The Morrison government’s attribution of skyrocketing fuel prices solely to the war in Ukraine is absurdly simplistic. Labor Party leader Anthony Albanese MP has at least publicly acknowledged that disruptions to international oil markets triggered by the war had merely exacerbated an existing trend, but likewise failed to identify the real underlying cause—perhaps because to do so would require Labor to own its share of the blame. First, it should be noted that the international oil price is being pushed up not by the war itself (which has had zero effect on global oil supply), but by unilateral US sanctions on Russia (a major exporter of both oil and gas) which are supported by both Labor and the government. But more importantly, our nation is hostage to the vicissitudes of the global oil market solely because both parties have spent decades destroying domestic fuel production through counterproductive economic and environmental policies and subservience to their corporate donors. Australia possesses sufficient oil reserves that were they properly managed—ideally via nationalisation, and development by a Commonwealth statutory authority—we could reclaim our former self-sufficiency in petroleum fuels indefinitely into the future.

Australia is a major exporter of energy (mainly to Japan, China and Korea), principally in the form of liquefied natural gas—of which we are currently the world’s largest exporter—and coal. For reasons which will be elaborated below, exact figures on Australia’s natural gas reserves are surprisingly difficult to come by; but Commonwealth geological and geographic agency Geoscience Australia (GA) states in its “Australia’s Energy Commodities 2021” report that in 2019, Australia produced around 5,500 petajoules (PJ, a measure of the energy released upon combustion) of gas, of which some 74 per cent was exported, and held estimated total reserves of 269,206 PJ, “with an estimated life of 42 years for conventional gas and 36 years for unconventional gas”1 at current and projected production rates. Under the Citizens Party’s longstanding policy to nationalise Australia’s gas reserves, set aside as much as is needed for domestic users, and sell it to them at cost of production, Australian households and businesses would pay the lowest prices for natural gas in the world, rather than one of the highest as at present. (That said, as much of the nation as possible should be run on electricity generated by state-owned nuclear plants, utilising our one-third share of the world’s uranium, since natural gas is far more valuable as an industrial feedstock than an energy source.)

Fuel security is the bigger, and much vaguer, issue. Aside from some specialty products, even under “free market” conditions Australia was essentially self-sufficient in petroleum fuels until around 2004. About 80 per cent of Australia’s annual oil production (most of it light, “sweet” crude) is exported and refined into specialty fuels abroad, while our two remaining refineries—Viva Energy’s plant at Geelong, Victoria, and Ampol’s (formerly Caltex) at Lytton, Queensland—rely on imports of heavier crude from abroad. The federal Department of Industry, Science, Energy and Resources (DISER) reports that in January 2022, only 30 per cent of all petroleum products sold in Australia were refined here, from only 25 per cent domestic feedstock.

Oil aplenty

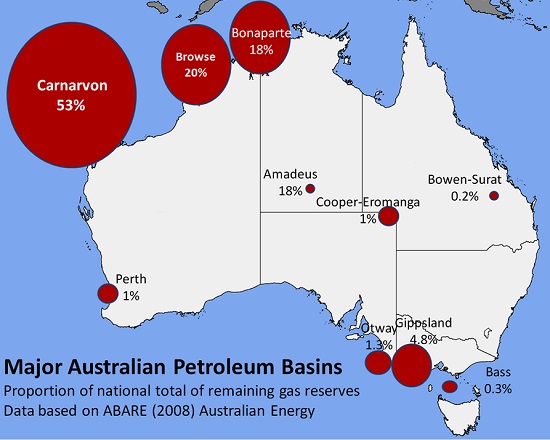

A Senate Economics References Committee inquiry into Australia’s oil and gas reserves commenced in September 2019 but, after multiple delays and extensions, issued its final report only last month. The report cites what appears to be a somewhat dated estimate by GA that “Australia has about 0.3 per cent of the world oil reserves … [most of which] are condensate and liquefied petroleum gas (LPG) associated with giant offshore gas fields in the Browse, Carnarvon and Bonaparte basins.” It further states that “In 2020-21 crude and condensate production decreased by 11 per cent from the previous year”, mainly due to “technical issues” at various large LNG projects. (Condensate and LPG, and lighter grades of crude, are often found accompanying large gas deposits). The general consensus is that were we to cease importing oil, we would have at most three years’ supply (presuming we could refine it) at present rates of consumption.

GA’s 2021 report, however, states that “Australia’s 2P [proven, plus probable] reserves of conventional oil resources in 2019 are estimated as 10,263 petajoules (PJ; 1,803 million barrels [MMbbl]).” At Australia’s current consumption rate of approximately 1.15 million barrels of oil equivalent per day (bpd), that would supply domestic demand about four years and four months. The 2P figure, however, includes only “commercially recoverable” reserves—that is, those which private oil companies can make their expected profit margins on. GA states that as of 2019 there were “contingent” (2C) deposits, defined as “potentially recoverable amounts of petroleum in known accumulations … [which] are not yet considered to be commercially recoverable due to one or more technical, commercial or other factors”, of a further 2,210 MMbbl—enough for another five and a quarter years. GA also lists a total of 2,713 MMbbl of identified 2P and 2C condensates and 338 MMbbl of identified LPG resources, totalling about another seven and a quarter years’ supply.

Already, that puts domestic oil reserves at a notional 16 years and 10 months; better, but still not great. But that is literally not the half of it: according to GA, there is also an estimated 14,360 MMbbl of oil in known “unconventional oil shale accumulations”, more than 34 years’ supply at current consumption, that no private company has yet found it commercially viable to exploit—but which a vertically integrated Commonwealth petroleum company, such as the Citizens Party proposed in 2017,2 could extract, refine and sell at cost to domestic users (and tip any export earnings directly into public coffers), without worrying about such things as shareholder dividends and bloated executive salaries. Not only that, but GA also notes that “Australia has significant undiscovered unconventional oil resources potential, including shale oil, tight oil, basin centred oil and oil shale.” In January 2013 Griffith University research fellow Vlado Vivoda wrote in The Conversation that Brisbane-based company Link Energy had that month released two survey reports conducted independently by different geophysics companies, “estimating the amount of [shale] oil in the Arckaringa Basin near Coober Pedy in South Australia … at between 233 billion and 103 billion barrels [i.e. 103,000-233,000 MMbbl] of oil equivalent respectively.” As Linc managing director Peter Bond pointed out to media at the time, if the higher estimate were accurate this would be “several times bigger than all of the oil in Australia”. Even the lower estimate would be enough to supply Australia’s current oil consumption for 245 years; the upper, 555 years. If Australia, and humanity in general, has not moved beyond the need for fossil fuels by then, there is truly no hope for us.

Fake regulation strikes again!

All of which is to say, we have literally no idea how much oil Australia actually has—especially offshore. Data for onshore deposits are at least publicly available, and are “based on government statistics and company estimates reported at various dates between June 2019 and June 2020”, GA reports. But such is the political clout of the gas export cartel that data on offshore gas deposits are made deliberately opaque and kept secret from the Australian public—and oil (which is often found together with gas) along with it. For example, GA’s estimates of LPG, which is generally recovered as a by-product of gas extraction, “do not include any identified LPG resources for the Northern Carnarvon Basin due to the lack of reported LPG reserves or contingent resources for this basin area in the offshore data. As there are significant volumes of LPG produced from the North West Shelf project in the Northern Carnarvon Basin, the LPG estimates are less than actual LPG reserves and contingent resources.” (“Significant” is an understatement; as GA notes elsewhere, the North West Shelf is home to some 93 per cent of Australia’s conventional gas resources.) Not only that, but all the estimates in GA’s report are based on the aforementioned public onshore data “aggregated with confidential offshore data submitted to the National Offshore Petroleum Titles Administrator (NOPTA). … Data are aggregated for composite basin regions where necessary to de-identify confidential offshore field data in the custody of NOPTA.” (Emphasis added.)

In 2011, Labor legislated to establish NOPTA to “[administer] titles and data management for petroleum and greenhouse gas (GHG) titles in Australian Commonwealth waters”, as its website explains, on behalf of DISER. The same amendments also replaced former commonwealth regulator the National Offshore Petroleum Safety Authority (NOPSA) with the new National Offshore Petroleum Safety and Environmental Management Authority (NOPSEMA), with which NOPTA cooperates “on matters relating to the administration and enforcement of the OPGGS Act and regulations”.

Unlike NOPTA, however, NOPSEMA is not a branch of DISER, but rather a Commonwealth-owned corporate entity attached to but run independently of the department, (similar to how the “independent” Reserve Bank is attached to Treasury), with broad scope to act however it sees fit. The OPGGS Act’s aforementioned confidentiality provisions pre-date the creation of NOPTA; however, whereas much of the pre-2012 data collected by the former Designated Authorities and NOPSA continues to be publicly available via the respective state and territory departments, the 2011 legislation not only expanded secrecy across the industry, but in some cases made it permanent. NOPTA is funded by industry levies (as is NOPSEMA), and describes on its website how it makes every effort to identify “opportunities to reduce the level of regulatory burden on industry to achieve desired outcomes”. Under the neoliberal economic doctrine espoused by both major parties, those “outcomes” seem to consist mainly of maximum profits for multinational oil and gas companies, which have a vested interest in maintaining the false impression of perennially impending shortages. The result, as journalist Callum Foote reported 21 September 2021 for Michael West Media, is that “What they call the gas ‘market’ in Australia, critics call the ‘gas cartel’, because there is no disclosure of buyers, sellers, prices, volume. It is all a secret controlled by four major players [BHP-Exxon (who have joint marketing arrangements), Origin, Santos and Shell]. The failure to have an open market has cost ordinary Australians dearly.

“Despite this country being the world’s biggest exporter of gas, customers pay among the highest prices for gas in the world. The chief beneficiaries are the four cartel operators, and these and their lobby group proxies, are among the most prolific political donors.”

Foote reported that in 2020 DISER commissioned a review of NOPTA by consulting firm ACIL Allen, which it tasked with “determining whether it was in line with the [OPPGS Act’s Resource Management and Administration] regulations” that monthly gas production reports and other “geo-scientific petroleum and greenhouse gas data be disclosed in the public interest.” The review found that most of what NOPTA had hidden was not “excluded information” under the Act, and that the release of monthly production reports in particular would be in the public interest. Both major parties voted against an amendment to the Act to that effect proposed by independent SA Senator Rex Patrick, whom Senator Murray Watt, Labor’s shadow minister for Northern Australia and Queensland resources, criticised for not “consulting with industry”, i.e. the cartel. Labor had consulted the industry, Watt told Parliament, which had “argued that technical advice should have been provided alongside this proposal to inform the amendment given its complexity”, lest it have “unintended consequences for the safety of these projects and the environment”. Moments before this, Foote wrote, Watt had “denied having any knowledge that oil and gas giant Woodside … [had] donated $1.4 million to Labor over the last 10 years, and $110,000 in 2019.” In a follow-up article published 23 February, Foote reported that “Investigations have shown that in 2020 oil and gas giant Woodside was a platinum member of both Labor and the Liberals, paying each party $110,000 for access to their politicians. Woodside has since downgraded to gold membership ($55,000) in both major parties”, with other petrochemical companies paying amounts between $22,000 and $55,000 for similar “access” to both parties.

Foote reported that One Nation party leader Senator Pauline Hanson has proposed an amendment to the OPPGS Act which would impose a “national interest test” on gas policy, which has the support of left-wing think tank the Australia Institute.

Footnotes

By Richard Bardon, Australian Alert Service, 16 March 2022