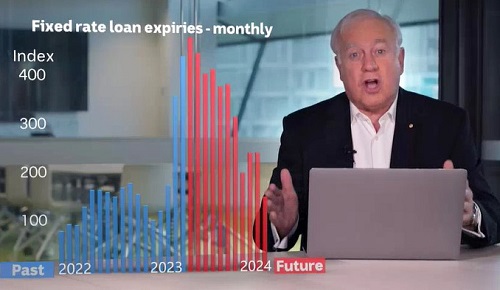

The Reserve Bank of Australia’s monomaniacal crushing of living standards with high interest rates to “fight inflation” has pushed mortgage stress to new highs, with far worse guaranteed to come for as long as the government refuses to intervene. The latest data show that by the end of May almost 30 per cent of borrowers were struggling to pay their mortgages, some of whom are now spending 70 per cent of their household income just to service their debts. All this before even half of 880,000 mortgages due to jump from record-low rates of around 2 per cent to 7 per cent or more as their fixed-rate period expires have done so, let alone the additional 450,000 that will follow next year. Meanwhile, Treasury research released under Freedom of Information (FOI) laws last week shows that the government was warned in April that wage growth and low unemployment are not driving inflation, and nor would they until the real drivers— led by exorbitant energy prices, global supply-chain disruptions, and corporate profiteering—were brought under control. But in the name of respecting “central bank independence”, the government has allowed the RBA to continue to pretend otherwise, and to smash households and small businesses, and set about deliberately to drive more than 140,000 Australians into unemployment, knowing all the while that it would not work anyway.

Citing figures from leading market research firm Roy Morgan, the Australian Financial Review on 4 July reported that as at the end of May, “The number of Australians struggling to make home loan repayments has surged by 627,000 over the past year, to an estimated 1.43 million borrowers”, or 28.8 per cent of all mortgage holders—the highest proportion since April 2008, in the depths of the Global Financial Crisis. According to the AFR, Roy Morgan assesses borrowers to be “at risk” if they have to pay between 25 and 45 per cent of their after-tax income on house payments. Of those 1.43 million, “Mortgagees considered ‘extremely at risk’—where borrowers pay more than 45 per cent or more of their income on loan repayments—increased to 922,000, or 19.3 per cent, over the three months to May, well above the long-term average over the past 15 years of 15.9 per cent.” And if those numbers were not stark enough, The Australian reported 5 July that according to economist Warren Hogan of Judo Bank, the people being hit hardest by mortgage stress are “young professionals aged between 30 to 45 whose repayments had increased by up to $6,000 a month … [who are now] paying up to 70 per cent of their income in debt servicing.” (Emphasis added.) Said Hogan, “There is a real liquidity squeeze on these people who have great job prospects but (it) is just the magnitude of the debt which leaves them very vulnerable, and this may be people working in banking or with good jobs who invested in homes with the expectation that rates would stay low.” Because, lest we forget, Governor Lowe repeatedly told everyone that the RBA would not even think about raising rates until at least 2024, right up until about a month before he started sending them through the roof.

Being May’s figures, Roy Morgan’s numbers reflect most of the impact to that date of the RBA’s 11 hikes of its official cash rate, from 0.1 per cent to 3.85 per cent, in the 12 months to that point; the effects of its June rate increase, to 4.1 per cent, are not included. Be that as it may, the AFR reports, Roy Morgan estimates that “Another two RBA interest rate increases [of 25 basis points each], which would take the cash rate to 4.6 per cent, would mean almost 30 per cent of all mortgage holders would be at risk of stress, approaching the high of 35.6 per cent reached during the global financial crisis in early 2008.” And more rises there shall surely be. The RBA kept the rate on hold this month, with RBA Governor Dr Philip Lowe citing “a ‘substantial slowing’ in household spending and ‘painful squeeze’ on the finances of some households”—which is, of course, exactly the desired effect of the rate rises to date. “However, the RBA flagged a ‘further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe’”, in light of “Stronger retail spending in May, resilient inflation and a slight increase in building approvals reported this week”. Lowe’s deputy Michele Bullock at least dispensed with the niceties, telling a gathering of the Australian Industry Group in Newcastle, NSW last month that “employment is above what we would consider to be consistent with our inflation target” and that it would need to return to 4.5 per cent—i.e. about 140,000 people would have to be put out of work—to be “consistent with the RBA’s inflation target”, the AFR reported at the time.

Treasury: wages growth ‘did not contribute’ to inflation

But it’s garbage, and the government and RBA both know it. As the Treasury informed Treasurer Jim Chalmers in a confidential 27 April briefing paper, which was released under FOI laws on 9 July, “Unlike other advanced economies, an increase in labour supply in Australia meant that wages growth did not contribute to above-target inflation.” (Emphasis added.) Even the RBA’s own analysis “found that at least half of the recent increase in inflation is attributable to supply shocks”, the Treasury paper notes. In the Treasury’s assessment, “The run-up of inflation in Australia can largely be explained by the direct and indirect impact of known cost increases and … large consecutive and compounding supply shocks. These shocks include: The impacts of the pandemic, which interrupted the flow of goods and generated significant price increases for freight; The invasion of Ukraine, which drove price increases for fuel, energy and food; [and] Severe weather events that have interrupted domestic supply.

“Reflecting the global nature of many of these shocks, import prices have increased by 26.4 per cent since prior to the pandemic. This aggregate figure includes significant increases in prices for key business inputs (Figure 3), including: Fuel (up 74.2 per cent); Freight (up 247.1 per cent); Food and beverages for industry (up 52.7 per cent); and Machinery and equipment (up 19.8 per cent).”

As for corporate profiteering, the Treasury paper attempts to pretend that it has actually not been a significant factor at all, but its rationale for saying so amounts to little more than a string of typical neoliberal “free market” excuses for Australia’s mining, energy and retail cartels behaving exactly as one would expect. The most glaring of which, is that “Demand has also interacted with supply constraints and increased opportunities for firms to pass on costs and increase margins in some global markets. … The passthrough of higher costs occurred more readily in sectors experiencing a temporary mismatch between supply and demand and large cost increases.” (Emphasis added.) For the uninitiated, “increase margins” means “make higher profits”, so obviously they were “passing on their costs” and then some. But then this: “With a few exceptions, consumer prices do not typically fall, including in instances where input cost inflation is easing but demand remains robust.” (Emphasis added.) That is, the costs of inputs have stopped rising—and indeed many have fallen from their temporary highs (including the abovementioned temporary weather-related shortages)—but retail prices stay at the level they rose to in order to “pass on” input costs (plus a bit) anyway, including for essential goods. If that isn’t profiteering, what is it?

Crunch time may come sooner than expected

While most of the focus has been on rising mortgage stress, recent data from international ratings agency Moody’s Investors Service shows that a rapidly growing contingent of Australians are already falling behind on their mortgages, unable to afford the higher (in many cases, more than doubled) monthly repayments after their interest rates reset. In a report published 5 July, Moody’s said Australian mortgage delinquency rates had increased over the March quarter, and would continue to do so over the next year due to “high interest and inflation”, the Australian reported. “Borrowers who took out mortgages at very low interest rates in the few years before the [RBA] started its monetary tightening cycle pose a particular risk”, Moody’s warned. The article continues, “The report, which is based on data on residential mortgage-backed securities [RMBS] rated by Moody’s, warns that the expiry of fixed-rate mortgages over the next 12 months will compound risks, with inflation further eroding borrowers’ ability to meet home loan repayments.”

According to the Australian, Moody’s reported that “the share of prime quality home loans at least 30 days in arrears rose from 1.05 per cent in December to 1.26 per cent in March. The delinquency rate for non-conforming mortgages (loans to borrowers with adverse credit histories or where lenders used ‘truncated means’ to verify incomes), rose by a greater rate, increasing from 3.35 per cent in December to 4.04 in March. The report notes that delinquency rates at the moment are below the peak of 1.76 per cent for prime mortgages and 4.80 per cent for nonconforming home loans during the pandemic.”

In a column published 10 July, Australian associate editor and 25-year veteran business journalist Eric Johnston wrote that the jump in delinquencies on “non-conforming”—better known as “sub-prime”—mortgages ought to have alarmed the markets (not to mention the government, the RBA and other financial regulators) a lot more than it has. “As the hunt goes on for signs of stress across the housing market, it is likely everyone has been looking in the wrong places”, Johnston wrote. “Indeed, one of the biggest early warning signs around housing stress quietly flicked to amber in recent days. But it wasn’t inside the big banks, rather the jump in the pain index has been in the so-called shadow banking sector.”

Shadow banks are the lightly regulated “non-bank lenders” that—with the open encouragement of the former Liberal government—helped keep the housing bubble alive in recent years, especially during and immediately after the 2018 Hayne Royal Commission when the big banks had to keep their noses relatively clean, by “growing their market share where banks were required to stress-test prospective borrowers through interest rate buffers”. Since the GFC, wrote Johnston, shadow banks “have been quietly building up the low-documentation loan market. That is lending to borrowers that have irregular income streams or even a patchy credit history. As the economy has evolved these borrowers range from ultra small businesses to ‘gig workers’ and have become a feature of the market. But customers of the non-banks are often the first to feel any slowdown or rise in interest rates.”

Since no-one really knows how big the shadow banking sector is or what its loan books look like, “The best way to track the health of the shadow banking market is through the RMBS delinquencies”, wrote Johnston. And Moody’s figures “show some big strains emerging in the lower-graded loans. … Remember there are real borrowers on the other side of the loans and missed payments mean mortgage stress.” And whilst the RBA estimates that loans from nonbanks in Australia only add up to around $100 billion, or less than 5 per cent of the market, “regulators fear it can still lead to a build-up of meaningful systemic risks”, both because of their often marginal clientele and because “The business models of [shadow banks] tend to involve even more leverage than banks and can often involve liquidity mismatches—that is, using shorter-term funding for longer-term loans.”

Johnston notes in closing that “The one bright spot to this remains Australia’s low jobless rate. All bank bosses closely watch this number as a barometer for future lending losses. As long as borrowers have an income stream they are likely to pay down their mortgages before anything else.” But quite a few won’t for much longer, if the RBA gets its way.

By Richard Bardon, Australian Alert Service, 12 July 2023