Part of the strategy of the Bank for International Settlements (BIS) to “reform” the financial system after the 2008 crisis was to introduce a middleman into derivatives trading—a central counterparty (CCP). In 2012 it became mandatory for exchange-traded derivatives to go through a CCP. The BIS did not act to limit or regulate the multi-quadrillion dollar gambling bubble, but to add another party into the mix, which concentrated the risk and brought new too-bigto-fail (TBTF) institutions into existence. The BIS admitted that this has eventuated, in an 11 May report, “The CCP-bank nexus in the time of COVID-19”.

Already in 2016 a report prepared by the Bank for International Settlements’ Committee on Payments and Market Infrastructures and the International Organisation of Securities Commissions admitted that CCPs may have become a threat to the financial system. In a December 2018 Quarterly Report, the BIS said CCPs could cause “a destabilising feedback loop, amplifying stress”. This is exactly what is now happening.

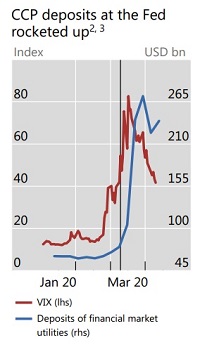

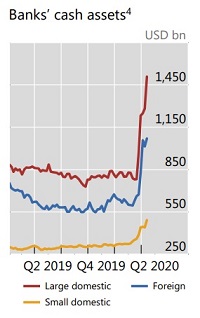

This month’s report warns of the impact of CCPs ramping up margin calls and the interconnected nature of big banks and CCPs, which can “amplify” shocks. During March, increased margin calls and cash hoarding due to market turmoil caused a shortage of liquidity across the system, as occurred when the derivatives holdings of Lehman Brothers began to unwind in 2008. Some margin calls—buffers paid to CCPs to cover potential losses on speculative bets—doubled. In addition, some banks doubled cash kept on hand over March. As market volatility increased, “CCP deposits at the Federal Reserve more than tripled within a month” from US$70-270 billion, a reflection of the increased margin calls, the BIS report stated.

Given that the model of margin calls triggered by large price movements can be destabilising, the nexus between banks and CCPs needs to be examined, said BIS: “actions that might seem prudent from an individual institution’s perspective, such as increasing margins in a turmoil, might destabilise the nexus overall.” A resulting liquidity squeeze affects corporations and households. (The option of resolving this problem by separating banks that lend commercially from those that invest in derivatives, is not discussed.)

The other problem is the large concentration of derivatives in a handful of CCPs. The five largest entities account for over half of total outstanding positions. A single CCP provides 85 per cent of clearing for interest rate derivatives. For some categories of derivatives this exceeds 90 per cent. Further, some CCPs hold tens of billions of dollars’ worth of reverse repos, affecting this lending market as well.

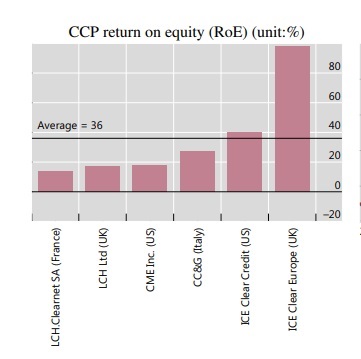

A 25 May BIS working paper warns that if CCP margin models underestimate potential losses it could lead to the failure of CCPs, “with systemic consequences”. CCPs have become “systemic players” in derivatives markets. This report also reveals that CCPs are very profitable, even more so than banks, with an average return-on-equity of 36 per cent at the end of 2018, which reinforces the fact that they have joined the TBTF fraternity.

By Elisa Barwick, Australian Alert Service, 27 May 2020