The Australian Alert Service is the weekly publication of the Australian Citizens Party.

It will keep you updated on strategic events both in Australia, and worldwide, as well as the organising activities of the Citizens Party.

To subscribe to the Australian Alert Service, it's easy, and it's secure.

Click here for subscriptions within Australia

Click here for overseas subscriptions

Lead Editorial

7 October 2020

Vol. 22. No. 40

Treasurer Josh Frydenberg’s budget delivered on 6 October has put gross government debt on track to hit almost a trillion dollars by 2024. But for what—what will incurring that debt do for the economy?

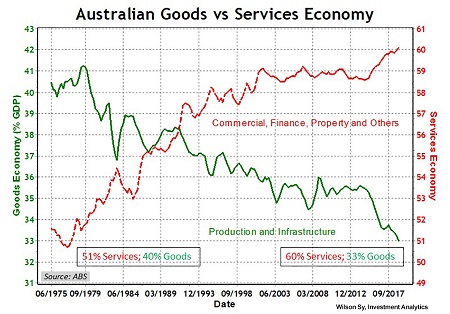

Essentially, nothing. The budget deficit this year will be $214 billion to keep the existing economy on life support. The government says it’s a plan to create a million jobs, by giving businesses incentives to invest and employ more people. Even if that happens, however, and that’s a big “if”, they will be a million jobs in the existing economy, which is an economy that has put all its eggs in the basket of unproductive financial services, a housing bubble, and raw materials exports. This is the economy that got us into this mess, that collapsed under the pandemic but would have similarly collapsed under any number of crises.

The most revealing item in the budget is infrastructure. Of all the hundreds of billions the government will spend this year, Frydenberg announced $11 billion to be spent on infrastructure. More than half of that will be transport projects, mainly road upgrades, by the states. The government’s main motivation for this spending is to quickly stimulate the economy and create a few jobs. The problem with this thinking is it doesn’t set Australia up for the future.

The Member for Kennedy, Bob Katter, attacked the budget in a 6 October press release, saying it “lacked the vision to drive Australia out of the COVID-19 economic depression as barely any ‘make-money’ projects were funded”. He pointed out that the economic development potential of North Queensland to transform Australia into a productive powerhouse, had again been ignored while the government focused on what he calls “absorb money” projects in the major cities. “It really makes your blood boil when you see $5 billion for a metro to the Western Sydney Airport, another $5 billion for Melbourne Airport Rail and $750 million for a road on the Gold Coast at Coomera, all while Hells Gates Dam (Revised Bradfield Stage One) and a tax-payer owned, multi-user Galilee rail line miss out on the big dollars”, Katter said. “The people of Australia must understand that we are in the worst economic situation since the Great Depression. The Treasurer has missed his opportunity to fund projects that would create wealth, thousands of jobs and pay for themselves. The Galilee Rail Line would double Australia’s coal production and the Revised Bradfield Scheme Stage One would increase Australia’s agricultural production by 50 per cent.”

The problem is Australia will never spend enough on infrastructure while it relies on the annual budget. That’s evident in the $600 billion infrastructure deficit the nation has incurred over the past four decades—a conservative estimate of the amount we should have invested in infrastructure but didn’t. Bob Katter is the loudest voice in Parliament for a national development bank, which is how we should be funding infrastructure investment outside of the budget. A national development bank can harness the savings of Australians that are currently in unproductive investments in Australia and overseas and put them to work developing Australia. Highspeed rail, major water projects like the Bradfield Scheme and Clarence River Scheme, and visionary value-adding proposals like Project Iron Boomerang, will set Australia’s economy up to supply high-value goods for ourselves and our fastgrowing Asian neighbours. If Australia built the infrastructure it needs, millions of jobs will be created in construction, supply industries, and new productive industries the infrastructure will unleash. The debt that federal, state and local governments will incur to borrow to invest in infrastructure will be low-interest loans from the nation’s own bank.

Bob Katter is working with the Citizens Party to develop national development bank legislation for Parliament. It’s the only way to stop holding Australia hostage to the “budget”.

In this issue:

- What have the major parties got to hide about ‘bail-in’?

- Your grandma is next! Fight Morrison’s creeping cashless economy agenda

- Aged care is a public good, not a cash cow

- Central Bank Digital Currency plan exposes new bailout strategy

- China’s energy conundrum

- Tony Kevin: Why history matters in Belarus

- UK China-haters use ‘Uighur genocide’ fantasy to hijack post-Brexit trade bill

- Falun Gong fronts Anglo-American strategy against China

- Is USA goading China to war over Taiwan?

- Cranking up the political debate

- Remembering Ross Russell and Roy Eykamp

- ALMANAC: Japan got the ‘China treatment’ when it tried to launch development in Africa

Click here for the archive of previous issues of the Australian Alert Service