The Australian Alert Service is the weekly publication of the Australian Citizens Party.

It will keep you updated on strategic events both in Australia, and worldwide, as well as the organising activities of the Citizens Party.

To subscribe to the Australian Alert Service, it's easy, and it's secure.

Click here for subscriptions within Australia

Click here for overseas subscriptions

Lead Editorial

24 June 2020

Vol. 22. No. 25

For too long the foundation of Australia’s economy has been a housing bubble. The health of our banks, riddled as they are with speculative gambling instruments, a.k.a. derivatives, depends upon that bubble. The entire system is speculation. What proportion of Australia’s GDP growth, or Australian bank profits for that matter, stems from actual economic advancement—building new infrastructure to develop the nation and its productive capacity, establishing new industries or harnessing new technologies?

A Commonwealth Bank scenario sees housing prices potentially dropping by up to 32 per cent. Freedom of Information requests have revealed that the Reserve Bank of Australia has been in crisis talks over the impact of the coronavirus lockdown on an economy over-exposed to housing, construction and real estate. With its worst-case scenario involving a market crash of 15 per cent, documents revealed the bank even contemplated having the government “temporarily halt all sales of established dwellings”. Experts contend the RBA’s concerns were a likely prompt for the government’s 3 June introduction of a new HomeBuilder grant.

Bizarrely, the government makes it very hard for people in need to qualify for its programs. The emergency rent relief program assisted only 628 people, activating less than 1 per cent of its allocated budget. According to Digital Finance Analytics principal Martin North mortgage stress has risen from 32 per cent to 37.5 per cent during the crisis. Come September do we really expect most people to simply resume rent or mortgage payments, let alone commence a repayment schedule for deferred loans? The increased JobSeeker payment and JobKeeper wage subsidy also expire in September, which will leave many households in the lurch, at a time when they are the second most indebted in the world. Many expect a housing sell-off to compensate.

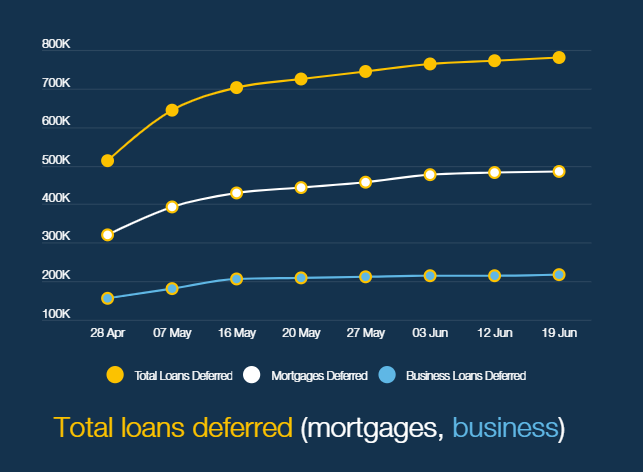

As the media is reporting, the government, our top banking authorities and the banks themselves are in dialogue about the financial cliff-edge on which we sit. According to the Australian Banking Association (ABA), due to the COVID-19 lockdown 779,458 loans have been deferred, including 485,063 mortgages. In dollar terms this amounts to $236 billion worth of loans, with $176 billion in mortgages and $60 billion in business loans.

With the equity capital of the big four banks sitting at $251.5 billion according to financial journalist Alan Kohler, total deferred loans comprise over 90 per cent of bank capital. In a 22 June Australian Financial Review article James Eyers reported on a Morgan Stanley note stating that the major banks “have $640 billion of exposure to industries likely to be most affected by COVID-19, 16 per cent of total exposures”, forcing bank provisions for losses to rise by four times over the next three years.

The exposure of Australian banks to mortgages is close to 65 per cent—it is a huge chunk of their business. A 19 September 2019 RBA report showed the banks increased their exposure to residential mortgages as money market trading became less lucrative.

Furthermore, the banks’ exposure to derivatives has skyrocketed. Just as derivatives spiked internationally with the flood of “repo” market liquidity in the last quarter of 2019, Australia’s derivatives increased by $7.5 trillion in the three months to March 2020, bringing the total to a record $53.2 trillion. At the time of the 2008 global financial crisis it was around $14 trillion.

The countdown clock on this ticking time bomb has been activated, so the fight to achieve the solution must succeed now: stabilise the banking system by passing the Banking Amendment (Deposits) Bill 2020 to prevent deposits being stolen in a crash (p. 3); implement GlassSteagall bank regulation to prohibit deposit-taking banks from speculating; and critically, create a national bank with the power to issue credit to launch the economy onto an emergency economic reconstruction platform.

In this week's issue:

- Don’t believe Morrison won’t ‘bail in’ deposits unless he puts it in writing!

- Don’t leave Australia’s economic future up to spies!

- Former intel chiefs slam ‘Wolverines’, call for ‘sensible engagement’ with China

- Genuine infrastructure program needed

- Call to Arms: Make a submission to protect deposits!

- Anglo-American ‘counterinsurgency’ planners bring permanent wars back home

- Will Bolton go to jail for revenge book?

- ‘Keep the change’: Resist the banks’ cashless scam

- ALMANAC: Libya’s great man-made river

Click here for the archive of previous issues of the Australian Alert Service