25 January 2021

Sydney solicitor Robert Butler sent the following preliminary analysis of the Maddocks Report on Christine Holgate’s purchase of Cartier watches to the Citizens Party:

I have read the Maddocks Report and would make the following preliminary remarks.

The Terms of Reference referred to an inquiry into Christine Holgate’s purchase of four Cartier watches, and also “Australia Post’s governance arrangements and management culture”.

The Terms of Reference virtually dictate the result it requires in respect of Christine Holgate:

“The Government expects all government entities, including Government Business Enterprises [GBEs], to act ethically and adhere to high standards regarding the expenditure of money, as the public also rightly expects.

“Specifically the investigation will determine: … Whether there are other instances in Australia Post inconsistent with appropriate behaviour for a GBE that require further investigation”.

The Report acknowledges that there was no power of compulsion in its investigation and acknowledges that not all prospective witnesses were prepared to get involved and others did so only on the basis of anonymity, and that not all relevant documents were made available. Interviews did not involve sworn testimony.

As a result the Report contains a disclaimer: “Maddocks does not accept responsibility for the accuracy or completeness of the contents, and will not be liable for any loss or damage that may be occasioned directly or indirectly through the use of, or reliance on, the contents of this report.”

The overall impression one gets from reading the Report is that it was designed to justify PM Morrison’s attack on Christine Holgate in Parliament on 22 October 2020 and an agenda which resulted in such an attack. That there was more to the attack was expressed by Australia Post Chair John Stanhope as quoted in the Australian Financial Review on 24 October 2020 that “I do think Christine has been caught in some kind of wider play.”

The Report states in its Summary Findings that: “There is no indication of dishonesty, fraud, corruption or intentional misuse of Australia Post funds by any individual involved in the matters relating to the purchase and gifting of the Cartier watches.”

However, the Report does not then exonerate Christine Holgate or the Board from wrongdoing, the Summary going on to find that: “The purchase of the Cartier watches was inconsistent with the obligation imposed by the PGPA Act on the Board relating to the proper use and management of public resources (section 15(a) of the PGPA [Public Governance, Performance and Accountability] Act) and was inconsistent with public expectations in relation to the use of public resources due to:

(a) the absence of a clearly identifiable and directly applicable policy, authorisation, direction or accountable authority instruction issued by the Board that supported the expenditure

(b) the unanimous view of the non-executive Board members interviewed that they would not have approved the purchase of the Cartier watches

(c) a technical breach of section 18 of the Public Governance, Performance and Accountability Rule 2014 (PGPA Rule), which is partly the result of the issue in paragraph (a) above

(d) expenditure using the Office of the CEO credit card being approved by the Chief Financial Officer, a role subordinate to the Group CEO & Managing Director, being inconsistent with the requirement in section 16 of the PGPA Act that the Board, as the accountable authority, establish and maintain an appropriate system of internal control for Australia Post.”

The Report also claims in its Summary Findings that: “The then Board did not consider or approve the purchase of the Cartier watches.

“There is no documentary evidence that the Board approved the expenditure for, and none of the Board members interviewed recalled any discussion about the purchase of, the Cartier watches.

“There is contradictory evidence as to whether the former Group CEO & Managing Director informed the former Chair that it was her intention to purchase the Cartier watches or whether the former Chair approved the commitment of funds for this purchase.

“No definitive finding can be made in this regard.”

This finding needs to be considered in the light of John Stanhope’s statements as appearing in the AFR article referred to above and which is not referred to in the Report. That article stated: “Mr Stanhope, appointed by Labor in 2012, said Ms Holgate proposed the gifts after the deal was secured with Commonwealth Bank, Westpac and National Australia Bank. “‘They brought a lot of revenue to Post and to taxpayers, let alone the benefits for banking in regional Victoria. That is why the board supported her recommendation’, he told AFR Weekend. ‘These people did an exceptional job and deserved a reward. But we left it for the CEO to decide the nature of that reward. I don’t recall being asked about how much would be spent’.”

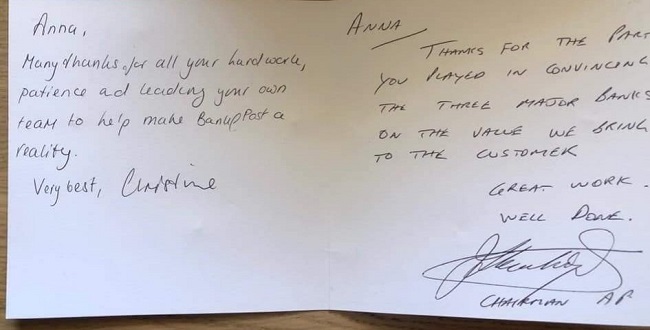

John Stanhope and Christine Holgate signed the “Thank You” notes which were delivered with the watches at a presentation ceremony and according to Christine Holgate, Stanhope briefly attended the presentation ceremony.

In her evidence before the Senate Estimates hearing, Christine Holgate stated that: “I have not used taxpayers’ money. We are a commercial organisation…. We do not receive Australian government funding. We are a commercial organisation and it was … a recommendation from our Chair that these people get rewarded.”

What does come out of the Report is that:

- Christine Holgate had an Australia Post credit card with a credit limit of $150,000;

- She had a discretion as to payments to be made with the credit card;

- She authorised the use of the card for the purchase of four watches as rewards for four Australia Post senior executives for work they did in securing payments from Australian Bank—the Report notes the extent of the work they undertook;

- The payment was approved by the Chief Financial Officer;

- The Post Office paid Fringe Benefits Tax on the purchases;

- The ATO wrote to each of the recipients confirming the payment of Fringe Benefits Tax;

- No issue was raised by Australia Post Auditors as to the payment;

- The purchase occurred in 2018—to suggest that others in Australia Post, including Board members, did not become aware until the evidence before the Senate in 2020 is simply not credible.

The Summary Findings also claim that: “The purchase of the Cartier watches was inconsistent with the obligation imposed by the PGPA Act on the Board relating to the proper use and management of public resources (section 15(a) of the PGPA Act) and was inconsistent with public expectations in relation to the use of public resources due to:

(a) the absence of a clearly identifiable and directly applicable policy, authorisation, direction or accountable authority instruction issued by the Board that supported the expenditure

(b) the unanimous view of the non-executive Board members interviewed that they would not have approved the purchase of the Cartier watches

(c) a technical breach of section 18 of the Public Governance, Performance and Accountability Rule 2014 (PGPA Rule), which is partly the result of the issue in paragraph (a) above

(d) expenditure using the Office of the CEO credit card being approved by the Chief Financial Officer, a role subordinate to the Group CEO & Managing Director, being inconsistent with the requirement in section 16 of the PGPA Act that the Board, as the accountable authority, establish and maintain an appropriate system of internal control for Australia Post.”

There are a number of references in the Report to “public expectations” as if it were some defined legal requirement. The claim seems to be based on a quote from Australia Post Chair: “On 9 November 2020, the current Chair of Australia Post publicly recognised that ‘the purchase of the watches in 2018 may not have met with expectations of members of the public’.”

Not surprisingly, the Report also notes that: “It is not possible in this report to definitively articulate the public’s expectations of board members and executives of GBEs and their management of the enterprise.”

Nor does the Report seek to explain why the purchase “was inconsistent with the obligation imposed by the PGPA Act on the Board relating to the proper use and management of public resources”. Section 15 of the PGPA Act quoted provides:

“15 Duty to govern the Commonwealth entity

(1) The accountable authority of a Commonwealth entity must govern the entity in a way that:

(a) promotes the proper use and management of public resources for which the authority is responsible; and

(b) promotes the achievement of the purposes of the entity; and

(c) promotes the financial sustainability of the entity.”

I would suggest that the award of the watches would be totally in line with this provision.

Much of the Report details the legislative and regulatory provisions relating to Australia Post and its Board and criticisms of the systems adopted by the Board. The Report states: “There were varying levels of understanding of the current and former Board members who were interviewed with regard to:

(a) the obligations of Australia Post’s Board as the ‘accountable authority’ for the purposes of the PGPA Act

(b) the duties imposed on them individually as officials by the PGPA Act

(c) the requirements of the GBE Guidelines that apply to Australia Post with respect to board and corporate governance and accountability obligations.”

The Report does not explain this lack of “understanding”, what was not understood and by what standard was this lack of understanding determined; or was it merely that they did not agree with Maddocks interpretations?

The Report quotes the Board’s Charter that “Specific limits on the authority delegated to the Group Chief Executive Officer and Managing Director are set out in Delegated Authorities approved by the Board” but does not provide details of those limits. The Report further states: “The Group Credit Card Policy states that ‘a credit card is a delegation to spend up to the credit card’s transaction and card limit’ and that, in obtaining a credit card, an employee gains a delegation” and states that the limit is $150,000.

The Report acknowledges that: “Based on the information available, there are no specific policies or apparent controls that have been (or were in 2018) implemented by the Board regarding the giving of internal gifts, reward or recognition which is in the nature of the Watches (that is, a luxury good or service).”

The Report notes that “As at the date of this report, no written approval of a commitment of expenditure given by the Board or an individual Board member in relation to the purchase of the Watches has been sighted” but then remarks that it is a failure by the Board: ‘If there was no written approval of, or any relevant policy authorising, the expenditure incurred in purchasing the Watches, this is indicative of gap in the internal controls framework required to be established by the Board.”

The Report states: “The Managing Director is authorised for card expenditure only in accordance with the applicable policy and standards of Australia Post. The potentially relevant policies that were identified are summarised in section 5 below.”

Section 5 includes: “The former CEO’s position is that the purchase and gifting of the Watches to the Watch Recipients was within Australia Post’s ‘gift and remuneration’ policy. No policy which supports gifts such as the Watches being made to Executives as a reward for high performance has been identified.”

It is difficult to see how a policy specifically for the gifting of watches would be expected in a policy standard. In any event the watches were not gifts (as apparently recorded in some records) but rewards for services (as evidenced by the Fringe Benefits Tax paid).

Section 5 then states: “The acquittal process for expenditure using the CEO credit card and the Office of the CEO credit card appears to involve approval for such expenditure being given by the CFO, a direct report to the CEO.” This is a reference to the necessity for the Chief Financial Officer to sign off on the expenditure, a step which was undertaken.

The Section further claims that “Board members interviewed indicated that the purchase and gifting of the Watches did not fall within any formal policy regarding rewards, recognition or incentives. All non-executive Board members interviewed agreed that the Watches were not an appropriate type of reward and that they would not have approved the expenditure. There is no specific policy made by the Board that would support the decision to purchase the Watches as a reward for superior performance.”

It is difficult to accept these statements in view of the history as noted above.

The Report acknowledges the extent of the work undertaken by the recipients of the watches: “The work associated with the Bank@Post Refresh was described as ‘intense’, ‘demanding’ and ‘pretty full-on’. The Bank@Post Refresh required those involved, to varying degrees, to work on weekends, on leave days and late at night” and that there was some discussion as to rewarding them: “There appears to have been a discussion between the former CEO and the former Chair a couple of weeks after announcing the agreements with CBA, Westpac and NAB regarding recognition of individuals from the Bank@Post Refresh team. While this discussion may have included mention of an appropriate amount to be spent on any recognition, it does not appear to have specifically canvassed purchasing the Watches for this purpose.”

The Report concludes with the following findings in relation to the purchase of the watches:

“6.8.1 There is no indication of dishonesty, fraud, corruption or intentional misuse of Australia Post funds by any individual involved in the matters relating to the purchase and gifting of the Watches.

6.8.2 The then Board did not consider or approve the purchase of the Watches. There is no documentary evidence that the Board approved the expenditure and none of the Board members interviewed recalled any discussion about the purchase of the Cartier watches.

6.8.3 Based on the available evidence:

(a) There is contradictory evidence as to whether the former CEO informed the former Chair that it was her intention to purchase the Watches or whether the former Chair approved the commitment of funds for this purchase. No definitive finding can be made in this regard.

(b) The purchase of the Watches was inconsistent with the obligation imposed by the PGPA Act on the Board relating to the proper use and management of public resources and was inconsistent with public expectations in relation to the use of public resources due to:

i. the absence of a clearly identifiable and directly applicable policy, authorisation, direction or accountable authority instruction issued by the Board that supported the expenditure

ii. the unanimous view of non-executive Board members interviewed that they would not have approved the purchase of the Watches

iii. a technical breach of section 18 of the PGPA Rule, which is partly the result of the issue in paragraph (a) above

iv. expenditure using the Office of the CEO credit card being approved by the CFO, a role subordinate to the CEO, being inconsistent with the requirement in section 16 of the PGPA Act that the Board, as the accountable authority, establish and maintain an appropriate system of internal control for Australia Post.”

The Report concludes with the following rather self-serving statements by Board Members in relation to Australia Post’s management culture:

“7.3.5 None of the Board members interviewed agreed with the statement by the former CEO in the Senate Estimates hearing that she had not used taxpayers money in purchasing the Watches.

7.3.6 A number of Board members expressed the view that this may have been a poor choice of words on the part of the former CEO and that CEO may have meant that Australia Post does not receive a budget allocation from the Government.

However, all of the Board members interviewed agree that the Australian Government or the Australian people were effectively the ‘shareholders’ of Australia Post and that, in turn, the assets of Australia Post are the assets of the Australian people.”

All-in-all, I think the Report was heavily influenced by the Government’s agenda in relation to Australia Post.

Regards,

Bob Butler