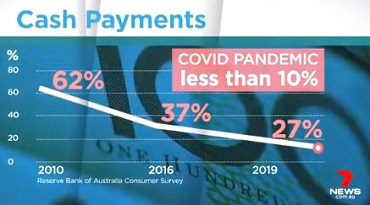

Channel 7 News reported on 19 June that the banks are boasting of using the COVID-19 pandemic to ram through their cashless economy agenda. The banks had a five-year plan to reduce cash use, but thanks to coronavirus they achieved their goal in just 10 weeks!

The Big Four banks closed 170 branches during the lockdown months, Channel 7 reported, some of which aren’t expected to reopen. The banks are on track to reduce the number of ATMs from 28,000 nationwide to just 15,000. National Seniors Association spokesman Ian Henschke complained vehemently that elderly and other Australians will be disadvantaged. “We’re talking about hundreds of thousands of people that still want to use cash, that still want to go into a bank”, he said.

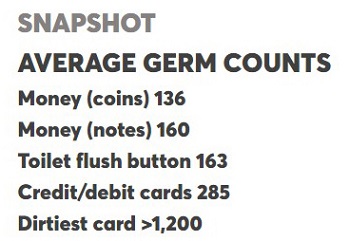

While caution and precautions in relation to the pandemic was understandable, there was never any basis for banks and businesses banning cash transactions for health reasons. The health authorities are clear: cash should not be singled out as a risky form of payment, as it is no riskier than other payments. In fact, it is less risky than some—cards and phones routinely carry more germs that cash. The health authorities insist there is no substitute to regularly washing hands, whatever form of payment is used.

The Citizens Party helped lead the fight against the government’s $10,000 cash ban precisely to stop people being trapped in banks and unable to escape sinister policies including bail-in and negative interest rates. The campaign against the cash ban bill fought it to a standstill, and now it is increasingly unlikely that law will go forward. But the banks have cynically seized upon the virus to advance their cashless agenda anyway. As businesses start to open up, the banks are pressuring them to remain cashless permanently. Many small businesses are against this, as they hate having to pay bank charges on electronic transactions, which will only rise as cash is phased out. But larger business and “chain” restaurants, such as Nando’s, are complying and insisting on cashless payment.

Resist!

It’s time for Australians to resist this cashless economy agenda and tell the businesses involved we won’t comply. The Citizens Party has provided the evidence that there is no health basis for banning cash:

- The 3 April 2020 release “Pandemic is no excuse to ban cash”, which reports that the World Health Organisation does not recommend a ban on cash, including for the reason that it could create a false sense of security when the issue is people should always wash their hands, whatever means of payment they use; and the Royal Australian Mint also opposes cash bans.

- The 19 June 2020 release “RBA docs confirm cash poses ‘minimal risk’ of transmitting diseases”, which reports that going back to the 2004 SARS outbreak, the Reserve Bank, CSIRO and University of Ballarat investigated the health risks of cash and concluded it should not be singled out as a greater risk than other forms of payment.

- Another resource is a 19 May blog by Stevie Bee, “Cash is no ‘dirtier’ than your plastic”, which reports the findings of a 2018 study by the University of Texas and CreditCards.com: “Contrary to the popular perception that money was ‘dirty’ and cards were less so, the study found cards had more types of bacteria on them than cash and coins.” The blog concludes: “So, the next time a retailer insists you use a card to pay because it’s cleaner, you might let them know the data say otherwise. The cards are no better than cash. In fact, they’re worse. It’s what you do after using them and before you eat that matters.”

Here are some suggestions on how to resist this cashless push:

- Know your rights, including that there is no health basis for banning cash.

- Use the above articles as resources: print them out and give them to businesses who have banned cash—some may just be complying out of ignorance and may thank you for informing them.

- Call business that don’t take cash, explain there is no health basis for the ban, and tell them you won’t shop there if they refuse cash.

- If you can take the time, during the day line up in your bank branch and withdraw cash over the counter. Inform the teller that the banks are reducing ATMs but you insist on using cash so you will now come into the bank to withdraw. Tell them to tell their manager to expect bank branches to start to clog up.

- Join the “keep the change” campaign: businesses can’t refuse payment in cash, as it is legal tender, so if a business refuses cash put it down on the counter anyway and tell them to keep the change. (A Victorian man who has been “de-banked” recounted to this author his recent experience at Mexican chain restaurant Fonda, where he ate a meal without knowing they didn’t take cash, and only found out when he went to pay. As he has been de-banked, he doesn’t have a credit card—he was within his rights to leave cash and walk out. A Queensland man who ate at Nando’s refused to use a card and told the manager it was illegal to refuse cash, so the manager rang up his bill at $0.00—he ate for free!)

Don’t let the banks get away with this agenda. With some basic acts of resistance, we can persuade businesses not to go along with the banks, and protect our right to use legal tender and not be trapped in banks.