The Australian Alert Service is the weekly publication of the Australian Citizens Party.

It will keep you updated on strategic events both in Australia, and worldwide, as well as the organising activities of the Citizens Party.

To subscribe to the Australian Alert Service, it's easy, and it's secure.

Lead Editorial

26 May 2021

Vol. 23. No. 21

Today the Senate Environment and Communications References Committee hands down the final report on its Australia Post inquiry. Regardless of its findings, the political process which brought about the inquiry, and the inquiry hearings themselves, have achieved two critical wins. Firstly, they revealed the insidious political agenda—owned by both sides of politics—of stripping and looting vital Australian services. The campaign has defeated the privatisation of our national postal service—for the time being. Secondly, a new item has been put onto the agenda—an Australia Post bank. The unique intervention of former AP CEO Christine Holgate (p. 3) has drawn attention to the creative problemsolving approach necessary to protect crucial community services in an era of rapidly changing technology.

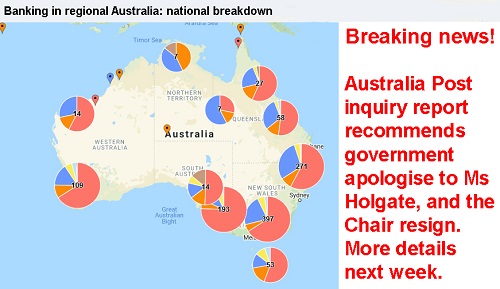

A 7 May article, “‘Big four’ banks casting a dangerous shadow in regional Australia”, available at medium.com, draws attention to the reality that a new approach is needed. The author, former News Corp. journalist Dale Webster, who has established her own independent regional news service online, has assessed the extraordinary bank exodus from regional areas over the last half century or so.

From 1975 to May 2021, 60 per cent of the Big Four banks’ network in regional areas was lost, Webster wrote. The figures are from Webster’s own research, given that figures provided by APRA conceal the real state of affairs; also noted are the top-down shifts that made this purge inevitable, from recessions to neoliberal policy reactions to worsening economic conditions.

Ten Australian towns have lost all four of the big banks; but a total of 716 have lost one or more. One hundred other towns “are one city boardroom decision away from joining them”, added Webster. Yet many of them are “vibrant enough to support multiple banks”. Understandably, in many communities this has led to an increased reliance on Australia Post, according to many locals interviewed by Webster. For many towns, there is no other option. “We are lucky we can still do our banking and get change at the post office”, stated a bakery owner who otherwise has to make a 140 km round trip to do banking. “People are banking at the post office”, said a councillor from Casterton, in western Victoria. “The supermarket has become a bank. Buying your groceries and getting money out over the counter is a standard.”

Reporting that cash is still very much king in regional communities, Webster takes up the government’s attempted “cash ban” on transactions over $10,000, asking whether this push is a case of “the tail wagging the dog” given that it is the banking sector—keen to absolve itself of the responsibility of providing cash services to regional areas where its use is thriving—“driving the conversation about Australia becoming a cashless society”. The Reserve Bank’s 2019 consumer survey reported that one quarter of personal transactions are still made in cash. Other nations that have gone cashless are running into problems, Webster reports, mentioning also the drama that occurred when bushfires brought down power and mobile networks, rendering digital banking perfectly useless.

It is this state of affairs, at a time when banking must play a critical role in reviving collapsing economies (“Refocusing the debt debate”, p. 10) that has brought postal banking to the fore in countries right across the globe. The fights waged by the Citizens Party on banking issues that would otherwise have slipped under the radar—including on depositor “bailin” (p. 9), the cash ban, the push for “Glass-Steagall” bank separation to rein in bank speculation and the Australia Post campaign—have established a platform making it easy for anyone, from your local MP to jaded ex-mainstream journos, to get involved. From this platform Australia Post can become a fully-fledged “people’s bank”. A new flyer and our full Commonwealth Postal Savings Bank Bill 2021 are now available at citizensparty.org.au/campaigns/auspost-bank— join us in the next phase of the fight!

In this issue:

- Why Christine Holgate moved on

- Citizens Party’s response to ECAJ submission

- Government has important role in insurance

- Stand up for exporters sold out by Morrison’s foreign policy

- Veteran journo confirms ASIO engineered Australia’s China hysteria

- Bank protection mafia demands impunity for ‘bail-in’ agents

- Refocusing the debt debate

- ‘Green steel’ is a job-destroying fantasy

- America needs a genuine clean break in Middle East

- The best defence is offence!

- China’s first footprint on Mars

- ALMANAC: The perils in the Biden Administration’s ‘climate’ agenda (Parts 3 and 4)

Click here for the archive of previous issues of the Australian Alert Service