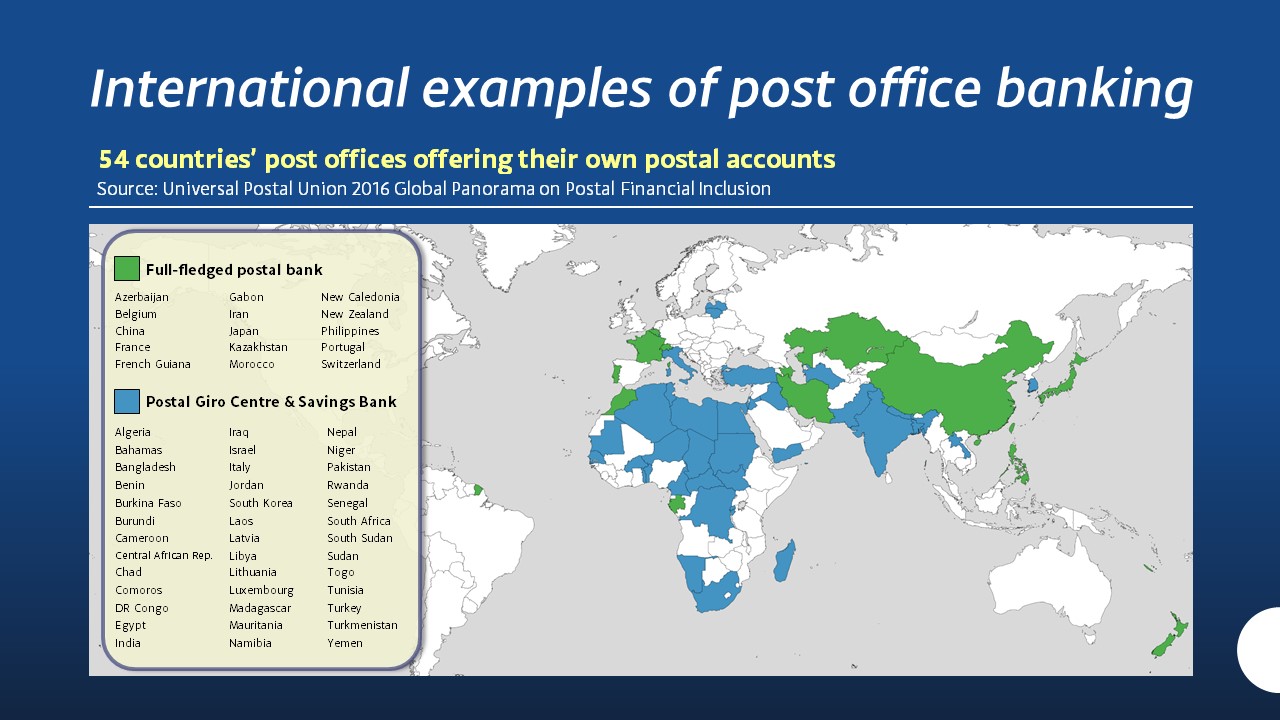

Postal banks are very common—and popular!—around the world.

Postal banking is undergoing a revival across the world. In particular, countries with a strong history of postal banking—such as the UK, France and Italy—have returned to the tradition in recent turbulent financial years.

A 2013 World Bank paper on “Financial Inclusion and the Role of the Post Office” pointed to the critical role of post office financial services in facilitating financial inclusion, particularly for the poor, less educated and unemployed, with accessibility increasing in proportion to the size of the postal network.

In Japan, home to the world-famous Japan Post Bank, 80 per cent of survey respondents held a post office bank account. Some countries recorded around 30 per cent with a postal account, but in most it was fewer than 10 per cent of respondents. Of 60 countries surveyed, seven had a licensed post bank; 29 had post offices offering deposit services without a banking license; and 24 nations operated banking services in partnership with other banks.

Unusually for postal banks, the French, Chinese and Japanese versions all hold universal banking licences and can therefore compete with commercial banks across the board.

For a a more detailed discussion read our article, Bring on the postal banking revolution! that looks at Postal Banks in many countries. Here is a quick look at France, Japan, New Zealand and United States.

France

The French have had a long history of postal banking. They established La Banque Postale in 2006 operating through La Poste’s 7,700 post offices. With a mandate to provide banking services to the public, it has become a leading lender to local government authorities. In recent years there have been efforts to privatise the postal banking service; a 2020 merger means the French government is no longer the majority shareholder.

A bill establishing postal banking first passed in France on 9 April 1881. It was proposed by the undersecretary of state (later minister of posts and telegraphs), Adolphe Cochery, to be a nationwide postal savings bank. He stated:

“The State has to achieve what cannot be done by private initiative. When private enterprise can attain its object, the State must disappear, but when private initiative is powerless, it is the duty of the State to lend its assistance. It is because the private savings banks cannot meet all the wants of the thrifty population that we submitted the bill which is under consideration.”

Funds were to be invested in French government securities.

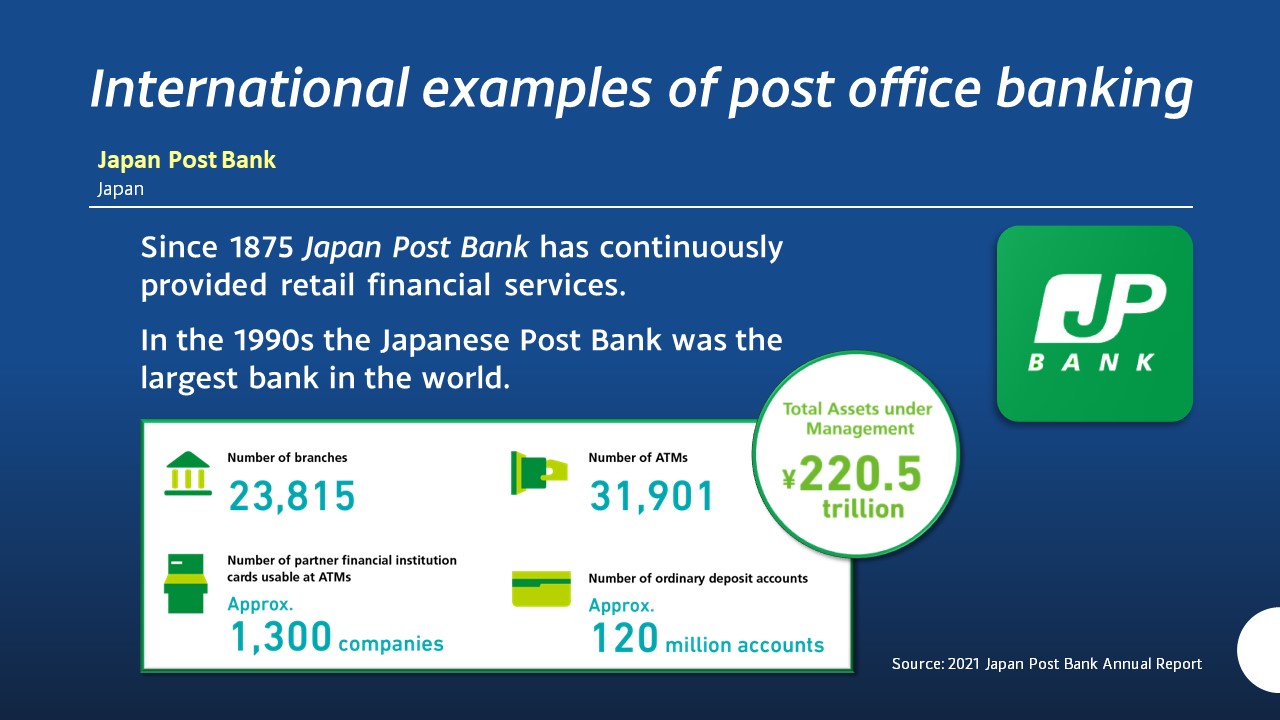

Japan

Japan Post Bank (JPB) has operated a continuous retail financial service since 1875 via 24,000 branches, with funds invested in infrastructure programs via government bonds. JPB is mandated to provide postal services across the country even if branches run at a loss. Japan’s post office generates 90 per cent of its income from financial services.

Watch our Citizens Insight interview with Daisuke Kotegawa, Research Director at the Canon Institute for Global Studies; Former Deputy Director at Japan's Ministry of Finance; Former representative of Japan to the IMF, discussing the success of Japan Post Bank.

Brief History

By 1878 postal savings were invested in government bonds via the Japanese Ministry of Finance and later in bank debentures. The post office bank system was soon well known as the safest way to save and a means of creating public investment. The institution helped popularise a culture of saving in Japan, starting when young children received passbook accounts.

From 1906 money transfers between postal accounts were introduced and in 1910 the postal system began to pay pensions, which led to a massive expansion of the postal savings system.

In 1949, the postal system was reinvented under the new Ministry of Posts and Telecommunications and due to comparatively attractive interest rates the volume of savings again expanded. Money invested through the Ministry of Finance was channelled into national investment programs to build highways, airports and other capital intensive national projects. Funds were lent to small and medium-sized firms and for housing construction.

In the 1990s the Japanese Post Bank was the largest bank in the world. The generation of domestic credit by the bank was how Japan avoided foreign indebtedness and the bank was often referred to as “Japan’s second budget”.

Starting in 2001 the Japanese government again began reorganising the postal system, leading to a plan to gradually privatise the bank which commenced in 2007.

Krys Suzuki in “The Unique History of Japan’s Postal System” published by Unseen Japan on 13 August 2019, showed that even on the eve of its sell-off the bank’s success was compelling: “From 2003 to 2007, it existed as not just the nation’s largest employer, with nearly one-third of Japan working for one branch or another of the Japan Post, but also acted as the largest bank in the world”.

Unfortunately, this was not enough to stop its partial sell-off. Discounting the bank’s history in Japan’s development, many believed the bank had run its course and privatisation was the next logical step. The bank was split into three separate service branches, supplying postal services, banking and insurance.

The Japanese government still controls over 50 per cent of the bank, and is obliged to own more than one-third of Japan Post at all times.

In 2019 Japan Post Bank had 120 million customer accounts and managed ¥205 trillion worth of assets. In addition to deposit accounts, the bank now offers credit cards, loans, investment products, time deposits such as certificates of deposit and pension accounts.

New Zealand

In 1867 New Zealand started the Post Office Savings Bank, but in 1987 its banking operations were split from postal operations and it became PostBank. This was to prepare it for sale in 1989, when PostBank was sold to ANZ.

In 2002, Kiwibank was established providing banking services via PostShops throughout New Zealand which immediately attracted a flood of deposits from New Zealanders desperate for an alternative to their big four banks (which are owned by Australia’s big four). It is now Now biggest New Zealand owned bank with over one million customers.

It provides basic banking services, home loans, business loans, and subsidiary companies provide wealth management services, insurance and financial services.

Former New Zealand Deputy Prime Minister Jim Anderton (1938-2018), who left the Labour Party over his

opposition to Rogernomics—NZ’s post-1984 neoliberal economic policy named after then-Labour Finance Minister Roger Douglas—played the pivotal role in winning the political support to establish the bank.

Watch our Citizens Insight interview with Matt Robson, a former New Zealand Cabinet Minister from the Clarke-Anderton government that established Kiwibank. He tells an amazing story of political persistence and triumph.

United States of America

There is currently a campaign for a postal bank in the United States, which is being supported by a grassroots movement called A Grand Alliance to Save Our Public Postal Service (see short explanatory video by actor Danny Glover) involving more than 90 national organisations and a myriad of local community organisations. We have the same potential in Australia to unite all communities and organisations that use and value local post offices, and the licensees who run them, to support the postal bank solution.

The US Postal Savings System was established in 1910 but discontinued in 1966. The service took deposits on behalf of banks and offered fixed-term bonds to savers. The rise of US Savings Bonds and Federal Deposit Insurance Corporation (FDIC) insurance of commercial banks is given as a cause of its demise, as it meant the service lost the advantage of its government guarantee of deposits and was seen as redundant. With today’s financial uncertainty that perceived redundancy has evaporated.

Independent Senator Bernie Sanders campaigned for a revival of postal banking in his 2016 campaign and Democratic Senator Kirsten Gillibrand introduced the Postal Banking Act in 2018. After Sanders was defeated in the 2020 presidential primaries, the Joe Biden-Sanders “Unity Task Force” agreed to pursue a commitment to postal banking. In September 2020, Gillibrand and Sanders announced the latest version of the Postal Banking Act.