The Australian Alert Service is the weekly publication of the Citizens Electoral Council of Australia.

It will keep you updated of strategic events both in Australia, and worldwide, as well as the organising activities of the CEC.

To subscribe to the Australian Alert Service, it's easy, and it's secure.

Click here for subscriptions within Australia

Click here for overseas subscriptions

2 October 2019

Vol. 21. No 40

Do you realise that the Currency (Restrictions on the Use of Cash) Bill 2019 would likely already have been passed if not for our campaign exposing its real agenda? Recall how the notorious “bail-in” bill—which granted the Australian Prudential Regulation Authority (APRA) extraordinary powers during a financial crisis to take control of banks and save them by confiscating certain investments and potentially deposits—passed the parliament without a formal vote on 14 February 2018. Due to the widespread awareness of how that law passed, our campaign against the cash ban bill has provoked a far more serious reaction, creating the climate which forced the ALP to agree to refer the bill to an extended inquiry.

Now the government cannot pass this bill in time for the ban to commence on 1 January 2020 as scheduled. This will delay their ability to lock depositors into being looted by negative interest rates and bail-in, to save the banks. There are already signs of a slow run on banks, as people realise the implications of the combination of a global banking crunch, a collapsing Australian housing bubble, and the cash ban bill.

Remarks by Prime Minister Scott Morrison from New York, and Treasurer Josh Frydenberg, pleading with banks to crank up their lending, reveal that the hype about the housing market revival is exaggerated. Morrison defended the record of our banks as the best in the world and urged them not to be gunshy on lending; Frydenberg scorned “responsible lending standards” induced by the Financial Services Royal Commission, which have negatively impacted consumer spending (p. 4).

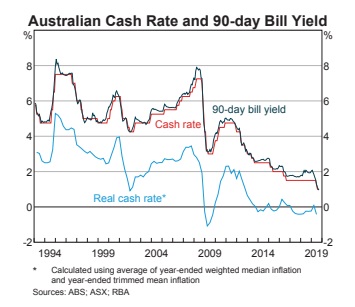

Reserve Bank Governor Philip Lowe yesterday cut rates below 1 per cent for the first time in Australian history, down to 0.75 per cent. In an evening speech, Lowe revealed the bank discussed the possibility of “a shock somewhere in the global system”. He echoed Morrison and Frydenberg, saying the pendulum had “swung a bit too far” into conservative lending standards, urging lenders not to be scared to loan money. Lowe took the opportunity to blast the black economy, associating 4-8 per cent of cash in use today with the “shadow economy”, and to plug the New Payments Platform—the KPMG-coordinated project to turn the economy totally cashless.

Only one of the big four banks immediately passed on the full rate cut to customers. They are hungry to rake in the dollars—and they lose more than $6 million per day for every 25-basis-point cut. Our banks have seen the largest ever increase in derivatives speculation over the last six months and are exposed to the big black hole opening up in international derivatives markets (p. 3).

At the UN Climate Action Summit in New York on 23 September, Bank of England Governor Mark Carney outlined the bankers’ plan for a new green bubble to drum up new injections of cash into global markets. Carney is a key figure in the Green Finance Initiative, a Bank for International Settlements (BIS) project to channel trillions of dollars into “green technologies”. The BoE—which defined the standards for the new bail-in regime—has prepared new prudential standards to align banking with the “transition to a net zero [carbon emissions] world”. Carney said the plan must “go global”, led by the Network for Greening the Financial System—a group of 42 central banks and supervisors which includes the BIS and Australia’s RBA. A “compact” signed by 130 global banks was revealed, committing them to a mission which will shut down what remains of the productive economy.

These bankers can’t be trusted—Carney called for a global currency at the US Fed’s August Jackson Hole summit, where “monetary regime change” to allow central banks to direct government budgets was also discussed. This is occurring in a period of mammoth political instability in the USA and the United Kingdom, but by exposing the real agenda we can disrupt it.

In this issue:

- Gaping black hole opens up in debt and derivatives bubble

- Desperation stations as housing ‘recovery’ falters

- Trump impeachment: 2017 warning on Intelligence Community comes true

- Congress looks other way as Fed offers $100 Billion a day to unnamed banks

- Banks push deadly climate agenda

- The real Al Gore

- Expand the reach of people power!

- Which is the real black economy?

Click here for the archive of previous issues of the Australian Alert Service