A public postal bank could solve financing needs of local government

By Robert Barwick—Australian Alert Service , 10 August 2022.

A public bank that operates through post offices could be anything the government wants it to be: it could be a quaint little savings bank that serves mainly regional communities with no other bank branches; or it could be a powerful competitor to the private banks that exposes their decades of neglect, by investing in local small businesses and industries currently denied credit by the banks, and in local, state, and national infrastructure.

The sky’s the limit, really.

When the Commonwealth Bank started in 1912, initially operating through post offices, its first Governor, Denison Miller, was a banking genius who operated the bank to its fullest potential.

One area in which Miller showed what the Commonwealth Bank was capable of was in lending to local government.

In his 1923 book The Commonwealth Bank of Australia: a brief history of its establishment, development and service to the people of Australia and the British Empire under Sir Denison Miller, the official history of its first decade of operation, C.C. Faulkner reported,

“The bank has granted loans to sixty councils in country districts to assist in developments and improvements.”

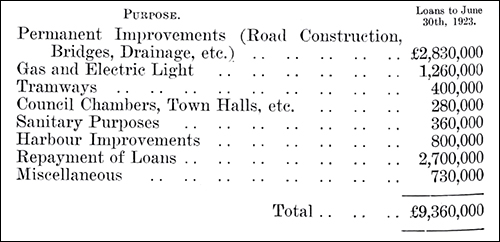

This development was impressive: it included electrification, which allowed the establishment of butter factories, flour mills, saw mills, and steel mills, such as an electricity plant in Newcastle which supported the steel works; road construction, including paved roads in the Western Australia wheat belt which facilitated farmers getting their wheat to railways and ports; bridges; drainage; gas and electric lighting for towns; tramways; council chambers and town halls; sanitation; harbour improvements; and more.

The success of the Commonwealth Bank in supporting local councils should be revisited today, given the financial difficulties afflicting local government across Australia.

Local councils are responsible for more costs than ever, but have less revenue than ever. For example:

- they are responsible for one third of all non-financial infrastructure assets, but only collect 3.5 per cent of all Australian taxation revenue;

- the value of their federal grants has declined from 1 per cent of Commonwealth tax revenue (CTR) to 0.55 per cent.

Many councils seem to be doing an admirable job of managing their finances, but balancing their books is coming at the expense of their infrastructure—not only the development of new infrastructure, but the adequate maintenance of existing infrastructure.

One WA shire president told AAS that if his council budgeted to cover the cost of properly maintaining its infrastructure, even with the majority of its revenue coming from grants, it would have to double the rates on residences, which nobody could afford.

In a 2014 report called “Debt is not a dirty word: Role and use of debt in local government”, by the Institute of Public Works Engineering Australia and the Australian Centre of Excellence for Local Government, author John Comrie, an experienced local government planner, asserted:

“It is simply not possible for many councils to make significant improvement in their financial, asset management and service delivery performance without greater and better use of debt.”

In other words, Councils shouldn’t be afraid to borrow more money.

While councils do borrow money, their average debt is relatively low, which would be a good thing if they were keeping up with their infrastructure, but that is not the case.

In most states, councils borrow through their state Treasury Corporations, which sell bonds in Australia and overseas on their behalf.

While it is beneficial for councils that state governments support their finances this way, in practice it isn’t adequate to their infrastructure needs, and it can also lead to cash flow problems, as the councils are obliged to make regular repayments of principal and interest on the bonds (moreover, the fact that some of these bonds are sold overseas means the repayments go overseas too).

In 2012, international accounting and consulting firm EY produced a report for the federal government titled “Strong foundations for sustainable local infrastructure: Connecting communities, projects, finance and funds”.

The report’s major recommendation was based on an acknowledgement that the federal government is best placed to assist in the borrowing needs of local governments for infrastructure. EY recommended:

“Our headline recommendation for the Australian Government is that it investigates establishing a national financing authority for local government (Recommendation 3). Building upon models which are successful overseas, the proposed financing authority would have a mandate to invest directly in local government programs by providing competitive and low-risk finance, and to facilitate inward investment. The authority would have the ability to bundle approved council borrowings into a limited number of bond issues, which could be underwritten by the Australian Government.”

Funnily enough, 100 years before EY produced this report, the Commonwealth Bank had started being a national financing authority for local government.

Like the Commonwealth Bank, a national postal bank would be a perfect national financing authority, but instead of only selling bonds to lend to councils, it could also use the deposits in the bank.

Using a public bank that reinvests the savings of the people of Australia would mean council borrowings wouldn’t have to come from overseas.

Also, a public bank would have the ability to lend to councils on flexible terms, so their repayments could be structured to fit with the fluctuations of their cash flow.

The bottom line is that by providing affordable and flexible loans, a public post office bank could help local councils expand their investment in their infrastructure, and in doing so retain the industries that support their local economies, and attract new industries that generate new wealth, and attract new residents, which means more ratepayers.

It would also mean reversing the population decline that is crippling regional Australia.