When corporate giants prey on the most vulnerable Australians, our flawed financial regulatory system ensures that these victims will be refused help and denied justice. This was the experience of Rob, a real estate developer who developed a devastating medical condition in 2017, which rendered him an incomplete quadriplegic. Although Rob had faithfully paid his insurance premiums for years, when he tried to make a claim because his disability left him unable to work he was treated horrifically by his insurance company, which engaged in inhumane and unconscionable conduct. Rob’s insurance company, which cannot be named because of ongoing legal proceedings, delayed paying out his income protection insurance for so long that Rob lost his house. The company harassed and repeatedly lied to Rob and his wife, Fiona, and frequently delayed payments, so that Rob was forced to “constantly … chase them and beg for payments”.

After several years of pursuing unsuccessful treatment options, doctors diagnosed Rob’s condition as permanent. However, despite Rob meeting the definition of “total and permanent disability” (TPD), his insurance company has refused to pay out his TPD claim for almost three years. This has caused Rob’s family almost unbearable stress and extreme financial hardship, including having to sell their possessions in order to make ends meet. Rob and his family have tried many avenues to draw attention to their plight, but have been rejected by politicians, consumer affairs watchdogs and financial regulators. Rob’s experience demonstrates that when vulnerable Australians are wronged by banks or insurance companies, they have nowhere to turn. Like Rob, most victims of financial firms find themselves on a futile merry-go-round, shunted from one department to another, while being denied access to compensation or true justice.

No help for victims of financial misconduct

The Australian Securities and Investment Commission (ASIC) is responsible for regulating insurance companies. ASIC’s website claims that it “takes action against insurers who fail to comply with the financial services laws”. This includes when insurers are “acting unconscionably”. However, when Rob wrote to ASIC and informed them of his insurance company’s misconduct, the regulator replied that ASIC “does not intervene in private disputes” and “generally do[es] not act for individuals and [will] only take action where it will result in a greater market impact and benefit the general public more broadly”.

Rob tried to present his case to Western Australia’s Department of Mines, Regulation and Safety (DMIRS), which is responsible for regulating consumer protection in WA. DMIRS replied that they were unable to identify any breach of Australian Consumer Law (ACL), and would therefore not be able to help Rob. DMIRS was unable to find a breach of consumer law in Rob’s case because financial services and products are not covered under ACL. Instead, ASIC has responsibility for overseeing consumer protection in the financial sector.

Rob also complained to the Australian Prudential Regulation Authority (APRA), which has oversight over insurance companies. However, APRA only supervises the overall financial soundness of banks and insurance firms, and replied to Rob that it would not investigate individual complaints unless they were of prudential concern. Rob also made a complaint to the Australian Human Rights Commission (AHRC) about the firm’s unconscionable behaviour towards him, stating: “I am not the only person they have done this to and not the only person they are doing this to currently. Please help stop this terrible disrespecting, dignity-crushing organisation from inflicting so much pain and devastation to the disadvantaged like myself.” AHRC replied that it was not the most appropriate body to consider the issues that Rob had raised. Rob tried to report his insurance company’s behaviour to the Insurance Fraud Bureau (IFB), however he was informed that the IFB only investigates alleged fraud committed by customers, not by insurance firms. In desperation, Rob wrote to the CEO and management of a state football team which is sponsored by his insurance company, informing them of the terrible way their sponsor treats vulnerable customers, with no result. In January of this year, Rob’s wife Fiona wrote to Assistant Treasurer and Minister for Financial Services, Labor MP Stephen Jones, informing him of their plight. Jones’ office merely thanked Fiona for drawing the matter to their attention and suggested that they seek legal aid.

In addition, Rob tried to hold his insurance company accountable for numerous violations of the Life Insurance Code of Practice (the Life Code), which purports to be “the life insurance industry’s commitment to mandatory customer service standards”. This includes a promise to “be honest, fair, respectful, transparent, [and] timely”. However, as Rob unfortunately discovered, the Life Code is completely worthless. The Code is not legally enforceable, does not guarantee any consumer protections, and insurance companies can repeatedly violate it without any meaningful consequence.

No help from AFCA

Most of the organisations which Rob contacted to appeal for help directed him to the Australian Financial Complaints Authority (AFCA), an organisation which is the only option for most victims to attempt dispute resolution, or to receive compensation from their financial firm. However, as the ACP has previously documented,1 although AFCA is promoted as an alternative to courts and tribunals, it operates extra-judicially (outside of the court system). Therefore, AFCA is not bound by the rules of evidence, and does not afford consumers the same legal protections which are provided by the courts. In addition, many of AFCA’s senior decision-makers are poachers-turned-gamekeepers, as they joined AFCA directly from careers in the financial sector. AFCA, a private company authorised to operate Australia’s official external dispute resolution scheme, is not a genuine avenue for complainants to access true justice.

A complainant to AFCA has to overcome myriad obstacles in order to have their case heard by an AFCA decisionmaker, which include extensive rules, compensation caps and mandatory exclusion provisions. If a complainant manages to progress to a point where AFCA makes a determination, AFCA decides in the firm’s favour 76 per cent of the time.2

In 2021-22, AFCA received 2,482 complaints related to life insurance, an increase of 53 per cent over the previous year. Around one third of these complaints were closed in the initial “Registration and Referral” stage, which involves communication between the firm and complainant, and does not directly involve AFCA. Although AFCA records the majority of complaints closed in this stage as “resolved by agreement”, there is no indication as to whether complainants, who are facing the might of banks and insurance firms, were satisfied with the outcome or if they were pressured into accepting an unfair settlement under threat of poverty or losing their home. In 2021-22, AFCA reported that the average time taken to close a life insurance complaint was rising, and was now a total of 126 days—this is far longer than most Australians can afford to wait to have their disputes resolved.

In 2021-22, AFCA received 1,409 complaints related to income protection insurance, which is the first type of insurance Rob’s insurer delayed paying, ultimately causing him to lose his home. In the case of 5 per cent of these complaints, the insurance companies did not even bother to respond to AFCA. Only 92 (8 per cent) of the total 1,117 complaints closed in 2021-22 were resolved in favour of the complainant. The majority of complaints were closed “by agreement” (37 per cent), found in favour of the financial firm (23 per cent), were discontinued (21 per cent) or were dismissed as outside AFCA’s rules (14 per cent). If a complaint progressed to the final stage where AFCA’s decision-makers made a determination, AFCA decided in the insurance firm’s favour 78 per cent of the time.

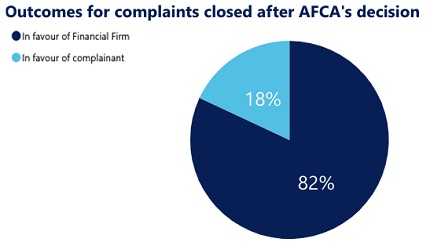

Similarly, in 2021-22 AFCA received 1,209 complaints related to total and permanent disability (TPD) insurance, which is the type of insurance Rob’s insurer has refused to pay out for almost three years. Again, 5 per cent of these complaints did not receive a response from the financial firm. Only 6 per cent of the 924 complaints closed in 2021-22 found in favour of the complainant. If a TPD complaint progressed to the stage where AFCA made a determination, AFCA decided in the financial firm’s favour 82 per cent of the time.

AFCA’s Rules include mandatory exclusion provisions which disqualify complainants from accessing AFCA’s services. As the ACP has previously documented, this includes monetary caps on claims, which are so unreasonably low that they exclude many small businesses and primary producers from accessing AFCA’s services.3 In Rob’s case, AFCA refused to consider his complaint about his insurance company refusing to pay TPD insurance, because the total amount that Rob was insured for was around $2.6 million, which exceeded AFCA’s claim limit of $1.085 million.

AFCA’s Rules did allow AFCA to consider Rob’s separate claims for non-financial loss, namely the distress and hardship caused by the insurance company’s unreasonably long delay and over-investigation of his claim for income protection insurance. In this case, AFCA found in Rob’s favour, and awarded the maximum amount of $5,400 for non-financial loss. This payment was made without Rob’s financial firm being required to admit any liability.

Rob’s story shows that nothing has changed since the 2018 Financial Services Royal Commission, which exposed widespread misconduct by banks and insurance firms. Australia’s financial regulators are still failing in their responsibilities to protect consumers from corporate predators. Now more than ever, it is evident that Australians need the option of a government insurance agency, which Australia previously had in the various state government insurance offices, before the privatisation mania which started in the 1980s. This idea was recently resurrected in a 22 November 2022 speech by Liberal Senator Gerard Rennick, who suggested that as a solution to the banks’ abandonment of regional communities, Australia needed “a government owned postal bank to provide banking and insurance services”.

Footnotes

By Melissa Harrison, Australian Alert Service, 22 March 2023

Australia—an insurers’ playground— the scam of the century!

The following is excerpted from a letter written by Fiona, whose husband, Rob, has been a victim of unconscionable conduct committed by his insurance firm. Rob’s story is discussed above in “No help for victims of insurance industry misconduct”.

Do you have insurance for Total and Permanent Disability in Australia? Are you insured for over $1.1 million? If you are, you have bought into one of the biggest scams running today in this nation.

Let me tell you a little about our story. I’m a mother and a wife to my husband of over twenty years. Six years ago my husband sustained spinal cord damage which rendered him a c2 incomplete quadriplegic. This damage has left him in chronic pain, chronically sleep deprived, and with a variety of physical symptoms which impact him significantly every day.

Prior to this event, we had bright prospects for our future. We were about to build a new home, we had plans for expanding our business, we slept at night knowing we had Life, TPD and Income Protection insurance to back us up should the worst happen.

Sadly, the day came when we did need my husband’s insurance, and after my husband’s MRI, emergency surgery and the devastating consequences that followed, I was left to deal with his claim. Initially, his Income Protection Insurance was the first policy I had to tackle. At a time of great stress I found it difficult to organise all the required documents to submit a claim. I had become a carer for not only our children, but for my husband as well. The future was unknown and the emotional and mental pressure intensified. My husband was not able to cope with much of the paperwork side of things as he was busy dealing with his now very different body and the mental challenges that came with this life-changing event.

The process was not easy. After providing extensive information requested by the insurance company, a fraud investigator was sent from Sydney to visit us. This person trawled through our financials and through our personal lives. For four hours my husband was recorded and interrogated whilst medicated, struggling with his severe pain, sitting in a special lay back chair in the lounge room of our home.

Still, after enduring this very distressing process, more paperwork was required.

I had to deal with all of this. I had to deal with the fact that we had no income and some days I went hungry. My clothes started to come from hand-me-down bags sent our way from friends and family. This scenario may have been nothing new for previous generations, but it was very new for me.

I then had to deal with the banks knocking on our door and taking possession of our block of land, and saying goodbye to the dreams we were building as a family. All the while I was up throughout countless nights as my husband cried out in terrible pain, struggling to care for him and to settle his body.

During the day I was caring for my husband as well as pulling together the paperwork for the insurance claim and I was also very involved in my children’s lives. Both our girls have an Autism diagnosis and additional health challenges. There were appointments galore to get to between the three individuals and I ran the “taxi service” as well as the mental health and education support services.

Over the five years to come, the insurance company did not pay my husband regularly. They also continued to ask for financial documents and they were generally difficult to deal with. The Insurance Ombudsman even found them to have “unnecessarily over-investigated” and to have “purposefully delayed”, and our difficulties with them did not stop there.

Two years before the Income Protection payments were due to cease, my husband received the news that the damage to his spinal cord was permanent: nothing more could be done to improve his condition. Due to the severity of his injury and the impact it had on his ability to work, we then approached our insurer about claiming his TPD Insurance.

At this time we were not informed of the full extent of this process. The policy documents stated that the time for claims to be processed was a maximum of six months, and up to 12 months if there are extenuating circumstances. Little did we know that these words printed on the insurer’s own promotion and policy material are just throw-away lines.

In fact, nearly three years have passed since my husband began the process of claiming for his TPD Insurance. Over six months have passed since we received our last Income Protection payment. We have been surviving on our government benefits and the kind donations from family members ever since. I work a little but I am very limited in what I can do now that I am a carer for three people. My days are constantly busy and full, and sometimes I need to take a break for myself, but I rarely, if ever, get to.

I am constantly tired and there are days, especially when my husband is having a flare-up or my children are needing extra support, where I am pushed to my absolute limit. The bills are piling up all the time and I am left praying desperately that our insurance will come through.

About a year ago, we managed to find lawyers who were willing to take on our case and to champion my husband’s claim for his TPD. They have been actively undertaking their role to get the claim across the line, but to no avail. They are now gearing up to take the insurance company to court as they have exhausted every available avenue. This action requires money, and should they win our case, a huge chunk of what is meant to support us into the future will be chewed up by the system.

Through our journey and through our own investigations, we have uncovered a ghastly and evil loophole that has been set up to benefit insurers and which allows insurance companies to operate freely as is their will, unanswerable to any industry body when it comes to any individual claim for a policy which pays out more than $1.1 million. It works like this:

An insurance company may advertise that they have adopted a Code of Conduct for the consumers’ “peace of mind”, however, this Code is not enforceable. An insurance company can decide not to follow their Code of Conduct if they so choose, with no real fear of repercussions. An insurance company might include references in their policy documents and literature to the Australian Financial Complaints Authority (AFCA), advising that if a policy holder has a complaint, they can approach this Authority for assistance or representation. AFCA is only able to represent an individual if their amount of claim is at, or below, you guessed it … $1.1 million. The Australian Securities and Investments Commission (ASIC), which is the national regulator for financial services cannot help. In their own words in correspondence to us, “ASIC is not a dispute resolution body and does not act for individuals.” So where is the consumer left to turn for help?

As confirmed to me by the office of the Federal Minister of Financial Services as general advice, the only way for my husband to hold his Insurer accountable for the policy that we paid for, and for which the Insurer willingly sold him, is through the court system. The effort involved is practically insurmountable for a family struggling to function with what is already on their plate. And that is with the help of our lawyers—I think every day about the people who are struggling even more than us—the people who don’t have the health or education or family support to make it to court, let alone to figure out that this legal path is their only option. I despair for everyone suffering similarly to my husband, me and my family through this cruel deception.

I repeat—the same applies to every financial Insurance Policy sold in Australia that is for coverage of more than $1.1 million.

This is the greatest scam of the century, preying on the helpless, sick and vulnerable. The corporate giants that rule the roost in this country, all the while enjoying the freedom to flout this loophole and to act however they choose at the expense of suffering people—all for the purpose of holding on to the almighty dollar—is ruthless, despicable and an atrocity that must be stopped immediately.

Most astoundingly of all, our Government allows this to happen. By their inaction and through knowingly supporting this scam (for the Government are fully aware that this loophole exists), the Government holds their share of responsibility and must be held accountable in order for justice to occur.

So now I ask, what have the Government to gain by allowing the blatant exploitation of the people of Australia in this way? Who are these insurance giants who roam freely and act according to their will at the expense of the unsuspecting? What can be done to stop this outrageous rip-off scheme once and for all?

And, how dare they! How dare they treat the unsuspecting, vulnerable and chronically suffering people of this country with such outright contempt, disrespect and deceit!