The Australian Alert Service is the weekly publication of the Australian Citizens Party.

It will keep you updated on strategic events both in Australia, and worldwide, as well as the organising activities of the Citizens Party.

To subscribe to the Australian Alert Service, it's easy, and it's secure.

Lead Editorial

23 June 2021

Vol. 23. No 25

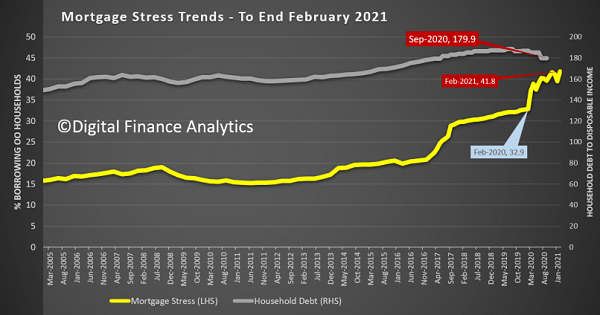

An extra half-million Australian families are in mortgage stress compared with February 2019, despite the findings of the Financial Services Royal Commission released on 1 February that year. Over 1.52 million Australian households are now struggling with mortgage repayments that exceed 30 per cent of their income, according to Digital Finance Analytics surveys.

The Reserve Bank of Australia (RBA) defends its housing bubble-boosting policy with claims that households spend more as they see the “value” of the family home rising (with banks willing to lend them more against their increased collateral), creating an overall “wealth effect”. But the reality is debt is growing on the back of fictitious values, that will wipe out families when they collapse. Australia’s household debt is 212 per cent of net income, the fourth highest in the world, according to February finder.com figures, compared with 68 per cent in 1990.

Since 2019 the effort to keep the housing bubble from bursting has been an intensive operation. It was clear in late 2017 that the jig was up, and tanking 2018 prices accelerated in 2019. In March 2019 the nation’s biggest markets of Sydney and Melbourne experienced the largest falls ever recorded. Warnings sounded from the IMF and a host of experts: a collapse of the Australian housing bubble would shake the foundations of Australia’s banking system, and potentially the world’s. The coordinated campaign that commenced, to protect housing values at the cost of Australians’ futures, was nothing short of breathtaking (see box p. 7).

With the advent of COVID-19 in 2020 a hiatus on mortgage repayments and defaults intervened to temporarily delay a housing collapse. By September, however, further intervention was required. Against a backdrop of collapsing housing credit, Treasurer Frydenberg announced the government intended to wind bank responsible lending laws. On 2 October, Assistant Minister to the Prime Minister and Cabinet Ben Morton announced the commencement of the Deregulation Taskforce as part of the “Government’s Deregulation Agenda”, claiming in the usual neoliberal doublespeak that combatting the economic crisis demanded more of the same deregulation which led to the crisis.

In mid-October, announced 23 October, Frydenberg moved to oust one of the only regulators who was actually following the banking royal commission’s demands for increased scrutiny of banks, the Australian Securities and Investments Commission’s James Shipton (p. 4). The same day, a public servant who did more than any regulator to force the banks to serve the community—Australia Post CEO Christine Holgate—was also thrown under a bus. Nothing and nobody was to get in the way of the Deregulation Agenda.

By March 2021, house prices were back—with the fastest growth in 32 years—and the risks too. The April 2021 RBA Financial Stability Review warned that the financial system could be threatened if a debt blowout and asset price bust coincided. The IMF’s World Economic Outlook warned that tighter financial conditions posed a major risk for any nation with inflated asset bubbles, and could lead to a “sharp re-pricing of financial assets” causing volatility in the banking system.

The Citizens Party’s legislation for a Commonwealth Postal Savings Bank is thus crucial, as a mechanism to force the Big Four banks to actually compete on service, which will boost the regulatory health of the financial system. The fight against watering down responsible lending laws is another crucial front, and a Greens’ motion may soon succeed in removing the bill from the legislative agenda. On 22 June, Greens Senator Nick McKim told parliament: “The system is designed to make homes more expensive”. Slamming the policies which contributed to house price increases at nearly twice the rate of wage rises, he declared that “this government is all for property speculation and all for helping out its mates who benefit from it, be they developers, the banks or their rank and file, who lord over massive property investment portfolios.”

In this issue:

- We know what Barnaby says—what will he do?

- ASIC chair James Shipton copped the Christine Holgate treatment—for the same reason

- ‘Regulator beware’ of the Morrison government

- Housing crash spectre of 2019 still haunts us

- Witness K and Collaery face sham Australian justice

- Morrison moves to militarise the ‘Top End’ for war with China

- Point of no return? Bubbles at bursting point

- National Infrastructure Bank bill introduced, gains support

- Biden and Putin take steps to resume war-avoidance efforts

- US-Russia Presidential Joint Statement

- Intention defines action!

- The fascist, banker-owned roots of the Institute of Public Affairs

- ALMANAC: The perils in the Biden Administration’s ‘climate’ agenda (Parts 6-7)

In this issue

Click here for the archive of previous issues of the Australian Alert Service