Australian Citizens Party – submission to the Senate inquiry into Treasury Laws Amendment (Reserve Bank Reforms) Bill 2023 [Provisions]

Read the Citizens Party's submission here (PDF)

Australian Citizens Party – submission to the RBA Review panel

Read the Citizens Party's submission here (PDF)

Chalmers’ RBA reforms: The next chapter in the private hijacking of Australian banking

A four-part series in the Australian Almanac brings back to life the debates of the late 1950s over the creation of a central bank independent of the government—the Reserve Bank of Australia. Published in the Australian Alert Service of 10, 17, 24 April and 8 May, “Chalmers’ RBA reforms: The next chapter in the private hijacking of Australian banking”, shows that the banking reforms of the post-WWII Robert Menzies government amounted to a takeover of national banking functions by private interests, at the recommendation of international central bankers and their local private banking satellites.

The included documentation, excerpts from the Hansard of that time, should make the Albanese government cringe with shame at what they are proposing today in the Reserve Bank Reforms Bill 2023, which among other travesties would remove the government’s power to overrule the RBA. The 1959 speeches include a vigorous defence of the Commonwealth Bank and its incredible achievements in its role as Australia’s national bank (which even the Menzies government of the day did not try to deny), by Australian Labor Party greats from Gough Whitlam to Jim Cairns, then in Opposition; and expositions on the private control of banking from patriotic statesmen of whom most Australians today will never have heard. The orations include a detailed survey of the political, banking and big-business complex, which shepherded the 1959 banking legislation through the halls of parliament.

The bottom line in the effort to “erase the potential of the Commonwealth Bank to act in the interest of the people”, is that even leading representatives of the Menzies government insisted that in the final analysis “the Prime Minister and the Treasurer are supreme in relation to the Governor of the Reserve Bank”. Today, Australians cannot let Treasurer Jim Chalmers junk democratic protections that leaders on both sides of politics have deemed crucial.

Click here to read the series and arm yourself with this crucial history.

Published by Australian Alert Service, April-May 2024

Supporting material:

- Senators slam hypocritical ‘high priests’ at the RBA

- A breakthrough in the battle over bank policy

- Cairns: We should have borrowed from RBA not overseas

- RBA review must jettison neoliberal mandates

- Resolving the RBA dilemma: Save the economy not banks!

King O'Malley: A National Postal Bank goes hand-in-hand with a Commonwealth Bank

Read a three part series summarising key elements of legendary Aussie MP King O'Malley's proposal for a National Postal Bank and a Commonwealth National Bank, in his five-hour parliamentary speech of 30 September 1909.

- RBA take note! O’Malley tells how to regulate credit

- King O’Malley tells how to create a nation of producers

- O’Malley: ‘Finance is a government institution’

The genesis of austerity (series)

Download the full series in a pamphlet, here.

Dowload by section:

- Part 1:

- Austerity: bankers’ policy to crush nation states

- Part 2:

- The post-WWI cauldron of neoliberalism

- Part 3:

- Test tube: The Austria project

- Part 4:

- Test tube: Italian austerity was Fascism

- Parts 5:

- Italy: Fascist economics opens new era of governance

- Part 6:

- The rise of the BIS financial dictatorship

- Part 7:

- The Mont Pelerin Society dictates global fascism

- Part 8:

- From Austria to Australia: Bank of England’s Niemeyer dictates austerity

- Part 9:

- The 1930s: Australia risks fascism for austerity

Other articles on austerity

A case study in austerity: Jeff Kennett's Victoria

The Australian Alert Service has published “A case study in austerity”, a four-part series by Elisa Barwick which focuses on the “revolutionary” economic model imposed by Jeff Kennett as Premier of the Australian state of Victoria in 1992-99—a model that swept the country and wrought destruction nationwide. “Whether it be our collapsing power grid, hollowed-out healthcare, or emaciated education system,” the series opens, “Victorians are living the results of the earliest neoliberal experiment on Australian soil—featuring budget and industrial austerity, deregulation, privatisation, asset-stripping and public sector ‘reform’.”

Following on from last year’s series The genesis of Austerity, now available for download as a pamphlet (above), Barwick now shows how the program for Victoria was scripted well ahead of Kennett’s election, by a combination of think tanks associated with the global Mont Pelerin Society. The authors of the 1920-30s austerity program that had led to Fascism and Nazism, precipitating World War II, after the war set up the MPS complex to save their economic model under the more acceptable guise of “neoliberalism” and spread it across the world. As in Europe, the MPS “solutions” in Australia were propelled by debt crises, which economic liberalisation and financial deregulation had themselves created.

The new series includes these articles:

- How Jeff Kennett’s Victoria paved the way to neoliberal hell

- Jeff Kennett’s privatisation rip-off

- Kennett outsources the state

- Financial deregulation propels Kennett’s rise

In the article “How MPs’ brains were painted neoliberal”, we also profile the Institute of Public Affairs, one of the big business-backed think tanks that ushered neoliberalism into Australia, by sponsoring Kennett and brainwashing countless Australian parliamentarians.

Click here to download the entire series in one PDF.

Austerity: The History of a Dangerous Idea

A review of the austerity response to the 2008 global financial crisis in a three-part series inspired by Mark Blyth's, Austerity: The History of a Dangerous Idea:

- Collateral damage: how the housing bubble blew up global finance (AAS, 1 Feb. 2023)

- The 2008 crisis and the European sinkhole (AAS, 15 Feb. 2023)

- Our economic model is based on permanent austerity (AAS, 15 Mar. 2023)

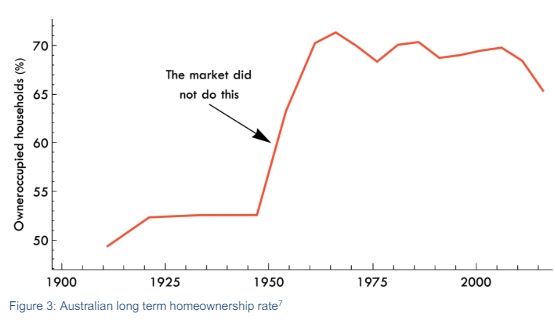

How neoliberalism sabotaged Australian home ownership

A three-part series in the Australian Alert Service, “How neoliberalism sabotaged Australian home ownership”, documents how Australian governments have solved housing crises in the past, providing a compelling historical perspective which shows up today’s deeply flawed approach.

Today’s housing strategies are doomed to failure because they are anchored in neoliberal economic policy dogma, authored and imposed on nations by mid-20th century economists and bankers.

By contrast, the successful approach portrayed in the AAS articles was characterised by:

- Government financing of major home construction programs, including through the Commonwealth Bank and State Banks;

- Powerful housing and planning authorities to oversee economic development and national works, procure materials, build homes, control rents and issue loans, delegating authority as necessary;

- Federal and state government coordination (under both Labor and Liberal governments) of public housing projects through the Commonwealth State Housing Agreement (CSHA) in the postwar period, to overcome an extreme lack of manpower and construction materials against a backdrop of building inflation.

The article documents the gradual takedown of the CSHA by the Menzies and successive governments, according to the precepts of neoliberalism and letting the “free market” prevail, which created the “survival of the fittest” housing market we have today.

Click here to download and read the package (PDF). Appended to it is the article “Australia’s ‘impossibly unaffordable’ housing a symptom of political cowardice”, from the 3 July AAS, an update on today’s housing crisis and the utter inadequacy of the Albanese government’s housing program.

How ‘Operation China Threat’ demonised the Belt and Road Initiative—a Special Report

Now available in pamphlet form and as a single pdf file is the May-June 2022 Australian Alert Service series “How ‘Operation China Threat’ demonised the Belt and Road Initiative”, by Melissa Harrison. The four articles document the methods and motivation of the disinformation campaign against China’s BRI in Australia and around the world.

Since mid-2017 the Australian public has been targeted with propaganda, issued through mainstream media in coordination with national security and intelligence agencies and associated think tanks, to demonise China and the BRI. The distortion of the public perception of the Belt and Road Initiative is one part of a wider strategy for maintaining Anglo-American primacy in the Asia-Pacific region, through ever greater projection of US-UK military power, and through the City of London and Wall Street-controlled global financial architecture.

This series documents how under the BRI, China has revived the tradition of nation-builders like the Americans Alexander Hamilton and Abraham Lincoln, and their Australian co-thinker King O’Malley, who advocated using public credit to finance infrastructure development. China’s public investment approach is a threat to the post-World War II order, which especially since 1971 has enriched London and Wall Street banks and corporations, by enabling the looting and financial repression of developing nations. China’s alternative economic approach threatens the geopolitical power of the USA and UK, which rests upon the deregulated global financial system alongside military might.

The pamphlet includes two supporting articles:

- “Geopolitical elites fabricated BRI ‘debt-trap diplomacy’ narrative” reveals that baseless allegations about China’s lending for the BRI have been fabricated by “national security” proponents of British geopolitical theories that define international relations as a zero-sum game, in which the progress of one nation can only come at the expense of others.

- “Belt and Road opposition is a century-old “Great Game” shows that the demonisation of international infrastructure projects is not new. Predecessors to the BRI proposed by the USA, Japan, Russia and European nations were targeted for derailment by the same Anglo-American power structures that are viciously fighting the BRI today.

Click here to download the report.

Who ended the Bretton Woods system and opened an age of infinite speculation?

The floating currency exchange-rate system, instituted with the end of the Bretton Woods agreements 50 years ago, decoupled finance from the real economy throughout the trans-Atlantic financial sector and its appendages, Australia included. Many financial woes of nations and much suffering of people stem from the decisions made then. The people who wrecked Bretton Woods took aim against the post-war order US President Franklin Roosevelt had envisioned, in which sovereign nation-states could each and all develop economically for the benefit of their populations.

Unique research and insights into who the wreckers were and how they operated is presented in the six articles from the Australian Alert Service assembled here.

- “The takedown of Bretton Woods and the rise of financial speculation”, AAS, 28 July 2021

- “Destroying Bretton Woods: The rise of the Neoliberals”, AAS, 4 Aug. 2021, reviewing Nicholas Shaxson’s 2018 book The Finance Curse: How Global Finance is Making Us All Poorer

- “BIS: The sleeper cell that destroyed Bretton Woods”, AAS, 11 Aug. 2021, a look at the Bank for International Settlements, the central bankers’ bank the original Bretton Woods conference failed to dissolve

From a two-part Australian Almanac in the AAS of 8 and 15 Sept. 2021, “An age of infinite speculation: Who wrecked Bretton Woods, and why” (8 and 22 Sept. 2021):

- “The creation of the worldwide casino”, excerpted from our 2016 pamphlet The British Empire’s European Union: A Monstrosity Created by the City of London and Wall Street

- “Two varieties of monetarism: the Keynesian and ‘Austrian’ foes of real economic progress”, by Allen and Rachel Douglas, revealing the clique that pushed through “floating exchange rates” in the 1970s

- “The early economic forecasts of Lyndon LaRouche”, by EIR magazine editor Paul Gallagher, an edited transcript of his presentation to a conference on the 50th anniversary of the end of Bretton Wood

Towards a New Bretton Woods

A 3-part series on organising a new financial architecture that works for all nations:

1. Rewriting the rules of international finance, Step One, AAS, 12 Oct. 2022

2. Replacing hegemonic order with multilateral consensus (Step Two), AAS, 9 Nov. 2022

3. To reunify, rewind to Bretton Woods, 'American System' principles (Step Three), AAS, 19 April 2023

Reinventing bailouts

With the "repo" crisis of September 2019, the US Federal Reserve began re-writing the script for saving the banks. Not only will this not avert a replay of the 2007-08 global financial crash, it is destined to make the oncoming crisis dramatically worse. Following are some articles from the Australian Alert Service on the subject.

- The bell tolls for US Treasury market

- Stop hedge funds sparking a new global crash

- Unfinished US banking crisis portends systemic disruption

- Rethinking the financial matrix: two pathways (20 Sept. 2023)

- The fall of the hedge funds?

- Central banks map horror 2023 for masses

- Jackson Hole conclave: Crushing the real economy since 1978 (31 Aug. 2022)

- Leading economist: Say goodbye to era of banker control

- The rise of the hedge funds

- Does extreme Fed juggling act signal the end is nigh?

- ‘Great Reset’: Government of, by and for bankers

- March meltdown dwarfed September precursor!

- More Repo ructions: The Fed reinvents bailouts

- It’s all or nothing for big banks in new speculative frenzy

- Is Fed’s super-QE directed by JPMorgan?

- Is the Fed concealing a new global crisis?

- Pre-tremors of the next global banking meltdown?

- BlackRock's monetary 'regime change' is fascism

The BRI 'threat'?

A compilation of articles on China's historic Belt and Road Initiative:

- "BRI: reviving real economies for 8 years", AAS, 8 December 2021

- "Who made China and Russia the enemy, and why?", AAS, 26 August 2020

- "More refutations of ‘China debt-trap’ allegations", AAS, 22 May 2019

- "Why more nations will defy orders and join Belt and Road", AAS, 10 April 2019

- "Belt and Road, or bust! ", AAS, 31 October 2018

- "African nations applaud Chinese development assistance", AAS, 12 September 2018

- "Canberra’s plan to corrupt the BRI", AAS, 1 August 2018

- "Sri Lanka port controversy raises question, what have Western countries done?", AAS, 25 July 2018

- "China’s Glass-Steagall standard", AAS, 25 July 2018

- "Don’t believe the whispers about China in Africa", AAS, 13 June 2018

- "Why all the fuss over Chinese interference?What are we afraid of?", AAS, 6 June 2018

- "Who is out to control Africa’s mining sector?", AAS, 25 April, 2018

- "China shatters the era of the ‘economic hit men’", AAS, 28 March 2018

- "‘Washington Consensus’ indicted for genocide", AAS, 28 March 2018

- "Don’t miss the bigger agenda behind China’s BRI", AAS, 11 October 2017

- "Defence Department: China’s Belt and Road a ‘strategic threat’ to Australia", AAS, 24 May 2017

Anti-Russia sanctions have earth-shaking backfire potential

26 Mar.—The sweeping economic sanctions imposed on Russia by the USA and its allies after Moscow moved military forces into Ukraine may backfire in more ways than one. ...

Australia is not a corporation, it’s a corporate state

You won’t change bad laws by pretending they aren’t legitimate.