Experienced NSW solicitor Robert Butler, a member of the Committee of Management of the Citizens Electoral Council, has provided to the CEC the following legal analysis of the “bail-in” provisions of the Financial Sector Legislation Amendment (Crisis Resolution Powers and Other Measures) Act 2018. Bail-in is the system developed by the Financial Stability Board at the Bank for International Settlements in Switzerland, following the 2008 global financial crisis, to avert future bank failures not through government bailouts, but through writing off or converting into shares, a.k.a. “bailing in”, a percentage of the money that the failing bank owes to its “unsecured creditors”, a category which includes various types of bondholders, as well as normal depositors.

The Turnbull-Morrison government rushed this legislation through Parliament on 14 February 2018, with just eight senators present in the Senate chamber and without a recorded vote. The chair of the Senate Economics Legislation Committee which conducted an inquiry into the legislation, Senator Jane Hume, insisted to constituents that it was not a “bail-in law”; Treasury and other agencies stated it was not the “intention” of the conversion and write-off provisions of the law to bail in deposits. However, the government rushed the legislation through the Senate knowing that Pauline Hanson’s One Nation senators intended to move an amendment that explicitly excluded deposits from the law, but were not in the chamber; and another government senator, Amanda Stoker, has since admitted it is a bail-in law. Robert Butler has analysed both the legislation, as well as new information revealed by banking analyst Martin North and economist John Adams, that banks can arbitrarily change the terms and conditions of their deposit accounts.

Download PDF - Legal opinion: Australian deposits can be ‘bailed in’

Dear Sir,

RE: FINANCIAL SECTOR LEGISLATION AMENDMENT (CRISIS RESOLUTION POWERS AND OTHER MEASURES) ACT 2018 BAIL-IN PROVISIONS

I have been asked to provide an opinion as to whether the Financial Sector Legislation Amendment (Crisis Resolution Powers and Other Measures) Act 2018 (“the Act”) creates a power of bail-in by Australia’s banks of customers’ deposits.

At a minimum, the Act empowers APRA to bail in so-called Hybrid Securities - special high-interest bonds evidenced by instruments which by their terms can be written off or converted into potentially worthless shares in a crisis.

However, the Act also includes write-off and conversion powers in respect of “any other instrument”. The Government has contended that these words do not extend to deposits, on the basis that the power only applies to instruments that have conversion or write-off provisions in their terms, which deposit accounts do not. However, the reference to “any other instrument” would be unnecessary if the power only applied to instruments with conversion or write-off provisions; moreover, banks are able to change the terms and conditions of deposit accounts at any time and for any reason, including on directions from APRA to insert conversion or write-off provisions, which would thereby bring them within the specific terms of the write-off or conversion provisions of the Act.

The issue could now be simply resolved by Government passing a simple amendment to the Act to explicitly exclude deposits from being bailed in.

Bail-in is one of the 3 alternative actions which can be taken in respect of a distressed bank.

The alternatives are:-

-

Bankruptcy and liquidation of the bank;

-

Bail-out, which is the injection into the bank of the necessary capital to meet the bank’s liabilities. This is the action which was undertaken after the 2008 GFC by governments through their Treasuries and Central Banks bailing out the banks with taxpayers’ funds;

-

Bail-in, which is the injection into the bank of the necessary capital to meet the bank’s liabilities either by the bank writing off its liabilities to creditors or depositors or converting creditors’ loans or deposits into shares whereby creditors and depositors take a loss on their holdings. A bail-in is the opposite of a bail-out which involves the rescue of a financial institution by external parties, typically governments that use taxpayers’ money.

The provisions of the Act as they affect bail-in require a consideration of the issue in 3 different sets of circumstances, and the provisions of the Act need to be considered separately in relation to each such set of circumstances.

Those 3 sets of circumstances are:-

-

Hybrid Securities issued by banks;

-

Customer deposit accounts with banks;

-

Bank documentation implementing deposit accounts.

(i) Hybrid securities

The ASX describes Hybrid Securities as “a generic term used to describe a security that combines elements of debt securities and equity securities.” Whilst there are a variety of such securities, in short they are securities issued by banks which permit the amounts secured by the security to be converted into shares or written off at the option of the bank in certain circumstances.

The Act provides specifically for Hybrid Securities. Section 31 adds “Subdivision B-Conversion and write off provisions” to the Banking Act 1959 and inserts a definition Section 11CAA which provides that “conversion and write off provisions means the provisions of the prudential standards that relate to the conversion or writing off of:

(a) Additional Tier 1 and Tier 2 capital; or

(b) any other instrument.”

The Act also inserts Section 11CAB which provides:

“(1) This section applies in relation to an instrument that contains terms that are for the purposes of the conversion and write off provisions and that is issued by, or to which any of the following is a party:

(a) an ADI; ......

(2) The instrument may be converted in accordance with the terms of the instrument despite:

(a) any Australian law or any law of a foreign country or a part of a foreign country, other than a specified law; and .....

(3) The instrument may be written off in accordance with the terms of the instrument despite:

(a) any Australian law or any law of a foreign country or a part of a foreign country; .....

Under the Basel Accord, a bank's capital consists of Tier 1 capital and Tier 2 capital which includes Hybrid Securities.

The Section 11CAB provisions mean that any law which would otherwise prevent the conversion or write-off of Hybrid Securities does not apply unless a particular legislative provision specifically provides that it does apply. One of the principle types of legislation that this provision would be directed towards is consumer legislation, particularly those provisions which allow a Court to set aside or vary agreements if a party has been guilty of false or misleading conduct - this is precisely the sort of argument which could be raised in the circumstances referred to by outgoing Australian Securities and Investments Commission (ASIC) Chairman Greg Medcraft in an exchange with Senator Peter Whish-Wilson in the hearings of the Senate Economics Legislation Committee on 26 October 2017: Mr Medcraft said: "There are two reasons we believe a lot of the retail investors buy these securities. One is they don't understand the risks that are in over 100-page prospectuses and, secondly - and this is probably for a lot of investors - they do not believe that the government would allow APRA to exercise the option to wipe them out in the event that APRA did choose to wipe them out."

When Senator Whish-Wilson raised the spectre of "bail-in", Mr Medcraft confirmed: "Yes, they'll be bailed in. The big issue with these securities is the idiosyncratic risk. Basically, they can be wiped out - there's no default; just through the stroke of a pen they can be written off. For retail investors in the tier 1 securities - they're principally retail investors, some investing as little as $50,000 - these are very worrying. They are banned in the United Kingdom for sale to retail. I am very concerned that people don't understand, when you get paid 400 basis points over the benchmark[4 per cent more than normal rates], that is extremely high risk. And I think that, because they are issued by banks, people feel that they are as safe as banks. Well, you are not paid 400 basis points for not taking risks…" He emphasised: "I do think this is, frankly, a ticking time bomb."

The over-riding intention behind Sections 11CAB(2) and 11CAB(3) is to deal with issues arising from the examples in the comments of Graeme Thompson of APRA in an address on 10 May 1999 when he said: "... APRA will have powers under proposed Commonwealth legislation to mandate a transfer of assets and liabilities from a weak institution to a healthier one. This is a prudential supervision tool that the State supervisory authorities have had in the past, and it has proved very useful for resolving difficult situations quickly. We expect the law will require APRA to take into account relevant provisions of the Trade Practices Act before exercising this power, and to consult with the ACCC whenever it might have an interest in the implications of a transfer of business." The new Sections 11CAB(2) & (3) mean that APRA does not need to consider those issues (or any other) in relation to conversion and write-off of Hybrid Securities.

(ii) Deposits

Whether or not bail-in of other than Hybrid Securities is implemented by the Act has been the subject of debate and concern since the Bill which led to the Act became public. The principal area of concern is whether or not the bail-in regime was extended by the Act to deposits made by customers with banks.

The central issue is the wording of the definition in Section 11CAA quoted above and what “any other instrument” means. “Instrument” is not defined in the Act but a "financial instrument" is defined by Australian Accounting Standard AASB132 as "any contract that gives rise to a financial asset of one entity and a financial liability or equity instrument of another entity." As confirmed by the Reserve Bank, a deposit with an ADI bank comes under such a definition - it is a contract with terms and conditions as to the deposit being set by a bank, accepted by a depositor on making a deposit and creating a financial asset (a right of repayment) and a financial liability in the bank (the obligation to repay).

Deposits are created by "instruments" and are governed by the terms and conditions of those instruments.

The intent of the reference to “any other instrument” in Section 11CAAAA is assisted by the Explanatory memorandum which accompanied the Exposure Draft and which states: “5.14 Presently, the provisions in the prudential standards that set these requirements are referred to as the 'loss absorption requirements' and requirements for 'loss absorption at the point of non-viability'. The concept of 'conversion and write-off provisions' is intended to refer to these, while also leaving room for future changes to APRA's prudential standards, including changes that might refer to instruments that are not currently considered capital under the prudential standards.”

Section 11AF of the Banking Act provides that APRA can determine Prudential Standards which are binding on all ADIs. These standards are in effect regulations which have the force of legislation by virtue of the authorisation in the Banking Act. That Section provides, inter alia:

“(1) APRA may, in writing, determine standards in relation to prudential matters to be complied with by:

(a) all ADIs; .....”

Banks are ADIs.

The various Prudential Standards issued by APRA are accordingly headed with the phrase:

"This Prudential Standard is made under section 11AF of the Banking Act 1959 (the Banking Act)."

That power then leads into the issue of APRA using this authority to expand the meaning of "capital" the subject of conversion or write-off, to encompass deposits if deposits are not already covered by the reference to “any other instrument”.

That these provisions as to conversion and write-off are not limited to Hybrid Securities is confirmed in Section 11CAA itself as quoted above. The provisions extend to "any other instrument" by sub-section (b) of that Section and must relate to instruments other than those referred to in sub-section (a), i.e. other than “Additional Tier 1 and Tier 2 capital” (being instruments which themselves contain an explicit provision for conversion or write-off). All instruments that the Act refers to as to being able to be converted or written off "in accordance with the terms of the instruments" come under the definition of “Additional Tier 1 and Tier 2 capital” - "any other instruments" is not only an entirely unnecessary addition if the Act is intended to apply only to instruments with conversion or write-off terms, its very broad language must be intended to encompass some other instruments (“which are not currently considered capital” as stated in the Explanatory memorandum) and that could extend to instruments relating to deposits.

If Section 11CAA thus extends to instruments relating to deposits then APRA can as the Prudential Regulator issue a Prudential Requirement Regulation or a Prudential Standard for the writing-off or conversion of deposits.

APRA already has a power to prohibit the repayment of deposits by ADIs, a power which already verges on the writing off of those deposits. The Banking Act Section 11CA provides:

“(1) ... APRA may give a body corporate that is an ADI ... a direction of a kind specified in subsection (2) if APRA has reason to believe that: .....

(b) the body corporate has contravened a prudential requirement regulation or a prudential standard; or

(c) the body corporate is likely to contravene this Act, a prudential requirement regulation, a prudential standard or the Financial Sector (Collection of Data) Act 2001, and such a contravention is likely to give rise to a prudential risk; or (d) the body corporate has contravened a condition or direction under this Act or the Financial Sector (Collection of Data) Act 2001 ; or ....

(h) there has been, or there might be, a material deterioration in the body corporate's financial condition; or ....

(k) the body corporate is conducting its affairs in a way that may cause or promote instability in the Australian financial system. .....

(2) The kinds of direction that the body corporate may be given are directions to do, or to cause a body corporate that is its subsidiary to do, any one or more of the following: ....

(m) not to repay any money on deposit or advance;

(n) not to pay or transfer any amount or asset to any person, or create an obligation (contingent or otherwise) to do so; .....”

This provision was inserted into the Banking Act in 2003 by the Financial Sector Legislation Amendment Act (No 1).

It is not known whether this power has been exercised by APRA. Relevantly Graeme Thompson in the address referred to above said: " ... Particularly in the case of banks and other deposit-takers that are vulnerable to a loss of public confidence, APRA may prefer to work behind the scenes with the institution to resolve its difficulties. (Such action can include arranging a merger with a stronger party, otherwise securing an injection of capital or limiting its activities for a time.)"

It is a relatively small step to then convert or write-off what the ADI has been prohibited from repaying or paying out.

It might be argued that APRA’s powers in existing Sections of the Act are not absolute and are subject to various qualifications and limitations arising out of their context within the Act or the balance of the Section or Sections of the Act in which they appear. To avoid such an interpretation, Section 38 of the Act inserts 2 new sub-sections to Section 11CA in the Banking Act:

“(2AAA) The kinds of direction that may be given as mentioned in subsection (2) are not limited by any other provision in this Part (apart from subsection (2AA)).

(2AAB) The kinds of direction that may be given as mentioned in a particular paragraph of subsection (2) are not limited by any other paragraph of that subsection.”

APRA has already adopted the need for certain capital to be capable of conversion or write-off, regardless of laws, constitutions or contracts which may affect such decisions, the Explanatory Statement for Banking (Prudential Standard) Determination No. 1 of 2014 stating:

“The Basel Committee on Banking Supervision (BCBS) has developed a series of frameworks for measuring the capital adequacy of internationally active banks. Following the financial crisis of 2007-2009, the BCBS amended its capital framework so that banks hold more and higher quality capital (Basel III). For this purpose, the BCBS established in Basel III more detailed criteria for the forms of eligible capital, Common Equity Tier 1 (CET1), Additional Tier 1(AT1) and Tier 2 (T2), which banks would need to hold in order to meet required minimum capital holdings.

Basel III provides that AT1 and T2 capital instruments must be written-off or converted to ordinary shares if relevant loss absorption or non-viability provisions are triggered. Banking (prudential standard) determination No. 4 of 2012 incorporated the Basel III developments into APS 111 with effect from 1 January 2013. ...”

(iii) Bank documentation implementing deposit accounts

Even if the words “any other instrument” in Section 11CAA do not encompass deposits, there

is a further issue in relation to the implementation of bail-in of deposits revolving around the issue of the documents/instruments issued by banks in opening accounts and accepting deposits from customers.

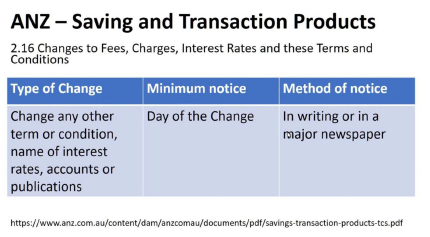

The documentation issued by each Australian bank when opening such an account, has a provision which enables the Bank to change the terms and conditions from time to time without the consent of the customer. The specifics of the power vary from bank to bank but each fundamentally contain such a power. Some examples of various clauses are set out in Appendix 1.

If APRA as the Prudential Regulator issued a Prudential Requirement Regulation or a Prudential Standard requiring a bank to insert a provision into its documentation/instruments relating to deposit-taking accounts providing for the bail-in of those deposits - their write-off or conversion - then those provisions would then clearly come within the specific provisions of conversion or write-off within the Act and the deposit the subject of the account could be bailed-in immediately.

Such a directive could be issued by APRA in accordance with the secrecy provisions in the Australian Prudential Regulation Authority Act1998 and be implemented with little or no notice to the account holder.

Whilst not directly relevant to an interpretation of the provisions of the Act, there are a number of unusual and concerning aspects to its introduction, passing and intentions. Some are summarised in Appendix 2.

As noted above, the issue could now be simply resolved by Government passing a simple amendment to the Act to explicitly exclude deposits from being bailed in i.e. written off or converted into shares.

Whilst not beyond doubt, it is my opinion that the provisions of the Act do provide for a power of bail-in of bank deposits which did not exist prior to the passing of the Act.

Yours faithfully,

R. H. BUTLER

APPENDIX 1

APPENDIX 2

One Nation Senators had attempted to insert a provision into the Act before its passing to ensure that its intention was clear and that it did not apply to deposits as was being contended by the Commonwealth Government. After the Senators notified the Government that they intended to move an amendment to the Bill to explicitly exclude deposits from being bailed in, the government offered to check the wording of their amendment, and while the Senators waited for the response, the government rushed the bill through the Senate and into law while the Senators were out of the chamber, and with only eight Senators present in the Chamber. In a 1 March 2018 letter to a concerned constituent, Senator Hume, ex-NAB, Deutsche Bank and Rothschild Australia banker, the chair of the Senate Economics Legislation Committee and who controlled the Senate inquiry into the Act when it was a bill in Parliament, wrote: "While I appreciate the concerns raised by the CEC, I can assure you that this bill does not constitute what some are referring to as 'bail-in' legislation. Treasury, the RBA, and APRA all confirmed in their answers that the Bill is definitely not 'bail-in' legislation."

Queensland LNP Senator Amanda Stoker, barrister, former prosecutor, judge’s associate in both the Queensland Supreme Court and High Court of Australia, had a different view and explained in a 5 November 2018 letter to a constituent: “The legislation facilitates bail-in as a type of resolution power which is available for dealing with financial institution distress. This was done after the G20 leaders endorsed a new Financial Stability Board standard for Total Loss-absorbing Capacity. Specifically, it builds on the Key Attributes which specifies that Financial Stability Board jurisdictions should have in place legally enforceable mechanisms to implement a bail-in. The purpose of the Total Loss-absorbing Capacity standard ensures there are mechanisms in place to stop the ‘domino effect’ and reduce loss on [sic] bank shareholders, creditors and the Government.”

It is to be noted that bail-in applies to deposits in every other FSB jurisdiction in the world - including the USA, UK, EU, Canada and New Zealand.

The International Monetary Fund’s February 2019 Financial System Stability Assessment for Australia seeks to put the intention of the Act beyond doubt and makes clear that the intent is to end Australia’s sovereign control of its own banking system, so that global banking authorities can dictate the confiscation of Australians’ savings to avert a global financial crisis, and the Australian people and government will be powerless to stop it. The IMF is demanding that Australia move beyond any uncertainty surrounding the “bail-in” scheme contained in the Act, and enact a full, unambiguous statutory bail-in regime that explicitly includes seizing deposits to prop up failing banks. The IMF Assessment provides that: “More needs to be done to ensure that the authorities are well-positioned to resolve a systemically important bank or to address a systemic banking crisis”. That “more” is statutory bail-in powers, which means a law giving APRA power to bail in whatever is necessary to save a bank.

The IMF’s Assessment takes the government at its word that the conversion and write-off provisions in the APRA crisis resolution powers in the Act may not extend to deposits: “in the absence of provisions on statutory bail-in”, the IMF states in a footnote, “such conversion and write-off provisions cannot be applied more broadly to other bank liabilities (excluding insured deposits).”

In the context of statutory bail-in powers to bail-in deposits, the IMF demands three changes to APRA:

1. A clarification of APRA’s responsibilities, which currently are stated as “the protection of the depositors” of the banks and “the promotion of financial system stability in Australia”, to reflect the fact that “financial stability” is the primary objective, ahead of depositor protection;

2. An end to the Treasurer being able to direct APRA, and to the current requirement that APRA obtain the consent of the Treasurer to implement certain measures in a bail-in “resolution”;

3. An end to Parliament being able to disallow an APRA prudential standard, a democratic safeguard which the IMF insist “weakens” APRA in terms of its ability to enforce measures (such as bail-in) to achieve financial stability.

In Australia’s official response to the IMF, included in the Assessment, Australia’s authorities

disagreed with these latter two demands to make APRA totally “independent”. Worryingly, however, their reason was not that these demands constitute an anti-democratic assault on our sovereignty, but that the democratic controls over APRA have never been used, implying they never will.