Don’t believe the hoopla about the vital role of the free market and independence from government intervention (from picking winners and the like) to secure economic progress. The entire global banking model is built on precisely the opposite approach. It’s only the small operators that are forced to compete, and be crushed in many cases, by the not-so-free market framework. Large banks and corporations are allowed to operate outside of this survival-of-the-fittest realm. They can freely enter into cartel arrangements, monopolies or oligopolies, and will even be rescued when they run into trouble.

This is confirmed by a September 2023 report, “Survival of the Biggest: Large Banks and Financial Crises”, by Matthew Baron of Cornell University, Moritz Schularick of the Kiel Institute for the World Economy and Sciences, and Kaspar Zimmermann of the Leibniz Institute for Financial Research SAFE. Based on eight years of research, the report shows unequivocally that “large banks have been at the epicentre of financial instability and risk taking throughout history”.

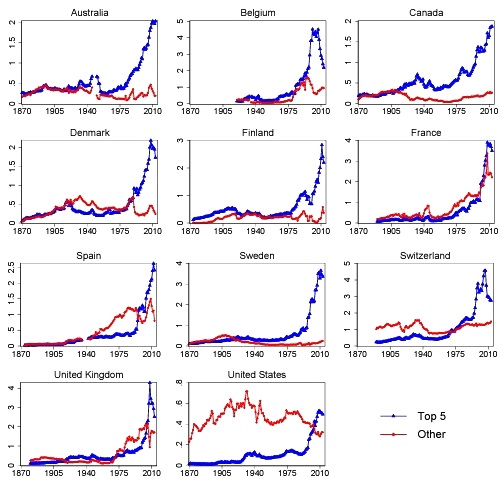

Using newly compiled data sets of bank balance sheets and stock returns, the document reveals that the market concentration of the world’s largest banks has only been achieved due to government interventions during financial crises, not because of market forces. These results were confirmed across nations and over history, by a study of 11,000 banks in 17 countries, examining records that stretch back to 1870.

Banking crises have precipitated the greater domination of finance by large banks, the report states. The record shows that the top-five banks of any given nation contributed to those financial crises in the first place by rapidly pumping out credit during the preceding booms. But those same banks are provided special treatment in the crisis that invariably follows. The crises in countries with concentrated banking sectors are worse than in countries with less large-bank domination, yet the cycle is perpetuated by the protection of the behemoth banks at fault. Such a “feedback loop” leads to the reshaping of banking sector structure, states the report. This “repeated pattern” during crises is dubbed “survival of the biggest” by the authors.

Financial stability?

In the 17 countries considered, large banks have grown to an ever-larger share of the banking sector over the last 150 years, accounting for the lion’s share of financial sector growth (graph). The included countries are: Australia, Belgium, Canada, Denmark, Finland, France, Germany, Italy, Japan, Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, the UK and USA. The top 20 banks of those countries are considered, divided into the top 5 and the smaller 6-20. Here are the key elements of the survival of the biggest cycle.

- Large banks “take more risks” in the pre-crisis boom period and “disproportionately contribute in the aggregate to the credit booms preceding banking crises”. The top five banks “account on average for about 75 per cent of loan growth during the run-up to banking crises and nearly all of the loan contraction after crises”.

- During a financial crisis, large banks face greater threats to solvency and “suffer higher losses”, yet they are less likely to haemorrhage deposits and “survive at a substantially higher rate” than smaller banks. The crisis allows them to grow their assets and market share, due to rescue operations and by acquiring smaller banks in the process.

- The survival and expansion of the largest banks is linked to “substantially higher rates of government rescue” than for smaller banks. The study shows that “policymakers are substantially more likely to rescue top five banks on the verge of failure” while smaller banks “tend to be merged or wound down”. Such “emergency rescues performed for the explicit purpose of preventing a specific bank from failing” are “extremely common for top five banks but a lot less common for banks 6-20”. The report notes that “there are only four examples of outright failures of top five banks” in 150 years. “[F]ailure rates for smaller banks are considerably higher than those for the top five banks”.

- Detailed historical case studies “reject the hypothesis that ‘survival of the biggest’ is mainly due to ‘market forces’ (e.g. economies of scale for the largest banks, natural advantages of large banks during crises) and suggests a key role of government interventions.” The figures indicate that without rescue operations the survival rates of large and small banks would be similar.

- Big banks are remarkably persistent: “About 50 per cent of the largest banks in 1910, and even 37 per cent of the largest banks in 1880 are still among the largest five banks [across all countries] today.”

- Banking systems dominated by large banks “are not measurably safer than more fragmented banking systems”, and the frequency of banking crises is not lower. A banking system with more large banks is likely to be less stable, the report concludes.

- Furthermore, “real economic outcomes are more severe in banking systems dominated by a few big banks”. The data shows that “banking crises in large-bank-dominated systems are deeper than crises in non-large-bankdominated banking systems”.

- Large banks likely exacerbate instability, particularly due to their size and complexity, which makes them more difficult to regulate. Higher leverage, lower deposit funding, greater interactions with international counterparties and heightened international opportunities for risky trading activities contribute to greater systemic risk. These factors are all “magnified”, the report said, as the big banks get bigger, amplifying the risk of contagion.

The cycle must be broken. Understanding the factors contributing to financial crisis are crucial, the authors write, particularly given the US bank collapses in March 2023. Rather than continuing to dole out special treatment to the biggest banks, the paper suggests, macro-prudential policy objectives must “target the very largest banks”. (Emphasis added.)

By Elisa Barwick, Australian Alert Service, 7 February 2024