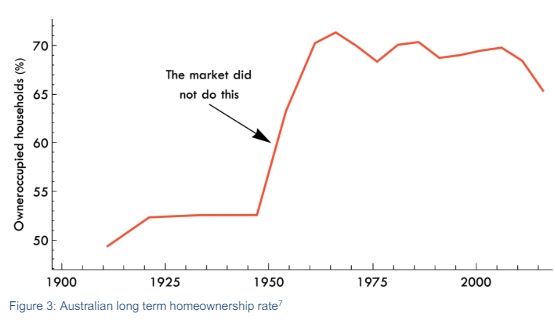

A three-part series in the Australian Alert Service, “How neoliberalism sabotaged Australian home ownership”, documents how Australian governments have solved housing crises in the past, providing a compelling historical perspective which shows up today’s deeply flawed approach.

Today’s housing strategies are doomed to failure because they are anchored in neoliberal economic policy dogma, authored and imposed on nations by mid-20th century economists and bankers.

By contrast, the successful approach portrayed in the AAS articles was characterised by:

- Government financing of major home construction programs, including through the Commonwealth Bank and State Banks;

- Powerful housing and planning authorities to oversee economic development and national works, procure materials, build homes, control rents and issue loans, delegating authority as necessary;

- Federal and state government coordination (under both Labor and Liberal governments) of public housing projects through the Commonwealth State Housing Agreement (CSHA) in the postwar period, to overcome an extreme lack of manpower and construction materials against a backdrop of building inflation.

The article documents the gradual takedown of the CSHA by the Menzies and successive governments, according to the precepts of neoliberalism and letting the “free market” prevail, which created the “survival of the fittest” housing market we have today.

Click here to download and read the package (PDF). Appended to it is the article “Australia’s ‘impossibly unaffordable’ housing a symptom of political cowardice”, from the 3 July AAS, an update on today’s housing crisis and the utter inadequacy of the Albanese government’s housing program.