Professor Richard Werner, a German banking and development economist at Oxford University, is a great defender of banks. No, don’t start cursing him—he’s a defender of small banks, community banks, co-operative banks, public banks, banks of all kinds and varieties, and lots of them! Werner is a champion of Germany’s unique Sparkassen (local savings bank) system and its Genossenschaftsbanken (cooperative banks) network, established in the mid-19th century. Today, despite efforts to reverse this, Germany still has around 1,500 publicly owned banks. These locally based banks house 70 per cent of German deposits and provide over 90 per cent of SME lending.

The abundance of banking options is something Germany has in common with China. This was discussed by Werner in a paper he wrote with K. Duan and P. Ivanov on China’s hybrid banking and development model. “The rise of the red dragon: the non-binary political economy of decentralised public banks”, published in March 2024 (Taylor & Francis) maps the “fusion” of banking models that led to China’s “unexpected economic ascent as an industrial dynamo”.

To start at the end of the paper, Werner and his colleagues’ description of the German banking model is important to understanding China’s approach. For Australia, like most of Germany’s European neighbours, banking is almost exclusively the domain of the private sector. In other writings, Werner has developed the institutional framework of development banking established in Germany to “address socio-economic challenges faced by the developing German states”.

“The decentralised public banking system emerged as the linchpin of the German economic system, supporting the success of the Mittelstand, the many family-run small- and medium-sized enterprises”, he and his co-authors wrote in the new paper. “In the words of the sociologist and expert in social and class conflict, Lord Dahrendorf: ‘Germany has established financial institutions that are not only successful in themselves but also contribute to social cohesion. That is the great accomplishment of the savings banks [and cooperative banks]. The [public banks] are exemplary models of how to combine increasing economic well-being with freedom in solidarity.” (Square brackets in original.) This model, the authors wrote, was adopted by post-War Japan and “later copied by the Chinese once the economic reforms were started in her post-Communist regime”.

It is not discussed in this paper, but this banking model originated in the USA after the Revolutionary War, as the fundamental element of what became known as the American System of Economics, developed as an alternative to the parasitical, British free trade model, and absolutely necessary to reinforce America’s hard-won sovereignty. (See, for instance, “Bloomberg discovers Hamilton, industry policy”, AAS, 17 April.) With leading figures such as statesman Sun Yat-Sen having been trained in this school, China drew significantly on the American System approach, protecting domestic industry with government intervention, while also accommodating free enterprise and the free market. (See “Sun Yat-Sen and China’s development of national capital”, AAS, 20 Oct. 2021.)

The solution: Banks, banks, banks

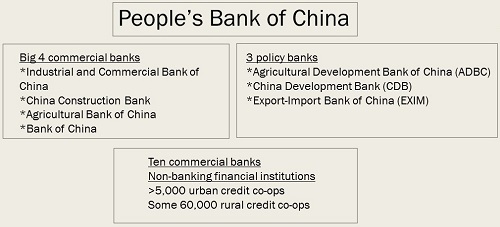

The paper instead situates China’s happy medium between two extremes of mid-19th British economic thinking, the Currency School—advocating a centrally planned public money supply backed by a 100 per cent gold standard; and the Banking School—based on a decentralised system of private banks operating under the free market model. China achieved an “ingenious synthesis” of these binary policy proposals, reports the article, by utilising banks: “The solution is public bank credit money produced in decentralised fashion by many small and competing local banks, but largely in public hands.” China embarked on a project to create thousands of new banks, “ranging from a few national champions to uncountable small rural, village or state-level banks, savings banks, post banks, credit co-operatives, as well as specialised banks of all kinds.” Banks “appeared like bamboo shoots”, even following the 2008 global financial crisis, when the rest of the world saw them disappear.

The Chinese approach utilised key aspects of the British schools, the authors argue, fashioning a yin-yang balance between the sovereign money supply of the Currency School and the decentralisation of the Banking School.

But the key to China’s success is something which did not feature in either of the two opposing British theories, both being monetarist schools. Under the Chinese model, the paper stresses, “bank credit is largely allocated to the real economy” (emphasis added). This is facilitated by top-down credit guidance policies, explains the paper.

‘Quantitative public bank easing’

“A ‘quantitative public bank easing’ with Chinese characteristics fuelled the rise of 850 million economic agents out of extreme poverty allowing the Red Dragon to lay claim to the top seat in the international order”, state the authors.

But Japan, notes the paper, abandoned this approach “under the auspices of US hegemonic influence”. Credit guidance was scrapped in 1991 as “free market reforms … forced the central bank to abandon such unorthodox tools not sanctioned by Chicago—or Washington—economists”. Thus Japan was set on the “painful road to a low-performance economy relying on privatised and increasingly centralised capitalism”.

The document cites the ongoing “deep mistrust” of economists regarding “government involvement in the allocation of credit”. They only trust credit allocation decisions made by private banks, despite the demonstrated failures of 2007-08.

Western bank slaughterhouse

In its conclusion the paper provides a contrast between China and growing Western banking deserts. It notes a “substantial and continued decline in the number of locally headquartered credit firms” in the USA, since the deregulation ushered in by President Ronald Reagan. In Europe, at the instigation of the European Central Bank (ECB), “Europe has lost more than 5,000 mainly small banks in the past two decades. This was not by accident”, the authors wrote: “The head of the ECB had declared it an official goal to reduce the number of banks, while political leadership has insisted on meeting ‘degrowth’ targets. This is consistent: In order to reduce economic growth, it is helpful to reduce the number of banks.”

“The eurozone has too many banks”, Mario Draghi, then ECB chief, told a 2016 conference of the European Systemic Risk Board; Elizabeth McCaul, ECB Supervisory Board member, in a 2023 interview remarked that “Europe is overbanked compared with the United States, and a certain degree of consolidation is needed.” The incontrovertible relationship between bank credit and real economic growth, from the opposite perspective to China’s, is reflected in the EU’s “advanced plans to reduce economic growth”, cited in the study, even funding a “degrowth” research project, justified by environmental goals.

By Elisa Barwick, Australian Alert Service, 8 May 2024