In June 2023 the European Commission (EC) put forward a twin proposal, to protect cash usage while supporting a new digital euro.

The first part is described as “A legislative proposal on the legal tender of euro cash to safeguard the role of cash, ensure it is widely accepted as a means of payment and remains easily accessible for people and businesses across the euro area.”

It is teamed with “A legislative proposal establishing the legal framework for a possible digital euro”—framed as an additional option, “a complement to euro banknotes and coins”, EC documents state.

The EC outline says its legal tender proposal “aims to safeguard the continued and widespread acceptance of cash throughout the euro area”. Under the proposed law, EU member states would need to “ensure widespread acceptance of cash payments, as well as sufficient and effective access to cash”. It adds that member nations “will need to monitor and report on the situation and take measures to address any problems identified. The Commission could step in to specify measures if needed. The proposal will ensure that everyone in the euro area is free to choose their preferred payment method and has access to basic cash services. It will ensure the financial inclusion of vulnerable groups who tend to rely more on cash payments, such as older people.”

As AAS reported at the time, several weeks earlier on 4 May 2023, an EC-hosted Brussels Economic Forum debate on going cashless witnessed a stunning rejection of the prospect, even from the top-level EU bureaucrats present. Ahead of debate, 58 per cent already opposed the motion for a cashless society; after debate, that figure rose to 72 per cent! (“Even EU economic forum rejects EU’s cashless society”, AAS, 17 May 2023.)

The EC had already been forced to cool its jets in the drive to continue tightening restrictions on cash payments in the name of blocking terrorism financing and money laundering.

The latest proposal, which will be voted on by the European Parliament (though whether that can happen before the upcoming June election is uncertain), reflects the continually increasing public support for cash.

According to French not-for-profit association CashEssentials, not all are convinced by the EU push. The president of Spanish pro-cash organisation the Denaria Platform, Javier Rupérez, has warned that “The current legislative proposal of the European Commission legitimises a system with two forms of public money (physical and digital) with regulations that are not at all homogeneous, when there should be a neutrality in the conditions of acceptance and access of both means of payment, as the central banks themselves have stated on different occasions”.

Regarding the timing of its proposal, the EC states that it is responding to a January 2021 judgement by the European Court of Justice which set out the principles of legal tender. According to that ruling, “legal tender entails, in principle, the mandatory acceptance of cash, at full face value, with the power to discharge from a payment obligation.” In light of the possible introduction of a digital euro, the EC proposal is designed “to ensure consistency among the two forms of public money”. “In addition”, says the EC, “this proposal seeks to address issues concerning the acceptance of cash that have recently emerged, which can lead to confusion for citizens wanting to pay in cash, as well as concerns which have been raised in a number of Member States about difficulties in accessing cash.”

Irish Member of the European Parliament (Sinn Féin) Chris MacManus, one of the self-described “six key MEPs shaping the new laws on protecting cash”, admitted that the initial proposal “was weak in some respects”, allowing loopholes for denial of cash usage. But in March 2024, he noted that “So far, I am making excellent progress in removing these exemptions, so that cash really is a right and not a privilege.” His statement followed government approval in January, back home in Ireland, of the Cash Access Bill proposed by Finance Minister Michael McGrath after a November 2022 review of retail banking highlighted the need to support continued use of cash. (“UK, European governments force the hand of regulators”, AAS, 13 Mar.)

Young Europeans use cash

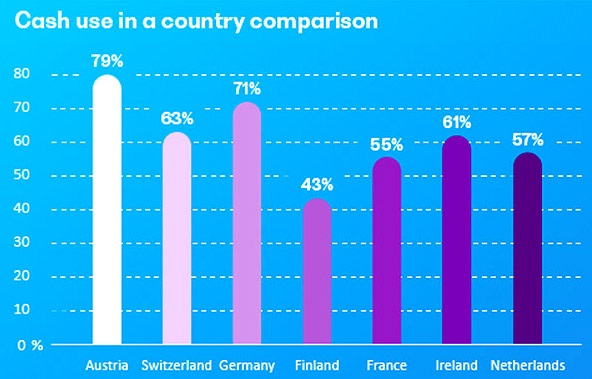

A survey conducted by BearingPoint, reported in February this year, revealed that cash is growing in popularity. When asked what payment method they preferred, large numbers of people surveyed in Germany, Finland, France, Ireland, the Netherlands, Austria, and Switzerland, said they preferred cash, with Austria and Germany in the lead (Fig. 1). A total of 43 per cent of all respondents supported the anonymity of cash as a payment option. As consultancy.eu reported: “cash still is king in many European countries”.

Christian Bruck, BearingPoint payments expert, observed: “It is interesting to see that cash is very common across all age groups and is clearly number one among respondents. It is also noteworthy that in the 18-24 age group, cash is used more frequently on average than mobile payment services.”

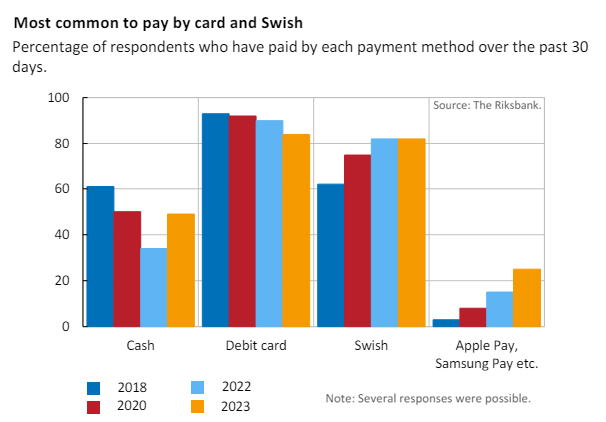

While some measures indicate cash usage has continued to decline, a 2023 survey by Swedish central bank, the Riksbank, on payment habits (Fig. 2) showed a 15 per cent increase in cash use (over a month), compared to 2022. And despite many not paying in cash, there is “an increasing number of people [who] have a negative attitude to the decline in cash use—44 per cent in 2023 compared to 36 per cent in 2022.” Additionally, a greater proportion of respondents say they could not cope without cash. The percentage of people wanting to pay in cash but being unable to do so increased to 50 per cent, from 37 per cent in 2022.

In Sweden, cash access is nearly completely dependent on machines. According to a Riksbank report, “All major banks have stopped offering cash services over the counter in their branches and only some savings banks still do so in a total of 126 branches”. Some banks allow withdrawal at stores, but in limited amounts and subject to cash availability. Businesses have complained about deposit machines, which do not accept coins, and have deposit limits. This, admits the central bank, means many stop accepting cash.

As AAS has previously reported, the central bank of Finland has proposed legislation to protect cash access, particularly to safeguard against payment system interruptions; similar legislation has been introduced in Ireland and has been passed in the UK. In Spain and Norway, businesses have been mandated to accept cash, to assure consumers can use it. Sweden, which has already legislated to ensure “reasonable access” (within 25km) to cash services, is now moving to join those latter two countries.

Sweden: security concerns drive cash backflip

The central bank of the world’s most cashless economy has become increasingly concerned about digitalisation. Journalist Nick Corbishley wrote in a 10 May article, “World’s Oldest Central Bank Keeps Sounding Alarm on Fragility of Cashless Economies. Are Other Central Banks Listening?” at nakedcapitalism.com: “the Riksbank was one of the first central banks in Europe to begin aggressively undermining the role of cash in the economy”, but a sea change in its strategy began to set in some eight years ago.

Sweden, often dubbed “officially cashless”, in late 2020 “had less cash in circulation than just about anywhere else in the world”, Corbishley wrote, at around 1 per cent of GDP. But as security concerns grew, with the war in Ukraine, energy insecurity and other factors, declining cash use has been increasingly seen as a negative development. The Riksbank introduced a directive in 2021 mandating that banks provide reasonable access to basic cash services, however it still became harder for consumers to pay with cash as fewer retail businesses were accepting it.

The Riksbank’s 2024 Payments Report, released 14 March, launched another central bank salvo in this campaign. While noting that cards and digital payments have made systems faster, smoother and (allegedly) cheaper, it asserts that some sectors of society have “become marginalised” and there are “serious problems of fraud that risk undermining trust in the payments system.” Digitalisation has made payments “more vulnerable to cyber-attacks and disruptions to the electricity grid and data communications”, says the report, at a time when geopolitical developments “require Sweden to have a strong civil defence. The ability to make payments should also be available in peacetime crisis situations and states of heightened alert.”

The report demands a greater focus on “the challenges posed by digitalisation”, concerning payment system reliance “in the event of disruptions, crises and wars, and the ability of everyone in society to pay”.

“Payments should work even in crisis and war”, blares one subheading. “Access to basic payment services is unsatisfactory”, contends another. It calls for “public sector intervention” to fix these problems. This includes solutions for cash transit. Currently one company conducts all cashin-transit services. Government must consider how banks and the public sector can share the responsibility to ensure cash is available to retail outlets “at reasonable prices”.

The central bank calls on the government to “urgently regulate” cash usage, including through adequate provision of cash infrastructure, by introducing “a general obligation for merchants to accept cash for purchases of essential goods and services such as food, pharmaceuticals and fuel”, and by introducing an obligation for banks to accept consumers’ deposits including coins, at increased daily levels. “If these decisions are delayed, there is a risk that cash will become almost unusable as a means of payment in the near future.”

While advocating a continuation of payments modernisation, the report calls on banks and payment service providers to adapt their systems to account for “people who have difficulty using digital services”, including provision of over-the-counter services and postal facilities. In order to support its continued use, banks must make it easier for businesses to access cash. New cash collection and deposit centres are proposed, “to improve the supply of cash. Having stocks of cash in more locations across the country reduces both the costs for companies and the risk that cash would be difficult to use in the event of a disruption.”

Suggestions to facilitate payment settlement in “peacetime crisis situations and states of heightened alert” include an expansion of options, not only cash but offline payment systems, increased usage of the central banks’ RIX payment system, and development of digital currency, the e-krona.

By Elisa Barwick, Australian Alert Service, 29 May 2024