The best way to rein in the corrupt banking power of the Big Four is to re-establish a public alternative. A public post office bank, utilising the Australia Post network, will break the banking monopoly of the Big Four banks, provide safety (no “bail-in”), guarantee banking services for all Australians, support the cash payments system and contribute to national economic development, all while ensuring the long-term viability of Australia Post, its thousands of licensed post offices, and the communities they serve.

A postal people’s bank is clearly both in Australia’s national interest, and is the long-term solution for Australia Post. For that reason, the Citizens Party has drafted legislation, called the Commonwealth Postal Savings Bank (CPSB), for introduction into Parliament in the near future, as part of a national banking system that includes a national infrastructure bank.

What would a postal bank do for Australians?

This bank would:

- Guarantee banking services to all communities, and force the big four private banking oligopoly to actually compete on service for the first time in 25 years;

- Guarantee banking services to everyone and every legal business without discrimination—no “debanking” as the private banks are doing to more and more businesses;

- Guarantee deposits, as the bank would be owned by the Commonwealth government;

- Support the cash payments system which the private banks are trying to get rid of—the banks have ripped out one third of Australia’s ATMs in recent years, but former Australia Post CEO Christine Holgate ensured Bank@Post would supply cash;

- Lend to local individuals and small businesses in the communities the postal bank serves;

- Invest surplus deposits in a national development or infrastructure bank, to be a source of credit for the economic development of Australia.

- Break the monopoly of the big four banks, including their power over Australian politics.

There are prominent politicians in every political party who support a postal bank. However, it is the Citizens Party who have led the way in drafting legislation to bring it about. Bob Katter MP is ready to introduce the Citizens Party’s CPSB bill in a future Parliamentary sitting.

However, in order to push it to the forefront of the political agenda, the Australian people must demand it. Again and again!

The private banking monopoly—the most powerful lobby in Australia—will fiercely oppose this policy, as was already seen in Scott Morrison’s ambush and removal of Christine Holgate as CEO of Australia Post. Holgate was supportive and even preparing a pathway forward to achieve a Postal Bank. That’s part of the reason she was taken-out by bank puppet Scott Morrison.

It is important that a Postal Bank be created by legislation in federal parliament, in order to be able to combat the dominance of the Big Four banks. Local community banks are not able to compete with the Big Four banks and can be easily gobbled up by them.

It’s up to the people to make it happen!

Sign & Share our Petition: An Australia Post ‘people’s bank’—a win-win solution for the nation

Resolution campaign for the Commonwealth Postal Savings Bank!

To promote and build support for the Commonwealth Postal Savings Bank (CPSB), the Citizens Party drafted a resolution which can be adopted by local councils, chambers of commerce, union branches, political party branches, and indeed any community organisation.

Success

On 27 July, councillors at the Narrabri Shire Council in NSW unanimously passed a resolution supporting the CPSB, calling on the Parliament to pass the legislation and on 28 July, the Banana Shire Council in QLD carried a similar resolution with no opposition. We have also been informed that on 3 August, the Licensed Post Office Group has endorsed the Commonwealth Postal Savings Bank Bill. As seen from these early results, activists are taking this resolution and motivating its adoption.

The Citizens Party urges all Australians who support a post office people’s bank to take to their local council, chamber of commerce, union branches, political party branches, indeed any community organisation, and ask them to endorse the Commonwealth Postal Savings Bank Bill:

Narrabri Shire Council Motion and Rationale

In moving the motion endorsing the Commonwealth Postal Savings Bank (CPSB), Councillor Maxine Booby provided the following “rationale”:

“As Councillors would be aware Wee Waa has recently lost both banks and their services.

This has disadvantaged many people and businesses and charity groups in town. Businesses have had to allow an employee to travel to Narrabri to do business banking. This involves 1-2 hours of lost time.

Businesses need to bank daily takings and or access cash to service customers in their shopping. Not everyone uses EFTPOS cards.

Charities do not have local access for cash for functions and these functions run on cash, ie: raffles, street stalls, Christmas carnival etc. A Commonwealth Postal Savings Bank would ensure these services that are so important to the smooth functioning of a community.

The present arrangement between the National Australia Bank and Commonwealth Banks can change at the banks’ whim. Already charges for transactions have increased to $4.50.

The situation in Wee Waa is exacerbated by the removal of the town’s ATM. EFTPOS is available for limited cash at IGA and the Bowling Club if you are a member. When the internet went down last week for 3 days people could not access their money and businesses could not service cards or cash outs.

A Commonwealth Postal Savings Bank (CPSB) would permanently secure the financial viability of Australia Post and the LPOs, based on a legislated agreement with Australia Post that guarantees the LPOs share the revenue—their income will not be at the mercy of the private banks deciding whether or not to renew their Bank@Post deals.

It would guarantee financial services for all Australians. The private banks have abandoned small towns in regional Australia and low-income suburbs, but they all have post offices, through which they will be able to bank with CPSB.

It would guarantee bank deposits. The CPSB will be a public bank, owned by the government, which will guarantee all deposits, so Australians who bank at the postal bank will know they won’t lose their savings in a financial crisis or deposit “bail in”.

There would be no “de-banking”. As a public bank the CPSB will not be allowed to discriminate by de-banking lawful businesses.

It would support cash payments. The private banks are trying to do away with cash, which would be a disaster. The CPSB would allow people to always access cash.”

The Executive Management of Narrabri Council added the comment: “It should be noted that the above motion is a template motion drafted by the Australian Citizens Party.”

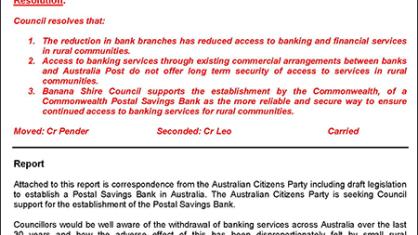

Banana Shire Council Motion

In a 29 July letter to the local MP, Cr Neville Ferrier, Mayor of Banana Shire Council advised that Council passed a resolution (right) in support of the Commonwealth Postal Savings Bank proposal at its general meeting on 28 July 2021.

In that letter he makes the point, “Council acknowledges that the National Australia Bank and the Commonwealth Bank have agency arrangements with Australia Post through to 2030 and that Westpac are currently negotiating longer term arrangements with Australia Post as well.”

“Notwithstanding the above arrangements the reality for small and medium sized rural communities is that the above arrangements are commercial in nature and subject to change at short notice. Council’s view is that the above arrangements do not offer long-term security of access to banking services for rural communities. Council has supported the establishment of a Commonwealth Postal Savings Bank to offer long term security of access to banking services to rural communities as well as ensuring the ongoing sustainability of post offices in rural communities.”

Council’s actions got some local media attention in the Rockhampton, The Morning Bulletin with an article, CQ Council endorses idea for national bank, by Lachlan Berlin on 5 August 2021.