In January 1974, about a year after Gough Whitlam’s election as Prime Minister, devastating floods in Brisbane claimed 14 lives and inundated 6,700 homes, costing $8.1 billion in damages (in 2014 terms). Thousands of victims discovered that their insurance policies did not cover them against flood damage, which resulted in strong public backlash against the insurance sector. On 29 April 1974, Whitlam stated that his government was “determined to give home-owners the opportunity to insure their properties for lower premiums and against natural disasters”, announcing a re-election promise to establish the Australian Government Insurance Office (later Corporation), which would “compete actively in all forms of insurance”.

Whitlam was re-elected the following month. Evidently spooked by the prospect of impending competition from a public insurer, the Australian insurance sector and overseas reinsurers colluded to present a report, Feasibility Study into the Introduction of a Natural Disaster Insurance Scheme for Australia, to the Whitlam government in October 1974. The report suggested an alternative: a government-backed natural disaster insurance scheme administered by a statutory corporation, to be financed by a compulsory levy, with commercial insurance companies acting as agents in the collection of premiums and in the settlement of claims. Reinsurance (insurance purchased by insurance companies to protect them in the event of a major claims event) would be provided by the overseas market. The government would step in as a last resort to meet shortfalls by extending interest-bearing loans.

In December 1974, Cyclone Tracy devastated Darwin, killing 71 people, causing nearly $4.5 billion in damages (in 2014 terms) and devastating 80 per cent of the city. Again, thousands of people discovered that they were not insured against flood damage. The insurance sector was financially damaged by the magnitude of the two disasters occurring within a relatively short period of time, resulting in many companies withdrawing from high-risk areas or greatly increasing their premiums, partly because of increased costs imposed by overseas reinsurers.

Although Whitlam had long advocated for a national natural disaster scheme (in Opposition he badgered the Liberal government for several years over the issue), Cyclone Tracy hastened his government’s plans to establish the Australian Government Insurance Corporation (AGIC). Where insurance against a particular class of risk could not be made available on a commercial basis, particularly for natural disasters, the Minister could direct the AGIC to provide it if the government deemed the provision of such insurance was a matter of public interest.

Unsurprisingly, the insurance sector fiercely opposed the AGIC. In an 18 May 1975 speech (excerpt below), Whitlam denounced the “highly extravagant and totally misleading” advertising campaign which insurance companies waged against the proposal—which included threatening their own staff with dismissal if they did not campaign against the AGIC! As reported by the 15 May 1975 Canberra Times, the Nationals (then the National Country Party) were involved in secret backroom meetings with insurance companies, including the Australian Mutual Provident Society (now AMP), colluding to derail the proposal. Before the legislation for the AGIC was even introduced, many Liberal politicians railed against its establishment. Opposition also came from the legal profession, out of self-interested fear over the potential loss of a significant portion of court activity (and therefore legal fees), and professed concerns over the constitutionality and administration of the scheme. Trade unions were also opposed, because they had their own competing agenda for workplace compensation insurance. As described by Justice Michael Kirby, as Chairman of the Australian Law Reform Commission in 1984, “[d]elay, and the constant critical scrutiny of the draft Bill … [lent] time for the organisation of the opposition” against the AGIC.1 Unfortunately, “time ran out” in the “bitter political circumstances” of 1975, when Whitlam was ultimately ousted as Prime Minister on 11 November.

The issue of affordable insurance didn’t die, however. Malcolm Fraser’s Liberal government, which succeeded Whitlam, announced in March 1976 that it had “decided in principle” to establish a natural disaster insurance scheme. Then-Treasurer Philip Lynch said he wished for it to be introduced “at the earliest practicable date”. Lynch appointed a working group, which would collaborate with the insurance sector to develop the scheme.

The working group acknowledged that the Brisbane floods and Cyclone Tracy had demonstrated the inadequacies of existing insurance arrangements, particularly for natural hazards such as floods, earthquakes and tropical cyclones, which, “because of their unpredictability and their potential to cause catastrophic losses, are regarded by the insurance industry as basically uninsurable on a commercially viable basis”. The insurance industry argued strongly that it could adequately cover all other natural disaster risks.

The working group recommended a scheme which was largely identical to the insurance sector’s October 1974 proposal. However, after 1976 the strong commitment to a natural disaster insurance scheme waned, particularly as the industry had recovered financially from the events of 1974, and views within the industry changed.

In 1977, future PM John Howard replaced Lynch as Fraser’s Treasurer. Howard was a self-described “economic radical” and a fervent admirer of free-market neoliberal ideologues Ronald Reagan and Margaret Thatcher (the BBC on 9 April 2013 would describe him as Thatcher’s “antipodean ideological heir”). As Treasurer and later Prime Minister, Howard pursued his ideological agenda by: starving the public sector of funding, including in healthcare and education; privatising public assets, including Telstra, broadcasting networks and airports; implementing tax reforms which increased inequality; and the wholesale deregulation and privatisation of Australia’s financial system. In a 19 February 2009 lecture for the Menzies Research Centre, Howard claimed that his reforms were an “essential Australian contribution to what one might properly describe as the neoliberal experiment of the past 30 years”. (Emphasis added.)

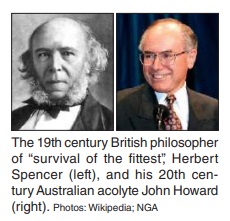

In January 1979, Howard announced that the Fraser Government would not be implementing the natural disaster insurance scheme. He authored a May 1979 paper justifying the decision, which claimed the scheme was inappropriate on budgetary, technical and insurance policy grounds, but in fact revealed that his reasoning was entirely ideological. Howard wrote that the government believed that such a scheme was inconsistent with its “political philosophy”—that governments should not intervene in matters than can be left to the private sector. This in fact demonstrated how his ideology blinded him, because he ignored the 1976 working group’s report that the private insurance sector considered floods, earthquakes and cyclones uninsurable on a commercially viable basis. Revealingly, Howard included a lengthy quote from The Man Versus the State (1884), authored by Herbert Spencer, the inventor of Social Darwinism and originator of the term “survival of the fittest”. Although Howard acknowledged that many would regard Spencer’s viewpoint as “somewhat radical”, he stated it “might nevertheless be thought to contain truths of great relevance to the issues that confront society and governments today”.

Since Howard’s ideological decision to reject a natural disaster insurance scheme, many Australians have experienced ongoing difficulty with obtaining adequate natural disaster insurance. Australia’s current arrangements are a combination of private insurance supplemented with unpredictable government funding and public donations, while the coverage that exists is fraught with uncertainty due to the fine print in policies. For decades, Australian communities have suffered from decisions made because of a “political philosophy”, rather than what the public interest demanded.

For example, flood insurance was largely unavailable in the flood-prone eastern states until 2008, and some regions still struggle to obtain adequate insurance, causing a recurring nightmare of personal and community loss. In a dreadful repeat of the 1974 disasters, after floods devastated Queensland in 2011 many people discovered that, despite faithfully paying their premiums for years, their insurance policy fine print did not cover flooding. As reported by the 29 January 2011 Courier Mail, Legal Aid Queensland stated that home repossessions were inevitable as people struggled to cope with postdisaster financial pressures. If flood-affected victims could not afford the subsequent premium increases, or had inadequate insurance, banks could use this as an excuse to claim the mortgagee was in breach of their loan contract and repossess their home. The floods caused a drop in property values, which meant that even after their homes were repossessed and sold, people could still owe tens of thousands of dollars on their mortgage. Mortgage insurance covered their bank for the shortfall, and then the mortgage insurer could pursue the former homeowner for the outstanding amount. Declaring bankruptcy was not even a way out—destitute and homeless flood victims were warned that if they declared bankruptcy, they might be unable to secure a rental property.

The problem has still not been solved. The 10 March 2022 Guardian reported that after the recent March 2022 flooding in New South Wales and Queensland, for which over 107,844 claims worth $1.62 billion have been lodged, the Financial Rights Legal Centre stated that thousands of victims may be unable to claim insurance because of exclusions in policy fine print. Insurance premiums in areas designated as highrisk can be extremely expensive, soaring by up to 20 times the cost of insurance in Sydney or Melbourne, according to the ABC on 7 February 2022.

Australia’s insurance sector is an oligopoly

Whitlam asserted in his 1975 speech that the proposed AGIC was necessary to compete with the private insurance firms, thus driving better service and cheaper rates for the public. Instead of an AGIC, however, years of consolidation and a lack of genuine competition has resulted in Australia’s insurance sector becoming highly concentrated—a fact acknowledged by numerous parliamentary inquiries and the industry regulator, the Australian Prudential Regulation Authority (APRA). A 2017 Senate inquiry into Australia’s general insurance industry found an illusion of competition is maintained through the distribution of products through many brand names and intermediaries; however, in reality an oligopoly of four companies dominates 74 per cent of the general insurance market: Insurance Australia Group (IAG) (29 per cent of the market); Suncorp (27 per cent); QBE (10 per cent); and Allianz (8 per cent).

Likewise, the home, contents and strata insurance market in northern Australia, a region prone to natural disasters, is also highly concentrated. In 2017 the Australian Competition and Consumer Commission (ACCC) conducted a three-year inquiry into insurance availability and affordability in northern Australia, publishing its final report in December 2020. The ACCC found that eight insurers dominated the market, operating through about 30 different brands and 119 intermediaries, led by Suncorp (35 per cent market share), IAG (15 per cent), QBE (13 per cent), RACQ (10 per cent), and Allianz (8 per cent).

The ACCC reported that northern Australia remains largely unprofitable for insurers, compared with the rest of Australia. However, this should be taken in context. In 2021, the largest companies announced significant rises in premiums ranging from 6-11 per cent, blaming spikes in natural disaster costs. Notably, as reported by the 9 August 2021 Australian Financial Review, in the same year that insurance giant Suncorp raised premiums by 7 per cent, the company reported a 42 per cent rise in annual profits to $1.06 billion, showered investors with a “special dividend”, bought back $250 million worth of shares and paid their CEO $4.2 million for the year.

In addition, as reported by Michael West Media on 27 May 2018, in 2018 none of the biggest insurers paid the full statutory corporate tax rate of 30 percent. IAG paid only 16.81 per cent tax.

As Whitlam pointed out in his 1975 speech, reinsurance was all owned by offshore companies, a situation which continues today. QBE’s reinsurance is provided through a company it owns, which is domiciled in the tax haven of Bermuda. The five biggest insurance broking companies are all foreign-owned, as are the two main loss adjusters. According to Organisation for Economic Co-operation and Development (OECD) figures, the market share of foreign-owned companies (defined as predominant control pf the company exercised from abroad through share ownership or control of votes) in Australia’s domestic life insurance market rose from 37.5 per cent in 2019 to 76.7 per cent in 2020. The rest of Australia’s insurance market is 38.5 per cent foreign-owned, a figure which is steadily climbing each year. Although the OECD states that these figures were supported by APRA-supplied data, APRA doesn’t readily publish figures of foreign ownership of Australia’s insurance market.

Affordable insurance still a matter of public interest

According to the ACCC, while northern Australia forms a relatively small share of the national home and contents insurance market, the region, which is prone to natural disasters, represents a larger share of total premiums and a higher proportion of claims.

By any measure the cost of home, contents and strata insurance is higher in northern Australia. In the twelve years prior to 2018-19, average home insurance premiums rose by 178 per cent (compared to a national 52 per cent), and average contents insurance rose by 33 per cent (compared with a national decrease of 3 per cent). Average premiums for combined home and contents insurance can be three times higher than the national average, and average excess levels are also higher in northern Australia.

Total non-insurance levels in northern Australia are at 20 per cent, and up to 40 per cent in northern Western Australia. Around 1.5 million Australians nationwide experience barriers to entry for insurance, which include affordability and availability. Non-insurance is more a consequence of affordability, rather than financial literacy.

In addition, the ACCC found that many insurers were actively implementing strategies to reduce their exposure to highrisk regions by not writing new business, exiting segments of the market, or by dramatically increasing premiums to “arrest growth” in high-risk areas. As the insurance industry has developed increasingly sophisticated data capabilities, it has introduced address-level pricing, which has enabled insurers to “selectively embargo” single addresses and parts of post codes deemed to be outside of their risk appetite. Insurers also avoid being the cheapest provider in high-risk markets and will usually increase their prices to “reduce the chance of acquiring a concentration of high-risk consumers.”

The ACCC inquiry considered the potential solutions of a government insurer or a government reinsurance pool, admitting that a government insurer: could “possibly” improve the availability of insurance in northern Australia; would likely lower reinsurance costs for private insurers; “could lower premiums to some extent”; and was “likely to have a positive impact on competition … for non-flood and cyclone insurance markets within northern Australia”.

However, the ACCC argued against both solutions, instead recommending direct government subsidies, increased product disclosure requirements, and reductions in stamp duties. Notably, the ACCC warned that a government insurer had the potential to “significantly disrupt the private insurance market”. Unsurprisingly, the insurance industry largely opposed both a government reinsurance pool and a government insurer.

Despite numerous natural disasters demonstrating the obvious needs of the community, successive governments, including the Morrison Government, have dragged their feet on ensuring insurance provision where it is needed most. Although the Morrison Government, succumbing to pressure from Queensland MP Bob Katter, announced its intention to establish a $10 billion reinsurance pool for cyclones in May 2021, this scheme does not include floods, which are Australia’s most costly natural disaster! (AAS, 16 Mar. 2022.) This omission has come under fire in the wake of the recent floods which have devastated New South Wales and Queensland. The legislation for the reinsurance pool is currently before the Senate, and Greens Senator Nick McKim has introduced an amendment which will include flooding in the scheme.

Rather than ongoing piecemeal solutions, the government should ignore the howls of the insurance sector, relinquish its discredited neoliberal ideology, and act to genuinely solve the problem, by establishing a government insurance office, based on the historical precedent of successful state government insurance corporations. (AAS, 26 May 2021.)

Australian Government Insurance Corporation

Broadcast by Prime Minister Gough Whitlam, 18 May 1975.

The Australian Government Insurance Corporation will be providing insurance cover that cannot be obtained from the other companies, either because they’re not interested or because it’s not sufficiently profitable.

The Australian Government Insurance Corporation will provide [natural disaster] insurance for everyone who needs it—and provide it at the lowest possible cost. It will open the way to more widespread insurance coverage against livestock and crop losses arising out of natural disasters, so it will be of particular value to the man on the lands.

I do ask you to ignore this absurd talk about nationalisation. Since when has it been “nationalisation” for government enterprise to compete fairly and on equal terms with private enterprise? There are many examples of such competition. No one suggests that the Commonwealth Bank isn’t competing fairly with the private banks and no one suggests that the airlines have been nationalised because TAA is competing with Ansett. In every case the benefits of such competition have been plain. For example, it’s cheaper to insure your house with the Commonwealth Saving Bank Insurance Scheme than with any private insurance company. If the Commonwealth Bank can do this for its customers, why shouldn’t the same low premiums be available to every householder? We want to see that they are.

It’s worth remembering that every state has had a state government insurance office for many years, and very efficient enterprises most of them have been.The fact is that under the Constitution, the Australian government has as much right to establish an insurance corporation as it has to establish a bank, it has as much right to establish an insurance corporation as the state governments have. No one today would dream of disbanding or restricting the operations of the state government insurance offices. They have served the public well. They will continue to do so.

Remember this: for all their patriotic talk, a large part of the insurance industry in Australia is controlled by overseas interests. Less than two years ago the level of foreign ownership of general insurance business conducted in Australia was nearly 46 per cent. A great deal of Australian money is being channeled to foreign countries. I know there are some great Australian firms, and I pay tribute to them; but an Australian Government Insurance Corporation will help reduce the flow of funds out of Australia and could well encourage more money into Australia. Genuine Australian-owned insurance companies have much more to fear from growing foreign competition than they have from competition from an Australian government corporation. Any suggestion that it will be given unfair advantage is simply untrue. Up to now, the unfair advantage has been with the private companies, they have lavished funds on expensive office buildings and in speculative real estate developments; their investment in housing loans has fallen steeply. A large part of their funds has gone overseas; and important fields of insurance have been neglected.

Footnotes

By Melissa Harrison, Australian Alert Service, 30 March 2022