The Australian Alert Service is the weekly publication of the Australian Citizens Party.

It will keep you updated on strategic events both in Australia, and worldwide, as well as the organising activities of the Citizens Party.

To subscribe to the Australian Alert Service, it's easy, and it's secure.

Lead Editorial

17 January 2024

Vol. 26 No. 3

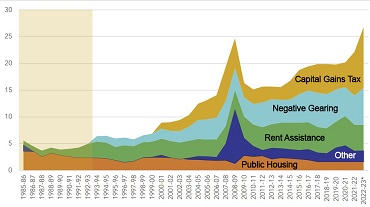

bubble. Source: Per Capita

The cost of living crisis in Australia is not a “perfect storm”-type natural phenomenon, but a policy, known as austerity, being implemented through the Reserve Bank’s interest rate hikes.

To address the cost of living crisis, this policy must be defeated, through measures such as the Treasurer ordering the RBA to drop interest rates, as the Australian Citizens Party (ACP) called for this week (p. 3).

Indicators of the crisis are intensifying. As The Australian reported 12 January, households are increasingly turning to short-term loans to cover mortgage arrears. An Essential Research survey conducted for the Super Members Council found that 53 per cent of Australians are experiencing some degree of financial difficulty, up from 39 per cent in mid-2022; 14 per cent described themselves as being in serious difficulty, and a regular concern was being able to pay all their bills.

This dramatic increase reflects the steep rise in interest rates and rents in that time, from the RBA’s agenda to make households pay for the inflation caused by the RBA’s 20-year expansion of the housing bubble. As MacroBusiness reported in November, housing costs account for 50 per cent of inflation in Australia, but the RBA’s response to inflation has been to deliberately drive housing costs higher through higher interest rates and rents.

While the RBA is busy punishing Australian households for the crisis it caused, and the government is doing nothing to stop it, the RBA and government are also allowing the banks to merrily get on with driving up the cost of housing even more. The Australian reported on 12 January that the value of new home loans rose 1 per cent in November, “fueling expectations 2024 will see higher property prices”. This is because the banks are back to speculating in housing: while new owner-occupier loans grew by 0.5 per cent in the month, they were completely outstripped by investor loans, which soared by 1.9 per cent. Bank lending to investors, as opposed to young families who need the houses, is the biggest factor of the growth of the housing bubble over the past two decades.

Again, this is deliberate policy. Per Capita, the public policy think tank which testified at the 1 December Senate hearing in support of the public postal bank policy, has released analysis showing that housing subsidies are now costing the federal government $27 billion a year. Of that, $18 billion subsidises property investors, which is up from $1.5 billion in the year 2000. The estimated share of government housing subsidy that goes to the top 20 per cent of income earners has soared from 9 per cent in 1993, to 43 per cent in 2023. So we have the government, RBA, and private banks fully backing investor property speculation to make housing more expensive, which is the main driver for inflation, and the RBA punishing households for the inflation by piling interest rate rises on them!

Ironically, despite this enormous support for investors, it hasn’t helped to supply the stock of rental properties the country needs, as the vacancy rate of rental properties is at all-time lows, which is the reason for the rental crisis across Australia. A big part of that is the enormous influx of immigration at the moment, which the government has expanded deliberately to create upward market pressure on housing and rental prices to counteract the downward pressure from the RBA’s rate hikes.

While the technocrats fiddle to save their system that is not fit for purpose anyway, they make the people suffer, which has always been how austerity policy works.

The essence of the ACP’s economic policies, especially a national bank, is the view that the point of the economy is to meet the needs of the people. This is why the fight against the RBA reforms is so crucial—make sure you make a submission before 2 February (p. 3).

In this issue:

- Demand Treasurer Chalmers use his power to cut interest rates and save households

- DFA Live—Q&A: The People Versus Financial Tyranny: With Robbie Barwick

- Banking as usual: Westpac lies to defend ‘mongrel act’; ANZ lies it ‘likes’ branches. Bust up banking as usual with public bank

- Morrison gov’s secrecy binge gives Canberra an Iraq War hangover

- German farmers rebel against austerity and green policy

- Stop hedge funds sparking a new global crash

- Israeli government vs Palestinians: It is intentional genocide, jurists, academics, intelligence specialists concur

- Experts’ assessments of Israeli genocide and the danger of wider war

- Joe Biden flunks the Gaza test

- People power can change the inevitable!

- Make 2024 the year of the National Infrastructure Bank!

- ALMANAC: Australia can revive its stellar history of public banking

Click here to find out how to subscribe. For freely available AAS articles, click here.

Click here for the archive of previous issues of the Australian Alert Service