large withdrawals from US prime Money Market Funds, making it “considerably more difficult and expensive for banks to raise short-term funding”. Similar disruption occurred in the UK and “significant interventions by central banks were needed to restore market function”.

A bigger ‘repo’ disaster

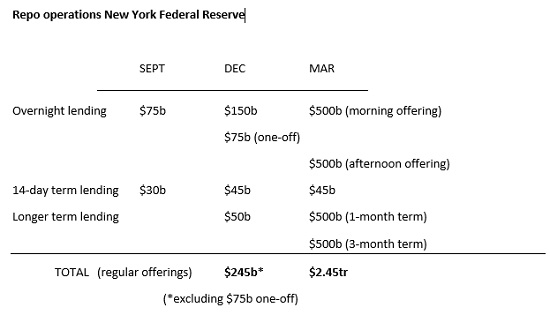

Unmentioned by the RBA, but unsurprising, was a dramatic expansion of New York Fed interventions into repo markets. This is where the Fed steps in to increase liquidity by lending to banks overnight, or on other short terms, against collateral that they agree to repurchase the next day. When the Fed used this mechanism beginning 18 September 2020 after repo rates suddenly leapt from just over 2 per cent to nearly 10 per cent, it had not been utilised since the global financial crisis. After an initial $53 billion US dollar offering, the NY Fed began offering regular $75 billion in overnight lending on a daily basis, as well as $30 billion in 14-day term lending, beginning at 3 times per week. The injections expanded, until at year’s end, with concerns about a new shock to the financial system, they jumped to $120-150 billion in daily overnight repos. With the various regular term offerings, this amounted to $2.93 trillion rolled over in just one month.

Interventions calmed down in the New Year, until on 9 March the NY Fed again began increasing the amount of lending offered through its regular overnight and term repurchase operations, far surpassing the September and December interventions. Overnight lending offered every morning increased from $100 billion to $150 billion over the course of the month, with an additional afternoon offering of $500 billion from 16 March through the end of the month. From 20 March the morning offering was also increased to $500 billion. 14-day loans increased from $20 billion to $45 billion (twice-weekly); monthly loans offered to the tune of $50 billion on 11 March were increased to $500 billion on 12 March, offered weekly; with the addition of $500 billion worth of 3 month loans offered weekly for the remainder of the month. Also on 12 March, the NY Fed announced purchases “across a range of maturities … to address highly unusual disruptions in Treasury financing markets associated with the coronavirus outbreak”. On 15 March additional purchases of Treasury securities and agency MBS were announced, “to support the smooth functioning of markets for Treasury securities and agency MBS”. On 13 April the NY Fed announced it would begin reducing the frequency of its interventions.

Neither these, nor the myriad of Fed-Treasury funding facilities, a.k.a. bank bailout vehicles created during the COVID crisis, went into real economy. If we inject credit into real economic development and shrink the bloated financial system, the crisis on both fronts—finance and the economy—can be solved.

By Elisa Barwick, Australian Alert Service, 21 October 2020