2 May—After rumours circulated throughout last week and shares collapsed to almost nothing on Friday, First Republic Bank was seized first thing on 1 May by US regulators, having reached a deal for its takeover by JPMorgan Chase. Surpassing the collapse of Silicon Valley Bank, First Republic is now the second-largest failure in US banking history after global financial crash victim Washington Mutual. With Signature Bank, the count is now three collapsed regional banks in under two months, plus Silvergate Bank which is being wound down and liquidated with full repayment of deposits.

Giant Swiss bank Credit Suisse also collapsed last month, with a takeover by UBS engineered by the Swiss government and major central banks. A memo issued 28 April by four economists from the French think tank Institut La Boétie (ILB) says the US and Swiss banks are “the first victims of the rise in interest rates and highlight the fragility of the banking system”. Calling for a return to Glass-Steagall bank separation to prevent deposit-taking banks engaging in risky speculative activity, and for a return to public banking, the paper says the crisis “invites us to take back control of the financial sphere and to transform it in order to put it at the service of the common good”.

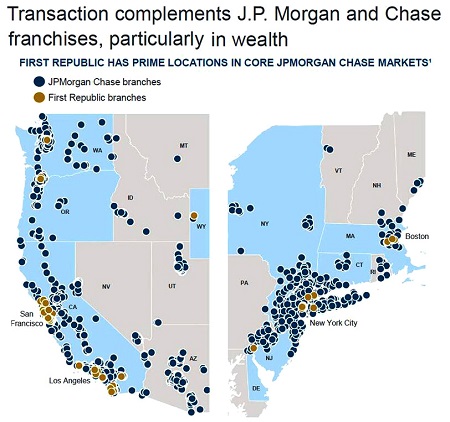

JPMorgan Chase bought up the remnants of First Republic’s operations at the invitation of regulators. According to the Federal Deposit Insurance Corporation (FDIC), it will inherit US$103 billion worth of deposits and US$229 billion of loans and other securities, but losses will be shared by the FDIC. Shares are not expected to be protected under the deal.

The collapse comes despite a US$30 billion bailout package organised 16 March by the Fed and led by JPM Chase, whereby 11 banks temporarily provided liquidity so First Republic could pay depositors. The failure of that intervention was confirmed by first-quarter reports released 24 April, in which the bank announced it was “exploring strategic options”. The report showed that at least US$100 billion was withdrawn from First Republic in March following the SVB and Signature bank collapses. The bank’s share value subsequently collapsed 60 per cent with trading halted at one point. The previous Friday, 21 April, Moody’s Investor Services had downgraded the credit rating of eleven regional banks.

The JPM Chase buy-up is a signal that worse is to come. Rather than deal with the underlying problem, as with previous crises, it is being rolled into a bigger one. JPM Chase is ranked by US regulators as the country’s riskiest institution. Banking watchdog site Wall Street On Parade provides an invaluable snapshot in recent articles. In the National Information Centre’s Systemic Risk Report, based on data provided to the US Fed, encompassing size, interconnectedness, substitutability, complexity, and cross-jurisdictional activity, JPM Chase represents the number one risk in two-thirds of all categories. Furthermore, its exposure to “Intra-Financial System Liability” risk increased by 46 per cent in one year, over 2019- 21. Making matters dramatically worse, JPM holds more over-the-counter derivatives than any other US player. These are the instruments that sparked the 2008 crash. It also commands an oversized role in the US payments system—larger than the next three biggest banks combined. The bank was a very big borrower of “repo” loans during the September 2019 repurchase market (short term loans for liquidity market) crunch, indicating unstable foundations.

The US Bank Holding Company Act prohibits any bank that controls “more than 10 per cent of the total amount of deposits of insured depository institutions in the United States”—which JPM exceeds— from purchasing another bank. But that law is waived, WSOP reported, “if the acquisition involved one or more banks in default or in danger of default”.

The bank with a long history of mergers and acquisitions and which swallowed up WaMu and Bear Stearns after the 2008 crisis continues to grow. It cannot result in anything good.

According to a Zero Hedge report, CEO Jamie Dimon indicated that his hoovering up of smaller banks, backstopped by federal regulators, would continue. Speaking about his takeover of First Republic during a call on 1 May, he said that the USA needs “large, successful banks”, stressing that “banks will consolidate”. Dimon claimed the crisis was nearing its end, but warned that “we are clearly going to see some reduction in bank lending”. In other words, assisting the Fed’s deflationary drive by restricting credit. As this publication has covered, JPM Chase has worked closely with the Fed since 2008 for a shakeout of banking that concentrates top-down control.

Real economic crunch

Even more critical than the impact of the banking collapse itself, is an associated decline in lending to the real economy. The Fed’s latest “Beige Book” update on economic conditions in all 12 Federal Reserve districts reveals a lending contraction, particularly in the regions of the recent banking crisis. It also notes a decline in manufacturing activity and freight transport. To highlight reports from the two epicentres of the crisis, the New York Fed states: “Conditions in the broad finance sector deteriorated sharply coinciding with recent stress in the banking sector. Small to medium-sized banks in the District reported widespread declines in loan demand across all loan segments. Credit standards tightened noticeably for all loan types....”

The San Francisco Fed reports: “Lending activity fell significantly in recent weeks amid higher interest rates and elevated uncertainty in the banking sector. Lending standards tightened notably, and several depository institutions opted to reduce loan volumes, especially for new clients, despite reporting ample liquidity. Reports indicated that existing and planned projects across sectors were delayed or cancelled due to higher funding costs, heightened uncertainty, and more limited access to credit.”

Another echo of this is Fed data showing a three-week decline (15 March to 5 April) of US$300 billion of total bank credit issued by all commercial banks.

By Elisa Barwick, Australian Alert Service, 3 May 2023