The Australian Alert Service is the weekly publication of the Australian Citizens Party.

It will keep you updated on strategic events both in Australia, and worldwide, as well as the organising activities of the Citizens Party.

To subscribe to the Australian Alert Service, it's easy, and it's secure.

Click here for subscriptions within Australia

Click here for overseas subscriptions

Lead Editorial

12 May 2021

Vol. 23. No. 19

The 2021-22 budget is the usual “sound and fury, signifying nothing”. It does not address the fundamental structural instability of an economy based on sophisticated financial looting, and as such does nothing to put our nation on the course of economic recovery.

The proposed $15 billion infrastructure spend over ten years is pathetic. Compare it to the visionary Snowy Mountains Scheme which at a time of record public debt in 1949 was allocated spending of 15 per cent of GDP— equivalent to $300 billion today, for a single project! The shift we need, away from Viking-style raiding of raw materials, and banking pirates plundering private profits, must start with a long-term vision of how our nation must look fifty to one hundred years from now.

In the background, however, something very different was transpiring during the budget discussions: Government MPs were lobbying the Treasurer to implement a National Infrastructure Bank! The support among a growing number of MPs—from all parties—for productive public credit to shift out of the current economic morass, is driven by their increasing engagement with an educated population demanding concrete changes.

The popular revolt against the full or partial privatisation of Australia Post is but the tip of a massive iceberg of which MPs are just becoming aware. Banks and ATMs are closing, sabotaging regional areas at the very time they should be driving the economic upshift with major development projects that open up the country.

The Opposition had no better alternative to the government’s budget, merely taking the other side of the political game, complaining about running up the debt and pork barrelling. The true opposition is emerging from an unexpected direction. The Australia Post hearings, engineered by a citizens’ movement, exposed the corruption beneath the surface of Australian politics in a way that has shaken up the entire political establishment. The unlikely collaboration this campaign unleashed, bringing together unions and billionaires, government MPs and cross-benchers, shows a new leadership movement is being brought into being.

A major driver of the awakening among both the people a n d M P s , is the global financial catastrophe looming on the immediate horizon. The consequences of extreme efforts to save the financial bubble with mammoth financial injections since September 2019, when the “repo” crisis petrified interbank lending, are coming home. The US Federal Reserve in its 2021 Financial Stability Report warns that “a broad range of asset prices could be vulnerable to large and sudden declines”, leading to “broader stress to the financial system”. Fed Governor Lael Brainard specified in a press release that the failure of Archegos Capital Management, which hit several large banks hard, had revealed the ongoing capacity for “leveraged investors to generate large losses in the financial system”, admitting that US regulators are still not capturing this risk. The Citizens Party warned after the 2008 global crisis that banks would find a way around any regulation that fell short of Glass-Steagall rules prohibiting deposit-taking banks from speculating. That is exactly what they have done, bypassing the inadequate Dodd-Frank Act’s Volcker Rule by reclassifying their speculative activities and shifting them off their balance sheets using complex derivatives.

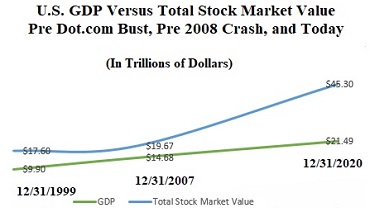

The US stock market is but a by-product of this mess, yet indication enough of the insanity of the process. According to financial website Wall Street On Parade, its more than US$49 trillion value is larger than the combined GDP of the four largest industrialised nations—the USA, China, Japan and Germany! As the piece recalled, the post-2008 crash review by the US Financial Inquiry Commission stated that the claims from Wall Street and Washington that “that the crisis could not have been foreseen or avoided” are simply not credible. There were warning signs, but “they were ignored or discounted”. We cannot afford to ignore them again today, much less allow political pundits to distract from this reality with hysteria about “external threats” which will drag us into global war.

In this issue:

- The Australia Post fight continues—time for a postal bank!

- India ban betrays Australia’s healthcare catastrophe

- No ‘security’ basis to tear up Port of Darwin lease

- Darwin: Australia’s gateway to Asia

- Time to discuss the real Prince Philip

- Greensill scandal exposes neoliberal hijacking of UK government

- Attention! Banking revolution ahead

- Senate bill pushes war with China

- Australian press ignore AAS terrorism allegations until cited by China’s Foreign Ministry

- A Postal Bank for the public good!

- Dante’s Commedia shows the way out of Hell

- ALMANAC: How to think about climate change

Click here for the archive of previous issues of the Australian Alert Service