The Sterling First rent-for-life scandal has all the hallmarks of a sophisticated white-collar crime operation involving the banks, a Big Four auditor, financial professionals, experienced Ponzi scheme artists, and the Australian Securities and Investments Commission (ASIC). As well as fleecing elderly tenants out of millions in life savings, Sterling conspirators roped unsuspecting landlords into an inflated mortgage debt scandal, with the complicity of all the major banks.

Beryl and Ray: the tenants’ story

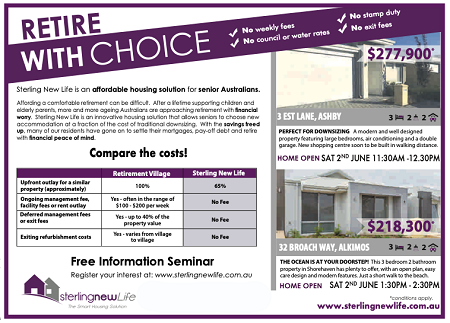

Beryl and her husband Ray are retirees who first heard about Sterling through an advertisement in the January 2016 Sunday Times. They were looking to downsize their home and Sterling’s rent-for-life offer was a financially attractive option compared with the expense of a retirement village. As part of her due diligence, Beryl searched the registers of ASIC and called the regulator to ask if there were any red flags about Sterling, and was advised that ASIC had no concerns about the company. (Notably, founder of the Banking and Finance Consumers Support Association and advocate for Sterling victims, Denise Brailey, reports ASIC had acknowledged complaints about Sterling in 2015.)

Beryl and Ray then sold their home and travelled Australia for a year, after which they signed up to Sterling. Like the other 140 elderly people targeted by Sterling for their $250,000-$300,000 in life savings, Beryl and Ray paid Sterling a lump sum as up-front rent for the rest of their lives. The home was in a new development in Ravenswood and was owned by Acquest, a Sterling Group subsidiary headed by Ryan Jones, the son of Sterling founder Ray Jones. Discharged from bankruptcy in 2015, Ray Jones had been involved in other financial scandals in which mum and dad investors lost millions. (AAS, 11 June 2021.)

In February 2017, Beryl and Ray sat down with Ryan Jones to sign a forty-year REIWA (Real Estate Institute Western Australia) rental agreement split into five-year leases, which they were told could be cancelled at any time if they chose. As part of the agreement, the retirees would pay an additional $125 per week rent to Acquest for seven years, and after that be rent-free. Beryl and Ray were informed their money would be held in a trust, and that their children would be the beneficiaries of any unpaid rent money. Beryl recalls the lease document was ninety-eight pages long and the signing process took two and a half hours.

At no time during the sign-up did Ryan Jones mention their rental agreement was actually part of a convoluted managed investment scheme. Beryl emphatically says she does not believe in investing and would never have agreed to the scheme. In previous employment, she had refused the offer to buy shares in the companies she worked for, and was vindicated when she later watched them “go down the gurgler”.

Consumer advocate Denise Brailey describes the Sterling sign-up process as a cleverly orchestrated fraud. Sterling victims were told their money was going to be held in a trust, but this was false—the bank account had simply been named the “Sterling Income Trust”. Twenty-one days after signing, Beryl and Ray received a large bundle of paperwork. Sterling’s Product Disclosure Statement (PDS), a legally required document disclosing risks to investors, was cleverly concealed in the bottom of the pile as glossy promotional material. Brailey reports that ASIC’s lawyers were assisting Sterling Directors to develop their PDS in 2015-16.

Sterling collapses

In August 2018, neighbours in Beryl’s development, who were also Sterling sign-ups, told her that ASIC representatives had been knocking on doors asking if everything was alright with their Sterling rental, while, curiously, assuring the tenants that everything was fine. Beryl and Ray were not contacted by ASIC. Brailey has evidentiary documentation showing that one of ASIC’s doorknockers was Alex McVey, an ASIC lawyer/investigator who went to work for Big Four auditing firm KPMG in February 2019. In May 2019, Sterling collapsed and administrators Ferrier Hodgson were appointed. Shortly after, KPMG swooped in and acquired Ferrier Hodgson, taking over the role of Sterling’s liquidators. Eight months after Beryl and Ray moved in, Ryan Jones purportedly transferred ownership of the property to Taboref, a company owned by real estate agent Greg Penn, although there are questions over documentation and the validity of the alleged purchase. Beryl and Ray were unaware of the property transfer and had continued to pay rent to Acquest. Although Beryl and Ray’s rental agreement is a valid REIWA lease, Penn has commenced court proceedings against Beryl and Ray to evict them.

Despite receiving $440,000 from ASIC to inquire into the Sterling matter, KPMG has never produced a report or spoken to any tenants or landlords, and has been extremely secretive. At times, KPMG’s behaviour has been truly bizarre. Early in 2021, a benefactor offered to purchase Beryl and Ray’s property and allow them to live there for the rest of their lives. KPMG’s contact for Sterling queries, Rassoul Khomeini, assured Beryl that this would be fine and told her to go ahead with organising the purchase. Beryl emailed KPMG twice to ask for more information, with no response. Two weeks later, Beryl called KPMG and angrily demanded to speak to a superior. She was transferred to someone who claimed to be the CEO of KPMG. Beryl was informed that Khomeini had left KPMG and could not help her, and that the benefactor could not buy the property as KPMG had given it to Greg Penn.

Aftermath of Sterling a ‘living nightmare’

Beryl says the aftermath of the Sterling collapse has been a “living nightmare”. Not only are their life savings gone, but Beryl and Ray have been relentlessly harassed and threatened by lawyers and associates of Ray Jones. They have received threatening phone calls and hostile emails from various people claiming to be Greg Penn, who send Beryl and Ray documents which all have different signatures. Another man, who is an award-winning real estate agent and former REIWA board member, has been present at Sterling creditor meetings and has told Beryl that he sells houses for Ray Jones. This man has relentlessly harassed Beryl and Ray, claiming that he was the owner of the property, and demanded they hand over the house keys. A “For Sale” sign was put up outside their home and disappeared a few weeks later. The former REIWA board member then made threatening phone calls to Beryl and Ray, claiming they had stolen the sign. KPMG have also been pressuring the retirees to pay large utility bills that are in Acquest’s name.

Beryl and Ray have had to increase security around their home: changing locks, installing security screens and cameras. Their cameras filmed associates of Ray Jones coming onto the property and searching around their home while Ray and Beryl were at a close family member’s funeral.

Beryl has repeatedly contacted her political representatives about the distressing situation, including Assistant Defence Minister and Liberal MP Andrew Hastie. Although Hastie has publicly professed concern for his Sterling constituents, he has failed to show up to Sterling victims’ meetings and has refused to get involved in any meaningful way. Beryl says that there are often Sterling victims protesting outside Hastie’s office, but Hastie “hides” and refuses to speak with his elderly constituents.

Beryl and several other Sterling victims “scrimped and saved” to buy tickets to Treasuer Josh Frydenberg’s 22 April 2021 speaking event at Perth’s Crown Casino. Afterwards, Beryl and her companions pushed their way through the crowd to press 110 letters from Sterling victims into Frydenberg’s hands, imploring him to read them. Although Frydenberg assured Beryl that he would read each letter, he has never responded. Afterwards, Beryl and her companions were overheard talking by the Assistant to the Prime Minister, Liberal MP Ben Morton, who promised to write to Frydenberg on their behalf. Morton also has constituent landlords affected by the Sterling disaster, and although he wrote to Frydenberg, the Treasurer has never responded to Sterling victims, nor is there any evidence he has responded to Morton.

Matt1: the landlord’s story

Unlike Beryl and Ray, whose house was owned by Sterling Group subsidiary Acquest, other Sterling houses were privately owned. Some landlords were long-time associates of Ray Jones, and Brailey reports that some, like Greg Penn, had reportedly loaned Jones large sums of money. Other landlords, however, were everyday people who were drawn into the Sterling rent-for-life scam, like Matt, a man in his thirties who bought a Sterling investment property on the advice of his financial advisor.

In January 2016, Matt’s financial advisor recommended he purchase a Sterling property in Ashby, Western Australia, as a cash-flow positive property investment—Sterling’s “top up agreement” promised inflated rental returns of $625 a week. Matt signed a twenty-year rental agreement, broken up into five year leases. He was told his tenant had paid a lump sum to Sterling as an investment, and that Sterling would pay the rent out of the investment returns.

Matt’s Sterling tenancy agreement commenced in September 2016 and rent was paid without issue until April 2019, when a rental payment was missed. Sterling assured Matt that this was a glitch caused by the public holiday, however the next month Matt found out that Sterling had gone into administration.

Sterling ‘investment’ an orchestrated scam

Examining the background of Matt’s Sterling “investment” property reveals the shocking extent of deceit and orchestration.

Unbeknownst to him, Matt’s financial advisor was actually a Sterling New Life Principal Agent, and has fronted advertisements for Sterling products in local newspapers. At his suggestion, Matt submitted an expression of interest about Sterling to PRG Property Investments, a property marketing and consulting company. PRG brokered the entire arrangement between Matt, Sterling, the tenant, and the property developer. The head of PRG is Michael Grace, a former Property Consultant with Armstrong Jones, a company founded by Sterling founder Ray Jones. In an example of the Sterling scheme’s level of coordination and planning, Matt met his financial advisor at the 2015 property expo in Perth. The advisor was standing next to the PRG stand, but did not give Matt any indication he was connected to PRG. Notably, PRG’s website offers opportunities for “Referral Partners”, which include mortgage brokers, accountants and financial advisors, but doesn’t disclose any such arrangements that are in place.

PRG organised Matt’s purchase of the house and land package from Endeavour Properties, a company headed by the co-head of Gemmill, the property’s builder. Matt’s financial advisor also recommended his settlement agent, who a 2015 PRG social media post reveals was “PRG’s recommended Settlement Agent”. He also recommended the mortgage broker who arranged Matt’s mortgage with the Commonwealth Bank (CBA). CBA valued the property at $460,000. After Sterling collapsed, Matt engaged another company to re-value the property, and it came in at $360,000.

This inflated property valuation was common to all Sterling landlords, even though their mortgages were with different Big Four banks. Brailey has condemned this “debt scandal”, and asks: “how did the Banks all manage to make the same ‘mistake’ that advantaged the banks re every payment made, and approve mortgages that were $100,000 more than the average value of similar mini homes and blocks of land?”

Sterling landlords were scammed for extra interest payments on the $100,000, in a scheme apparently coordinated amongst the banks. Crucially, financial engineering designed by Sterling Director Simon Bell convinced the landlords to pay the banks’ inflated values—indicating coordination between Sterling ringleaders and the major banks.

Brailey reports Bell was the actuary who designed Sterling’s complicated “investment formula”, which falsely manipulated data to convince landlords that Sterling’s promised rental returns would match their inflated mortgage commitments to the banks. The AAS has documented Bell’s involvement in numerous other financial schemes in which mum-and-dad investors lost hundreds of millions of dollars, including Bell’s key role in designing the investment products of the $680 million Westpoint Ponzi scheme, in which KPMG played a key role as auditor. (AAS, 9 June 2021.)

Landlords and tenants kept in the dark

Brailey reports that Sterling intentionally kept landlords and tenants in the dark, including by forging tenant signatures against the inflated rents. Landlords were unaware their tenants believed the rent cost was around $280 per week. According to Brailey, Sterling concealed the truth from both parties by splitting up the lease agreement. The tenants signed one section when handing over their life savings. Five days later, Simon Bell filled in another section with an inflated rent figure calculated to match the landlord’s mortgage commitment, which the landlord signed.

Sterling’s collapse took the tenants’ life savings with it, but they still had valid REIWA leases. Landlords still had mortgages to pay, with tenants who could not afford to pay them rent. A 1 June 2021 Western Australian Supreme Court ruling on Sterling acknowledged that both parties were innocent victims, but ruled in favour of the landlords. Matt’s elderly tenant has not paid rent since April 2020, and as Matt’s partner has recently left work to look after their newborn baby, his family is under significant financial pressure. Matt has repeatedly tried to contact KPMG for information and to request essential documents, but has been ignored.

Sterling was a sophisticated operation involving major banks, a Big Four auditor, numerous financial professionals, and Ponzi scheme artists well known to ASIC. ASIC not only turned a blind eye, but actually assisted the predatory scam. All Australians should back the Sterling victims’ demands for a Senate Inquiry into the Sterling Group and a Royal Commission into ASIC—we must expose the criminality and regulatory failings to clean up Australia’s financial system. Sterling advocate Denise Brailey, a trained criminologist, is currently putting the finishing touches on a report for the Western Australian fraud squad.

By Melissa Harrison, Australian Alert Service, 14 July 2021

Footnote