The Australian Alert Service is the weekly publication of the Australian Citizens Party.

It will keep you updated on strategic events both in Australia, and worldwide, as well as the organising activities of the Citizens Party.

To subscribe to the Australian Alert Service, it's easy, and it's secure.

Lead Editorial

6 July 2022

Vol. 24 No. 27

The latest rise in the Reserve Bank’s cash rate further locks Australia into the pre-programmed monetary orthodoxy of a failed economic system. We are caught between the rapidly rising tide of killer inflation and multiple speculative financial bubbles at bursting point, if we sit still, and an oncoming tsunami of collapsing debt from decades of cheap central bank money-pumping, threatened by the switch to monetary tightening.

Unless we reject this false dichotomy and establish a new financial order based on the supremacy of the real, physical economy which sustains our existence, economies will be wiped out.

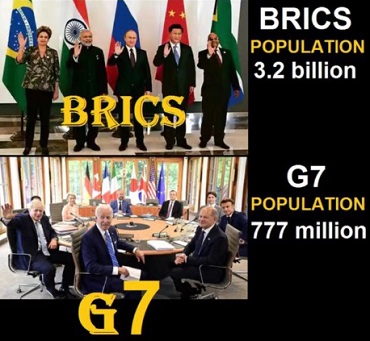

Across the world nations are realising that the liberal, “rules-based” order must be overturned, a recognition induced by both economic crisis and war. An alternative order is taking shape: at the 23-24 June BRICS+ summit Russian President Vladimir Putin announced that BRICS (Brazil, Russia, India, China, South Africa), is “exploring the possibility of creating an international reserve currency based on the basket of BRICS currencies”. As Chinese Foreign Ministry spokesman Zhao Lijian pointed out after the G7 summit, BRICS countries are home to 3.2 billion people, whereas the G7 (Canada, France, Germany, Italy, Japan, UK, USA) is only 777 million people.

A 1 July Financial Times article indicated the shift is already in progress, with 85 per cent of leading central bank reserve managers investing, or considering investing, their foreign reserves in the Chinese currency, given concerns about high US inflation, US dollar dominance, geopolitical flare-ups and the potential emergence of a “multipolar currency system”.

At the BRICS summit, Algerian President Abdelmadjid Tebboune referenced a May 1974 United Nations General Assembly Resolution, the “Declaration for the Establishment of a New International Economic Order”, which rightly specified that “the prosperity of the international community as a whole depends upon the prosperity of its constituent parts. … The political, economic and social well-being of present and future generations depends more than ever on co-operation between all the members of the international community on the basis of sovereign equality and the removal of the disequilibrium that exists between them.”

In 1975 American physical economist Lyndon LaRouche proposed an International Development Bank (IDB) to secure such an order, and it’s what China is pushing for today with its Belt and Road Initiative. Leading proponent for this new architecture, Eurasian Economic Union official Academician Sergei Glazyev spelled out in a 27 June Telegram post: “A quarter of a century ago L[yndon] LaRouche, a very profound thinker of our time, contended that a crash of the western financial system, which was built upon financial pyramids and bubbles … were inevitable. He called for creating a new financial system, servicing the requirements of expanded reproduction of the real economy.”

With Europe and Australia on the edge of energy rationing, action is urgent. Energy Users Association of Australia Chief Executive Andrew Richards told the Herald Sun on 3 July that many businesses will “bleed to death” under today’s energy costs; Echuca tomato processor Kagome’s CEO, Jason Fritsch, said if the problem isn’t sorted out soon, “There will be processors and manufacturers all over the country shutting down”; food processor SPC is facing a “cliff on energy prices”; the country’s only polyethylene (plastic) manufacturer, Qenos, which employs 800 people, warns manufacturing jobs are at risk; Victorian textile mill Flickers Australia, whose monthly gas bill has quadrupled, could be shut down by “one more hiccup”.

Reviving the real economy requires unleashing “the power of both marshalling and extending productive credit”, in the words of Cornell Professor of Law and Finance, Robert Hockett, guest on the latest US Coalition for a National Infrastructure Bank webinar, available at nibcoalition.com. As he proclaimed in a 23 June article for Forbes headlined, “You Have Far More Than a Hammer, America: Produce Your Way Out Of Inflation”, advocating the national credit system of first US Treasury Secretary Alexander Hamilton: “Nothing short of a revived Hamiltonianism will do now. Let us get to it.”

In this issue:

- How Kiwis fought back against the private bank cartel—and won! The story of NZ’s post office Kiwibank

- Is nuclear ‘the most expensive form of energy’?

- Europe faces power rationing, energy ‘Lehman’

- Von der Leyen lied, saying Ukraine’s government chose ‘democracy’

- UK documents reveal Australia’s role as Cold War propaganda proxy

- Biden’s ‘Asia Tsar’ driving Australia to war with China

- G7, EU and NATO summits define long-war plans

- Organise MPs for a postal bank!

- Hamilton fathered economic independence

Click here for the archive of previous issues of the Australian Alert Service